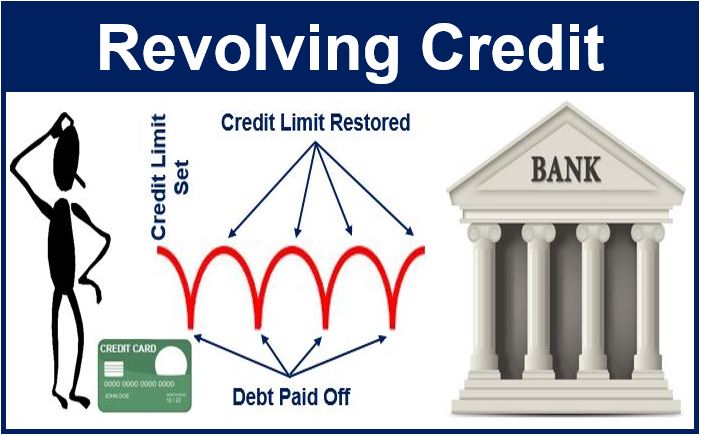

Revolving credit is a credit line that does not have a fixed number of payments, as opposed to installment credit. Once the sum has been repaid the credit line is automatically renewed.

This type of credit facility is also called an evergreen loan. We may refer to a credit line as a line of credit.

Put simply, revolving credit is an arrangement which allows for the loan amount to be used up, repaid, and then redrawn again several times, until the facility expires. Unlike a typical loan, the account does not automatically close as soon as the account reaches a zero balance.

Credit card companies provide customers with revolving credit. Many companies have revolving credit facilities which give them liquidity for their day-to-day operations. Other examples of revolving credit include HELOCs (home equity lines of credit) and retail cards.

With revolving credit, the loan amount is restored each time the borrower pays it off.

With revolving credit, the loan amount is restored each time the borrower pays it off.

With a credit card the customer is given a credit limit. Every time he or she buys something using the card, that amount is subtracted from their total credit limit. Each time they pay off their balance, their credit limit goes back up.

In the majority of cases, as long as the customer continues servicing the loan properly, the bank will be happy to carry on with the arrangement perpetually.

Example of revolving credit

John has a MasterCard issued by his bank with a $10,000 credit limit. This means he can go down to the shops and buy $10,000’s worth of products and services on the card.

If he spent $1,000 on a computer using his MasterCard, he would get a bill for that amount at the end of his billing cycle.

John is given some options on paying back the loan to the bank: 1. He can clear the whole $1,000 before the end of the grace period and avoid paying interest. 2. He can pay the minimum ($38). 3. He can pay an amount in between.

If he opts to pay $300, he is revolving the other $700 to the following month. However, he’ll have to pay an extra $8.75 in interest on those $700 (15% APR).

John does not use his card during the next month and receives a $708.75 bill (the revolving $700 plus $8.75 interest).

Experts say that with revolving credit people should try to pay back as much as possible. Otherwise they will end up paying lots of interest each month.