Many companies recognize this situation: you wait a long time for outstanding debtors to pay their invoices, while your wage bill, rent, and other costs (kosten factoring) require immediate payment. Fortunately, there is a solution for this problem – factoring. With this modern way of financing, a specialized financial institution advances money for each invoice you raise. This way, you are much less likely to have a cash flow problem.

Factoring in short

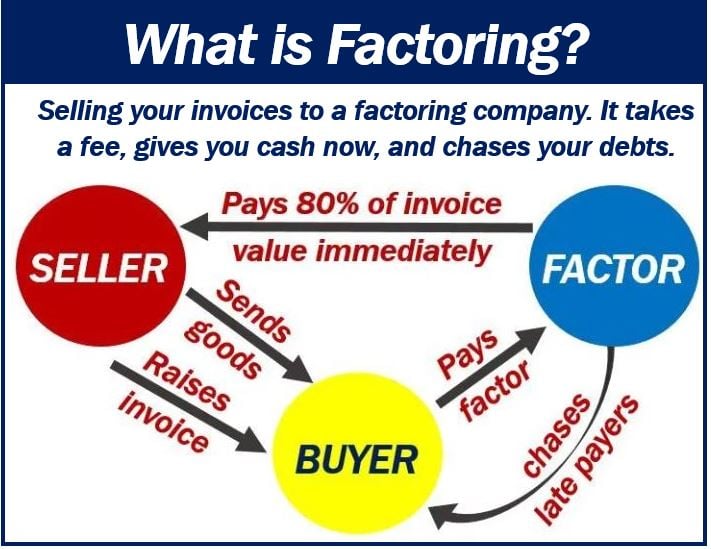

With factoring, the factor (factoring company) advances you money for each invoice you raise straight away. This means that you have money to pay bills, invest in growth, launch marketing campaigns, and continue functioning even if some of your debtors are very late in paying their invoices.

Some companies need extra funding but cannot meet their banks’ borrowing requirements for a loan. This is where factoring comes in. In fact, many banks refer their customers to firms that specialize in this service.

One of the main advantages of invoice factoring compared to a bank loan is speed. A bank’s loan approval process can take several weeks, and even months in some cases. Factoring companies can decide whether to take you on as their customer in as little as 24 hours.

Debt-free financing

Factoring makes sure that you have the necessary working capital quickly; typically, in less than twenty-four hours.

The factor purchases your invoices at a discount and advances most of the value of each invoice to your company. They usually do this within hours, as long as your customer is creditworthy. A company, person, government, or any entity that is creditworthy is a reliable debtor, i.e., they have a history of paying their debts.

When your customer pays your invoice, the factor forwards you the remainder of the money minus a fee for providing the service.

Unlike a bank loan, with this type of service you get the necessary financing without having to get into debt.

Is factoring suitable for me?

Whether factoring is the right choice for your company depends on the type of business you are in. FactoringVergelijken.nl, for example, can very quickly let you know whether your business is suitable for this kind of financial service.

For self-employed individuals and freelancers, there is self-employed ZZP Factoring. If the self-employed person is suitable and signs a contract with this factor, they can also receive a major part of the invoices they raise straight away. There are even arrangements in which the financial institution bears the risk of non-payment, i.e., if your supplier fails to pay, they cover the debt.

______________________________________________________________

Interesting related article: “What is Factoring?”