A Variable-Rate Mortgage, also known as a standard variable rate mortgage, adjustable-rate mortgage (ARM) or tracker mortgage, is a home loan whose interest rate is periodically adjusted, depending on the cost to the lender of borrowing money on the credit markets.

American lenders tend to use the term ‘Adjustable-Rate Mortgage’, while financial institutions in other English-speaking nations around the world say ‘variable-rate mortgage’.

Rates fluctuate

A lender’s standard variable rate (SVR) fluctuates, and when it changes the interest charged on a variable-rate mortgage also alters, by going up or down.

This type of home loan contrasts with a fixed-rate mortgage, where monthly payments remain unchanged for either a set period of time or during the whole term of the loan.

The bank’s standard variable rate is usually determined by changes in the level of the central bank’s base rate. However, lenders sometimes decide to change their SVR even when base rates remain unchanged. Most of the time, lenders use an FHA Loan Calculator that provides customized information based on the information you provide.

When the base rate falls, many lenders may not reduce their SVRs by the same amount. In the UK, the base rate plunged from 5% to 0.5% from 2008 to 2014. However, of the 20 largest lenders in the country, Lloyds TSB was the only one to pass on the full 4.5% decline to its SVR.

Lenders’ variable rate mortgages are typically between 2% and 5% above the base rate – but in some cases they may be much higher. In the UK, in July 2015, for example, TSB, Lloyds and Cheltenham & Gloucester had a 2.5% SVR, while Chesham Building Society’s stood at 6.45%, according to The Independent newspaper.

What if I’m unhappy with my lender’s SVR?

While lenders have to tell their customers when their SVR changes, they are under no obligation to inform them that they might save money by switching to another product.

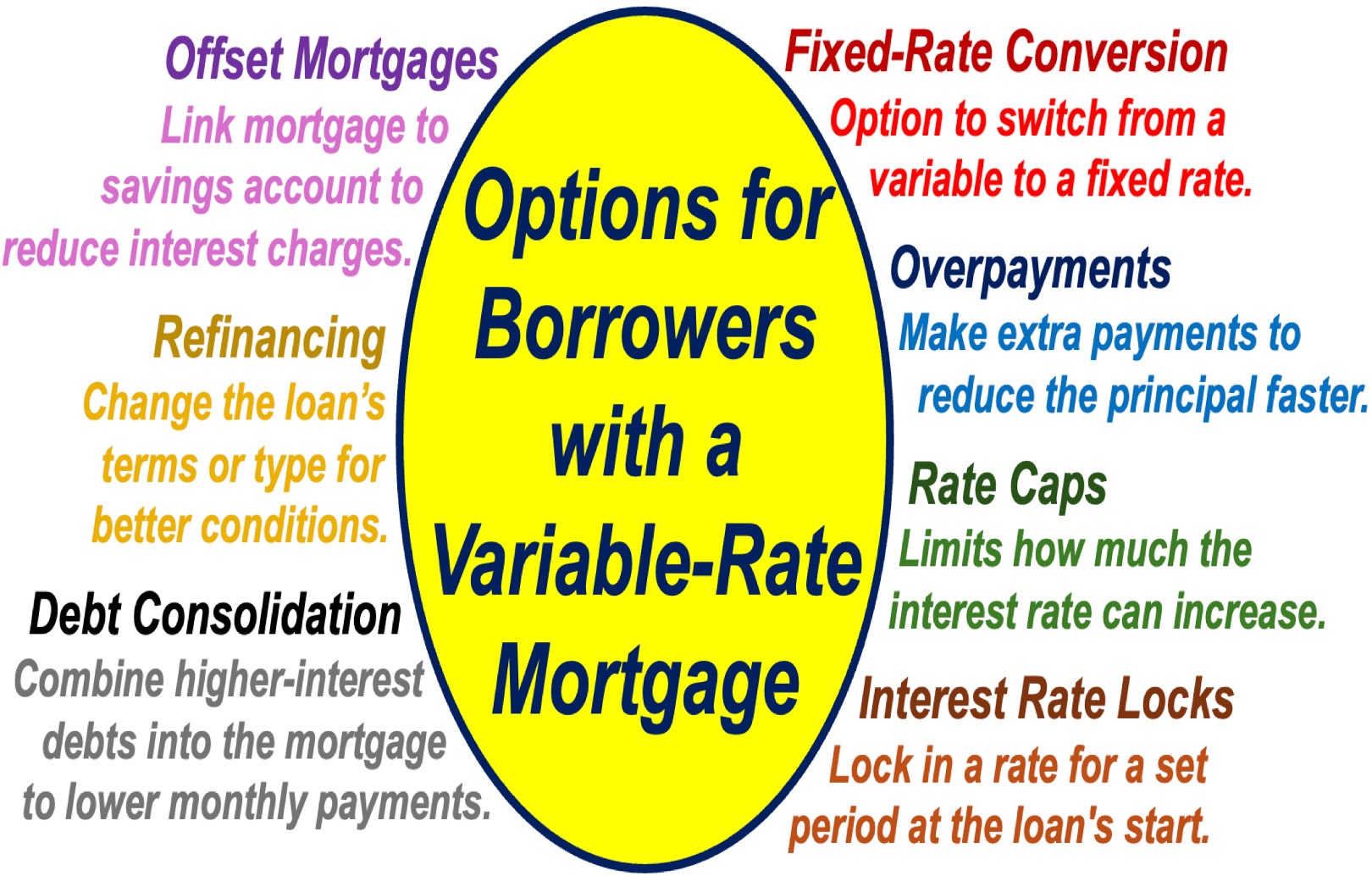

However, in most advanced economies, mortgagors (borrowers) are not tied to one mortgage product and will not be penalized if they remortgage on to another deal. So, it is worth shopping around if you are not happy with your mortgage.

Get professional advice

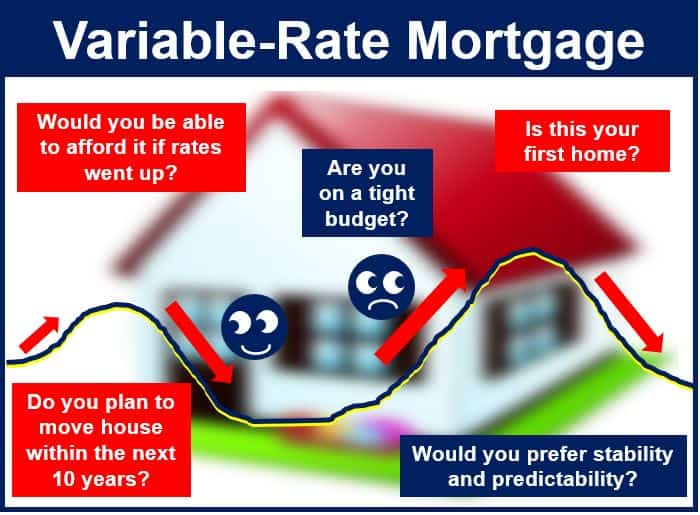

Before committing yourself to a variable-rate mortgage, it is important that you clearly understand what the loan consists of, its pros and cons, and what other loan options are available.

You may, perhaps, consider consulting with a mortgage expert to discuss your options.

You are more likely to get unbiased, professional advice from an independent mortgage professional than your bank manager. Most bank employees and executives are only allowed to offer their bank’s products.