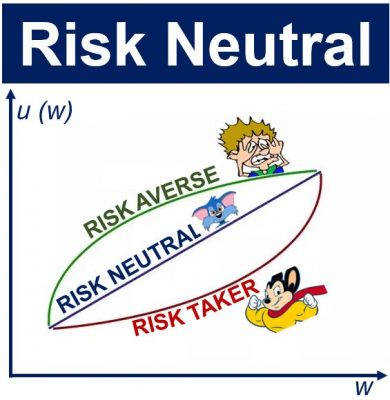

Risk Neutral is a term that is used to describe investors who are insensitive to risk. The investor effectively ignores the risk completely when making an investment decision. If you present a risk neutral investor with two possible investments that carry different levels of risk, he or she considers just the expected return from each investment – their risks are irrelevant to him or her.

Risk neutral is different from risk averse – which describes a person who chooses certainty and dislikes risk. The term is not the same as risk seeking either – which describes an investor who likes risk; if you like something you are not indifferent.

The risk neutral investor is simply not interest in risk at all, risk does not enter his or her cognitive radar – he or she is indifferent – regardless of whether it is high or low risk.

Risk neutral vs. risk averse

Imagine you have two people in front of you – an investor who is averse to risk and one who is neutral. You offer them two possible investment opportunities:

- Invest $500 with 100% certainty that it will increase to $550 in one year.

- Invest $100 with a 50% certainty that it will increase to $150 in one year, and a 50% chance that it might decline to $50.

The risk averse investor will choose the first option, because of the certainty.

The investor who is neutral to risk will not mind which one, because they both offer a return of $50. If you ignore the risk (losing $50), and only focus on the return – $50 in each case – both investments are equally appealing.

Individuals who are neutral to risk will take a long time to carefully weigh up investment options rather than making a rapid decision to either avoid risk or embrace it. Most of us focus almost entirely on the risk aspect.

Risk neutral investors often play a pivotal role in markets, providing liquidity and stability by making investment decisions based on expected returns rather than potential volatility

Risk neutral investors are significantly less common than their risk averse and risk seeking counterparts. Most of us are risk averse, and find the notion of risk neutrality rather strange.

In creating a portfolio, risk-neutral investors may focus on diversification strategies that are unaffected by market fluctuations, often adopting algorithmic trading models that are designed to exploit even marginal efficiencies.

Video – What is Risk Neutral?

This video, from our sister channel on YouTube – Marketing Business Network, explains what ‘Risk Neutral’ means, using simple and easy-to-understand language and examples.