Gamblers forecast Brexit before international finance markets did, say two researchers from the University of Cambridge. Their study shows how international financial markets should have forecast the Brexit vote hours before they eventually did. Betting markets predicted the referendum result one hour earlier than currency markets. According to economists, this created a ‘close to risk-free’ opportunity to make a profit.

When gamblers sensed the Leave vote before the currency traders, a window of ‘arbitrage’ was created. During this time, the price difference between FX markets and betting yielded up to a seven percent return on the pound.

Tom Auld and Oliver Linton wrote about their study and findings in the International Journal of Forecasting (citation below). They are both from Cambridge’s Faculty of Economics.

Brexit

BREXIT stands for BRitain EXITing the European Union (EU). The term became popular in 2015 during the UK’s General Election campaign. Conservative Party leader David Cameron promised an EU referendum if he won the election. The Conservatives won the elections.

On the 23rd June 2016, Britons voted in a Referendum. They had to decide whether they wanted to remain in the EU or leave.

The Brexiteers (wanted to leave the EU) got 51.9% of the vote, compared to the Remainers’ 48.1%. In other words, Britons narrowly voted for Brexit.

How did BetFair and FX markets forecast Brexit?

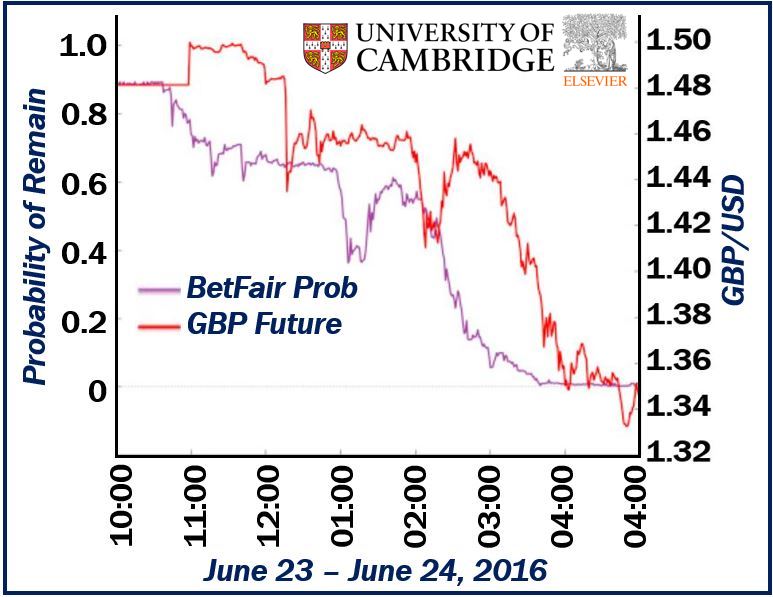

The researchers compared the behaviors of the BetFair betting market with the sterling-dollar exchange rate. They focused on the period after closure of the polls at 10pm. At that moment, BetFair was offering Brexit odds of 10-to-1.

The authors said that both markets had been ‘informationally inefficient.’ In other words, they had been very slow to forecast Brexit accurately in spite of the data already available. There was also a flooding in from vote counts nationwide.

This meant that there was a great opportunity to make money by trading early on either market, the researchers wrote.

The authors found that at about 3am, the betting market moved to a Leave result. By this time, the 10-to-1 odds had reversed to 1-to-10.

The foreign exchange market, on the other hand, did not fully adjust to the Brexit reality until about 4am. The BBC formally forecast Brexit at 4.40am.

Prediction markets may be best forecasters

In a press release, Cambridge wrote the following regarding the difference in the efficiency between Betfair and the currency market:

“The difference in efficiency between the two markets created an hour when selling £1 and hedging the result of the referendum on BetFair would have made up to nine cents of profit per pound sterling – a significant “unleveraged return” that, in theory at least, could have seen astute traders make millions.”

The authors wrote that their findings support the idea that the ‘prediction markets’ might be best forecasters of election outcomes. In other words, they may provide more accurate forecasts than either polls or experts. In this context, the ‘prediction markets’ means ‘gambling.’

BetFair punters forecast Brexit more accurately

Lead author Tom Auld, a PhD student, said:

“Clearly, punters trading on BetFair are a different group of people to those dealing in FX for international finance. It looks like the gamblers had a better sense that Leave could win, or that it could at least go either way.”

“Our findings suggest that participants across both markets suffered a behavioral bias as the results unfolded. Initially, both traders and gamblers could not believe the UK was voting to leave the EU, but this disbelief lingered far longer in the city.”

The researchers gathered and analyzed the expected outcomes for each voting area-data that had been publicly available before the referendum. They then created a ‘forecasting model.’

By adjusting their model with each actual result in turn, they believe that it would have forecast Brexit from about 1.30am. Had they deployed their model on the night, they would have forecast Brexit accurately before either the gamblers or currency traders.

Why did they forecast Brexit so late?

Auld said:

“According to theories such as the ‘efficient market hypothesis’, the markets discount all publicly available information, so you cannot get an edge on the market with data already out there.”

“However, using data publicly available at the time we show that the financial markets were very inefficient, and should have predicted Brexit possibly over two hours before they actually did.”

“If there is a second referendum, the vote should be better understood by markets – in line with a theoretical concept called the adaptive markets hypothesis. Studies such as ours will mean that market participants will be primed to profit from any possible opportunities and inefficiencies.”

Auld and Linton compared their modelling with currency market and gambling data from the night of the EU referendum. BetFair provided data from their exchange platform from 10am (June 23) to 5am (June 24). It is the largest betting exchange in the world.

Bets on the referendum result hit a record

During that seven-hour window, BetFair received over 182,000 bets. More than 88,000 trades were made in the pound sterling futures during the same period.

BetFair said that for a political event, gambling that night broke all records. Punters placed bets worth more than £128m ($164m), including more than £50m ($64m) that was matched on the night of the referendum itself.

Auld added:

“Prediction markets such as betting exchanges are an ‘incentive compatible’ way to elicit the private opinions of participants, as people are putting their money where their mouth is, whereas what they tell pollsters can be cheap talk.”

“Prediction markets could in theory be used to help value or price financial assets during events such as major votes. This is an area I will be focusing on for future research.”

Citation

“The behaviour of betting and currency markets on the night of the EU referendum,” Tom Auld and OliverLinton. International Journal of Forecasting Volume 35, Issue 1, January–March 2019, Pages 371-389. DOI: https://doi.org/10.1016/j.ijforecast.2018.07.014.

Video – What is a trader?

This Market Business News video explains using simple terms and examples what a trader is.