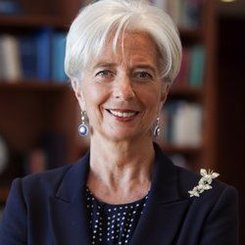

Global economic growth is weaker than expected, says Christine Lagarde, Managing Director of the International Monetary Fund (IMF). She predicts that global economic activity will pick up during the second half of 2014 and then speed up in 2015.

The central banks’ accommodative policies have not had much of an impact on demand, Lagarde explained. She believes countries need to boost GDP growth by investing in health, education and infrastructure, as long as their debt remains sustainable.

Later in July, the IMF will publish an update of its global economic outlook, which Lagarde says will be “very slightly different” from its April figures when it had forecast global GDP growth of 3.6% this year and 3.9% in 2015.

Subdued investment hurting economic growth

Lagarde said at the Cercle des Economistes conference in Aix-en-Provence, France, that global economic activity is accelerating, but the momentum could be less strong than the IMF had expected because of continued subdued investment.

The investment deficit in both the private and public sectors is undermining economic growth in most nations. Public investment needs to be increased, Lagarde emphasized.

Lagarde said:

“Despite the many responses to the crisis, recovery is modest, laborious, fragile, and measures to boost demand, despite the goodwill of central banks, will find their limits. We must therefore take steps to boost efforts to strengthen growth. This is the opportunity in a number of countries to relaunch investment, without threatening the viability of public finances.”

State projects could boost growth

The IMF chief repeatedly pleaded for countries to boost public investment, while at the same time acknowledging that some nations cannot afford to do so. Some state projects that would have a positive effect on growth could be launched without altering debt-to-GDP ratios significantly.

The US economy is now accelerating rapidly after a disappointing first quarter, Lagarde noted. As long as the US Federal Reserve exits from its easy monetary policy in an orderly way, GDP growth should be sustainable. The treasury needs to put in place a medium-term budget framework.

Easy monetary policy means low interest rates.

As the euro area gradually comes out of recession, Lagarde reminded the currency bloc’s member states to continue carrying out reforms, including the completion of the banking union. The IMF believes the Eurozone recovery is not as strong as it should be.

$1 trillion infrastructure spending gap

Economies with lower debt burdens and faster growth are precisely the ones that can afford to increase investment, Lagarde said. Germany, the UK and the US need to renew their infrastructure more than France does. “This has to be done on a case-by-case basis,” she added.

Lagarde quoted the World Economic Forum’s figures which show that global basic infrastructure spending is currently at $2.7 trillion “when it ought to be $3.7 trillion. The $1 trillion gap is almost as big as South Korea’s GDP. These are huge numbers.”

Regarding China and the other Asian economies, Lagarde said:

“Looking at emerging Asian countries, and in particular China, we are reassured because we do not see a brutal slowdown, but rather a slight slowing of a growth that has become more sustainable and that we see at 7-7.5% this year.”

According to a new OECD study, global economic growth will slow down while income inequality will get worse over the next 30 to 50 years.