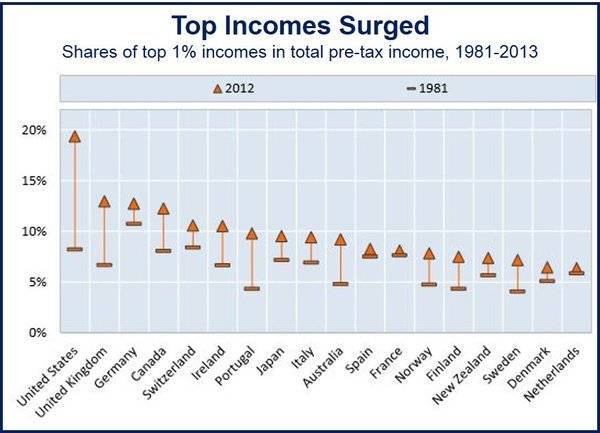

Growing wealth inequality has been present in most OECD nations for the past thirty years, according to a new analysis titled “Focus on Top Incomes and Taxation in OECD Countries: Was the crisis a game changer?“.

The top 1% earners continue to capture a progressively more disproportionate share of overall income growth.

In the United States, the richest 1% have captured 47% of overall income growth since 1981, while in Canada they took 37%.

Even in the supposedly more egalitarian Scandinavian nations, such as Sweden, Norway and Finland, the share of the top 1% grew by 70% to approximately 7% to 8%.

In Spain, the Netherlands and France the richest people’s share increased much more slowly.

In July 2014, the OECD published a new report which forecasts slower economic growth and greater inequality by the middle of this century.

Lower earners losing out on income growth

However, households with the lowest incomes have been unable to keep pace with overall income growth; many of them are no better off today than they were in the mid-1980s.

(Source: OECD calculations based on the World Top Income Database)

In several nations, income growth rates are alarmingly low if the richest 1% of the population is excluded from the calculations. This explains why so many people complain they do not feel that their incomes have risen in line with overall economic growth, the authors write.

The financial crisis and Great Recession that followed temporarily halted any changes in income trends, but had no detrimental impact on the previous rises in top incomes.

In 2010, the lower 90% of the population saw no real increases in incomes, compared to a 4% rise among the richest 1%.

Tax reforms encouraged growing wealth inequality

Tax reforms in nearly all OECD nations since the mid-1980s have significantly reduced burdens for top earners. In 1981, average income tax for top earners was 66%, compared to 43% in 2013.

The richest 1% have also enjoyed substantial increases in pay. Other taxes which tend to help top earners have been reduced too. On average, the statutory corporate income tax rate in OECD countries has fallen to 25% from 47% thirty years ago, while taxes on dividend income for distributions of domestic source profits declined to 41% from 75% over the same period.

OECD Secretary-General Angel Gurría, said:

“Without concerted policy action, the gap between the rich and poor is likely to grow even wider in the years ahead. Therefore, it is all the more important to ensure that top earners contribute their fair share of taxes”.

“Without concerted policy action, the gap between the rich and poor is likely to grow even wider in the years ahead. Therefore, it is all the more important to ensure that top earners contribute their fair share of taxes.”

What can governments do to stem the widening gap?

The authors outline some reforms governments could introduce to help make sure top earners pay their fair share of tax:

- Scaling back or abolishing several tax deductions, credits and exemptions which disproportionately benefit the very rich.

- Taxing all remuneration as ordinary income, including stock options, carried interest arrangements, and fringe benefits.

- Shift the taxation mix towards a greater reliance on recurrent taxes on real estate (immovable property).

- Review inheritance tax rates.

- Find ways to harmonize labor and capital income taxation.

- Find ways to minimize “treaty shopping” – where companies move their head offices to areas of very low taxation.

- Seek out ways of reducing tax loopholes, or opportunities for tax avoidance.

- Improve cooperation between countries regarding taxation, i.e. set up agreements with “tax havens” so that there is automatic exchange of information.

According to a Harris Poll, 79% of Americans today believe economic inequality is a major problem. In March this year the OECD warned that income equality could get worse.

Video – Income Inequality

This short video explains what income inequality is.