Stress testing is a simulation or analysis designed to find out how resilient a financial instrument, investment portfolio, financial institution, or whole economy is at dealing with extreme situations and economic crises. Stress testing may also refer to tests that measure how well a company or industry might fare when exposed to certain stressors.

Stress testing typically involves using customized computer-generated simulation models that expose whatever is being tested to hypothetical scenarios.

In IT (information technology), stress testing is a process that determines how effective a computer, program, network, website or device remains under unfavorable conditions. It may consist of quantitative tests, carried out in a lab, such as measuring the frequency of system crashes or errors.

Stress testing portfolios

Stress tests allow portfolio managers to understand how sensitive their investment portfolios are to unfavorable scenarios or significant economic change, and the implications for regulatory compliance, capital allocation, and provisioning.

**Basel II and III, which focuses on the banking sector, mandates certain portfolio stress tests alongside specific guidelines for capital approaches.

** The Basel Accords – Basel I, II and III – are a set of banking regulation recommendations created by the BCBS (Basel Committee on Banking Supervision). BCBS was set up by the Group of Ten countries in 1974.

Stress testing banks

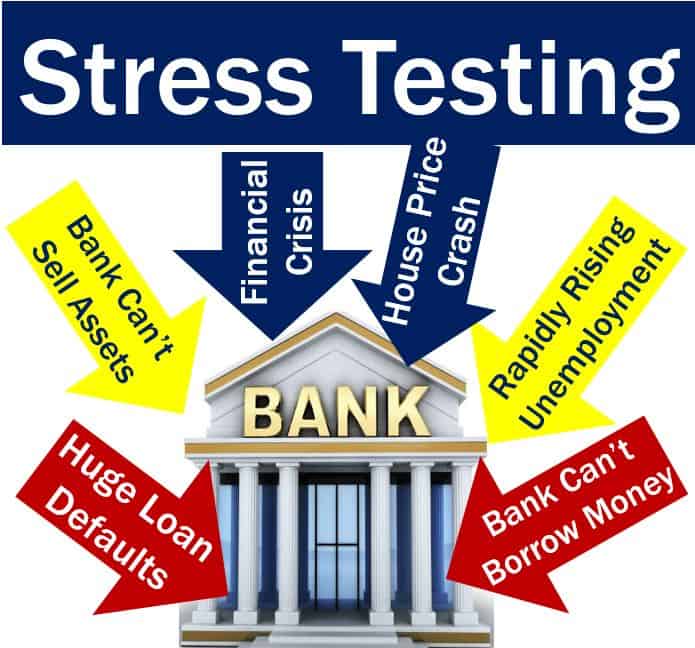

Known as the bank stress test – this test exposes banks to unfavorable economic scenarios to see whether they have enough capital to withstand the adverse shocks.

Until 2007, bank stress tests were typically performed only by the financial institutions themselves, for internal self-assessment.

During the 2007/8 global financial crisis, governmental regulatory bodies in the advanced economies became interested in carrying out their own stress tests to make sure their financial institutions could withstand future major economic and financial shocks.

Since the global financial crisis, stress testing has been routinely performed by financial regulators in countries and regions across the world.

In the United States, for example, financial institutions with $50 billion in assets have to undergo go stress tests from the Federal Reserve, as well as those carried out by their own risk management team.

Bank stress testing focuses on:

– Market Risk: this test gauges how changes in interest rates, the prices of equities and bonds and other financial assets, and exchange rates affect the value of the assets in a financial institution’s portfolio, as well as its capital and profits.

– Credit Risk: the test reflects potential losses on loan defaults, including mortgages and other consumer loans, as well as corporate loans. Stress testing for credit risk determines what the impact of rising non-performing loans (loan defaults) might be on bank profit and capital. Defaults occur when borrowers cannot pay back their debts.

– Liquidity Risk: looks at the cash on hand that the banks have. Before the Lehman Brothers collapse, bank supervisors were not too bothered about how much cash on hand – liquidity – banks had. During the last global financial crisis, many banks were simply unable get enough cash by selling assets because many asset prices had completely collapsed – they could not borrow money at reasonable interest rates either.

Consequently, the authorities had to think up unorthodox ways to inject colossal amounts of cash into liquidity-starved institutions. Stress testing showed that these measures taken by the government were insufficient. More adequate simulation tools have intensified.

Stress testing aims to find weak spots in the banking system at an early stage. If it manages to do that, banks can take action and be better prepared.

In its 2017 stress testing guidelines, the Bank of England says it now has two scenarios. Alongside the annual cyclical scenario – Scenario 1: Economic Shock – the UK’s central bank is, for the first time, running an additional exploratory scenario – Scenario 2 – Long-Term Challenges.

The US Federal Reserve’s stress testing results, published in 2016, in which thirty-three banks participated, had a ‘severely adverse’ scenario where those banks suffered loan losses totaling $385 billion. This scenario featured a severe global recession with US unemployment increasing by five percentage points, accompanied by negative yields for short-term Treasury securities, and a heightened period of financial stress.

Daniel K. Tarullo, who has been a member of the Board of Governors of the Federal Reserve Board since January, 2009, said regarding the latest tests:

“The changes we make in each year’s stress scenarios allow supervisors, investors, and the public to assess the resiliency of the banking firms in different adverse economic circumstances.”

“This feature is key to a sound stress testing regime, since the nature of possible future stress episodes is inherently uncertain.”

This Bank of England video explains what stress testing is, why it is necessary, and what the UK central bank’s approach is regarding testing the country’s financial institutions.