GoDaddy, the domain registrar and web hosting company, reported a 17.5 percent increase in first quarter revenue, driven by customer gains and higher revenue per average user. Revenue simply means sales.

The company reported total bookings of $498.7 million, up 13.7 percent year over year.

It had 13.1 million customers at the end of the first quarter ended March 31, up 13.7 percent compared to 11.9 million last year.

Domains revenue increased 10.4 percent, to $199.2 million. Hosting and Presence revenue climbed up to $140.2 million, a 21.2 percent rise. Business Applications revenue rose to $36.9 million, up 53.3 percent. International revenue increased to $95.9 million, up 23.4 percent.

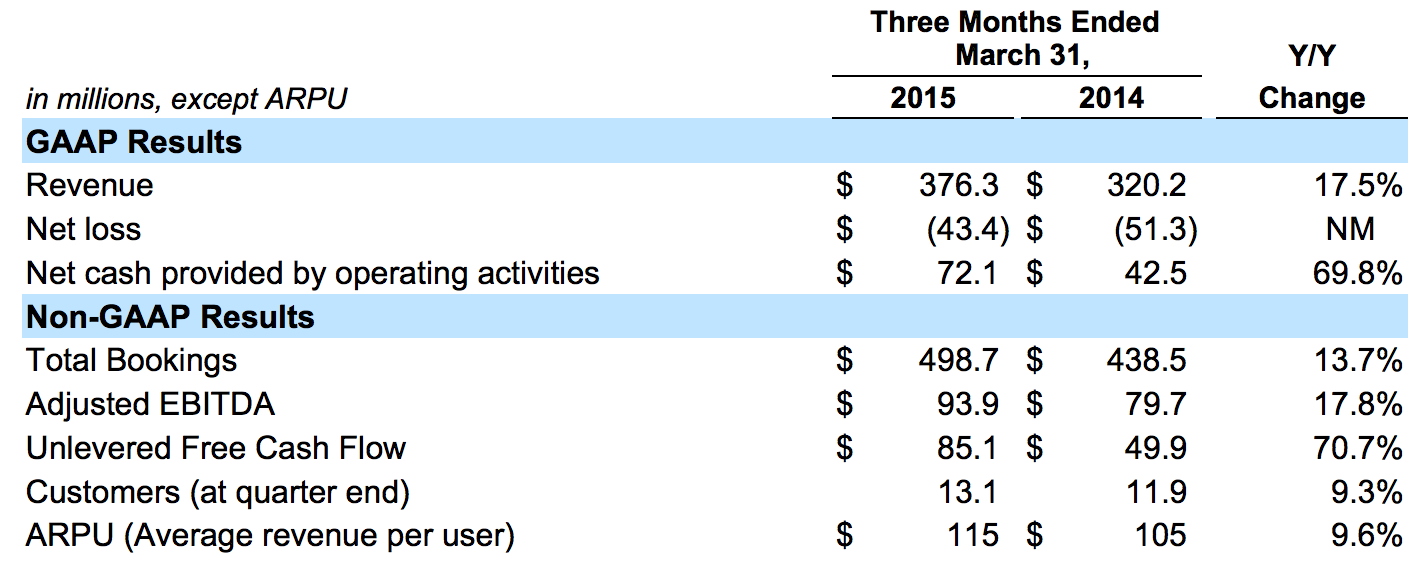

GoDaddy Inc. Q1 results:

Source: GoDaddy Inc. Form 8-K for period ending 05/12/15

The company’s net loss narrowed to $43.4 million, or 34 cents per share, for the first quarter, from $51.3 million, or 40 cents per share, last year.

“Our investments in products, technology platform, and customer care are making a real difference for our customers around the world, and our first quarter results demonstrate the benefits of focusing on their needs. Continued strong growth in customers and ARPU drove both our first quarter revenue and EBITDA up nearly 18% ,” said Blake Irving, GoDaddy chief executive officer.

Many investors look closely at EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) because it eliminates subjective accounting distortions.

On April 7, 2015, GoDaddy Inc. successfully closed its initial public offering (IPO) of 26 million shares of Class A common stock at a public offering price of $20 per share.

GoDaddy Inc. shares increased by as much as 5.5 percent in after-market trading.

Since the company went public last month, its stock has surged by over 33 percent.