A Salary is a regular payment by an employer to an employee for employment that is expressed either monthly or annually but is paid most commonly every month, especially to white-collar workers, managers, directors, and professionals.

A salaried employee or salaried employee is paid a fixed amount of money each month. Their earnings are typically supplemented with paid vacations and public holidays, healthcare insurance in countries without universal coverage, and other benefits.

Salaries are usually determined by comparing what other people in similar positions are paid in the same region and industry. Most large employers have levels of pay rates and salary ranges that are linked to hierarchy and time served.

In most countries, salaries are also affected by supply and demand – how many job vacancies there are for a specific position in relation to the number of people that exist in the area who could fill that post.

Salary packages may include bonuses or stock options, which are designed to incentivize employees and align their interests with the company’s performance.

What determines salary rates?

Apart from supply and demand (market forces), salaries are also determined by tradition and legislation. In the United States, for example, pay levels are influenced mainly by market forces, while in Japan seniority, social structure and tradition play a greater role.

Even in nations where market forces play a dominant role, studies have shown there are still differences in how monetary compensation is arranged for work done based on gender or race – men tend to earn more than women and white employees’ average incomes are overall higher than those of other ethnic groups.

In 2007, the US Bureau of Labor Statistics reported that women of all races earned 80% of the median wage of their male counterparts. Although the gender gap has closed slightly since then, total equality will probably not be reached for at least another five decades, experts believe.

No salary can be below the minimum wage, if one exists in that country. For example, if the minimum wage is $10 per hour, and the employee works 40 hours per week, his or her salary cannot be less than $20,800 per year ($10 x 40 hours per week x 52 weeks in a year).

Difference between salary and wage

The terms salary and wages are commonly interchangeable, and in many contexts, their meanings are the same – but not always.

A salary does not change on a weekly or monthly basis. Salaries are calculated annually, divided by twelve, and paid out each month. In some countries people are paid double in December, in such cases their annual salary is divided by thirteen, with two months’ pay included in their December paycheck.

Wages, on the other hand, are calculated on the number of hours worked that week, fortnight, or month. Employers pay wages either weekly, fortnightly, or monthly, and are linked to how many hours the employee worked. This is not the case with salaries – a salaried employee’s monthly income is always the same.

Managers, for example, are always paid a salary – never wages. Their monthly pay check does not change if they do overtime. Production-line employees and other blue-collar workers are usually paid overtime – their ‘wage’ varies according to how many hours they put in that week or month.

If an office worker’s income is $60,000 per year, we can say “His salary if $60,000 per year,” but it is unusual to say “His wage is $60,000 per year”.

Salary employees do not need to keep track of their hours in the way hourly workers do – there is no need for them to sign a time sheet.

Workers on wages are typically paid time-and-one-half for every hour of overtime work. At weekends and public holidays some employers may even pay double time. I remember when I was a student I once worked at a gas (UK: petrol) station on Christmas Day and was paid quadruple time.

Pros and cons of a salary vs. wage

Perhaps the main disadvantage of being paid a salary is that in most cases you are not able to earn overtime. This means that you often have to work extra hours for no extra pay.

In the United States, some lower-salary positions are still eligible for overtime rates, based on federal and state laws. In the UK, whether salaried personnel is paid for overtime for extra work done depends on their employment contract and any agreements the employer might have with a trade union.

It is generally harder for salaried personnel to separate home from work life than for workers on wages. Hourly employees typically find it easier to switch off completely from work mode as soon as their working day or shift ends.

The main advantage of receiving a salary is being able to plan ahead. You know exactly how much each paycheck will be for – your medium-term future is predictable. This makes it easier to decide how much you should borrow, what type of vacation you can afford for next year, what type of car to buy and when and how to purchase it, etc.

Salary employees are more likely to receive benefits, which will include paid vacations, and possibly a non-contributory pension scheme, health insurance, a company car, etc.

Which system is best for me?

In some cases, you will have no choice. If you have just qualified as an accountant, all positions offered to you will be salaried.

For those who may be exposed to either a salary or wage lifestyle, which one to choose depends on what type of person you are. If you value the predictability and security of a regular paycheck, you should go for a salary position.

If you want more extensive benefits and perks, you would be happier as a salaried employee.

However, if maintaining a clear separation between work and home life is a top priority, and you dislike the idea of having to work overtime with no extra pay, you would probably prefer an hourly position, i.e. one where you are paid a wage.

‘Compensation’ has a similar meaning to salary when talking about the monthly incomes of employees. However, compensation includes salaries/wages plus other allowances and possible perks such as subsidized meals, commuting costs, housing, company car, discounts, etc.

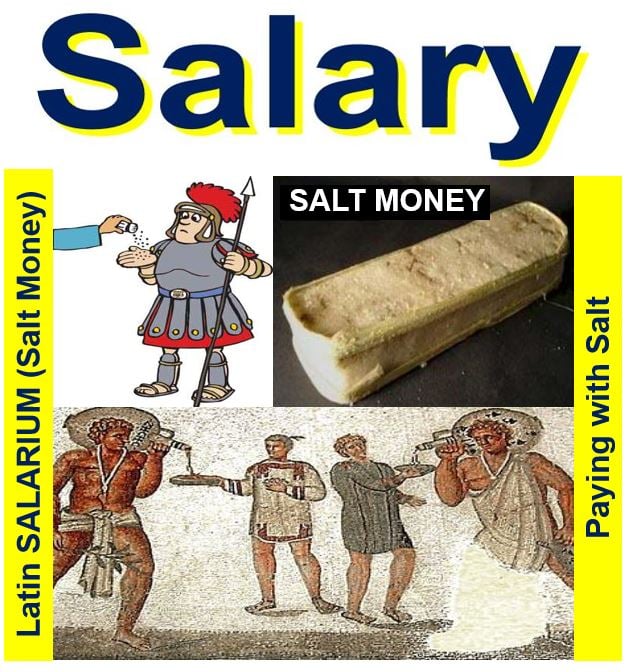

According to the Online Etymology Dictionary, the term ‘Salary’ meaning ‘compensation, payment’ first appeared in the English language in Britain in the late thirteenth century. It came from Anglo-French Salarie, which evolved from the Old French Salaire ‘reward, pay, wages’, which originated from the Latin Salarium ‘stipend, pension, salary’. Originally, the Latin term came from salt-money, a soldier’s allowance for the purchase of salt. The Latin word Sal means ‘salt’, while Salarius means ‘pertaining to salt’.

What is Salary Sacrifice?

Salary Sacrifice is a mutual agreement between employer and employee and the employee needs to make a change to their employment contract. The sacrifice of cash entitlement is usually replaced in some form or non-cash benefit. The reduction in cash entitlement cannot drop below minimum wage.

Salary sacrifice schemes often include options for retirement savings, childcare vouchers, or eco-friendly car programs.

Reservation wage: this is the minimum pay a person would accept for doing a job. If you are looking for a job as a supermarket attendant, your reservation pay maybe $8 per hour – this means you would not consider any vacancies that paid less than $8. The reservation wage of a skilled worker is higher than that of an unskilled worker.