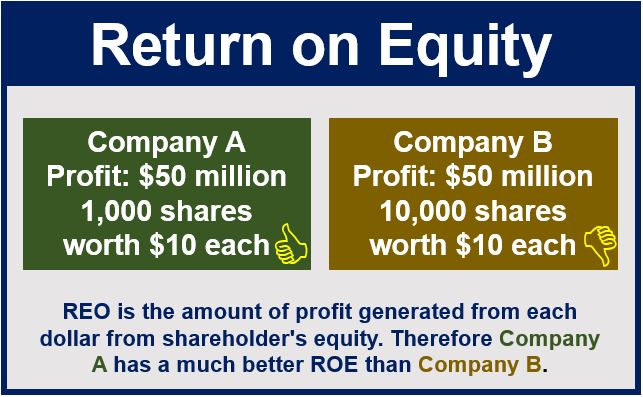

Return on equity (ROE) is an important metric of profitability. It compares a company’s net profit directly to the value of the company’s equities, i.e., what the shareholders outright own. Equity has many meanings – in this context, it refers to what a shareholder owns in a corporation.

We also refer to return on equity as return on net worth or return on owners’ investment. ROE tells us what a company’s earning power is, i.e., its ability to generate profit.

The Economic Times has the following definition of the term:

“The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings.”

“It signifies how good the company is in generating returns on the investment it received from its shareholders.”

Return on equity – good and bad

Many people say that ROE is the ‘mother of all ratios.’ However, some people have accused it of being partly responsible for the downfall of several banks. Specifically, their downfall during the 2008 global financial crisis.

We calculate return on equity by dividing a company’s net income for the fiscal year (after preferred stock dividends but before common stock dividends) by total equity (excluding preferred shares). The result appears as a percentage.

ROE and return on common equity reveal how earnings compare to the shareholder’s investment. This is different from return on assets or ROA.

ROA compares earnings to the owners’ investments and any asset investments made from borrowed capital.

What information does ROE provide?

A high ROE does not mean there will be any immediate benefit. However, it can indicate that the company will reinvest earnings. This will subsequently help the company grow faster.

ROE can potentially mean nothing if the business does not reinvest its earnings.

Calculating return on equity

Assume a furniture company generated net income of $1,000,000 in fiscal 2013. The shareholders’ equity at the end of fiscal 2012 was $12,00,000, and at the end of fiscal 2013, it was $14,000,000.

Average Shareholders’ Equity = ($12,000,000 + $14,000,000) / 2 = $13 million

Return On Equity = $1,000,000 / $13,000,000 ≈ 0.077 or 7.7%