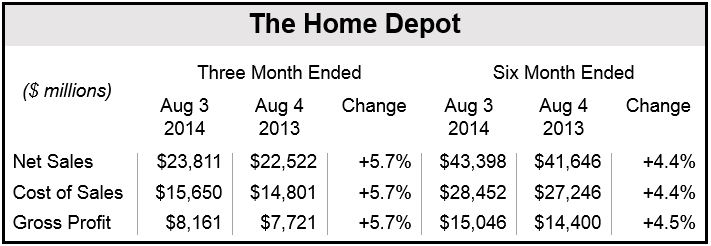

Home Depot Q2 sales increased to $23.8 billion, a 5.7% gain on fiscal Q2 2013. The world’s largest home improvement retailer posted net earnings of $2.1 billion ($1.52 per diluted share) from $1.8 billion ($1.24 per diluted share) in the same quarter last year.

Diluted earnings per share rose by 22.6%. Home Depot’s fiscal second quarter ended on August 3.

The do-it-yourself chain said higher-end items help boost figures, making it one of just very few retailers to improve its full-year profit estimates so far this quarter.

Chairman and CEO Frank Blake said:

“In the second quarter, our spring seasonal business rebounded, and we saw strong performance in the core of the store and across all of our geographies. I would like to thank our associates for their hard work and dedication, especially at this time of increased demand.”

Fiscal 2014 Guidance

Home Depot forecasts a 4.8% increase in 2014 sales compared to 2013.

Based on its Q2 performance and its 2014 outlook, the company increased its diluted earnings per share (EPS) guidance by 20.2% to $4.52 for this fiscal year.

This EPS guidance includes the benefit of the $3.5 billion in share repurchases so far this year and the company’s intention to repurchase another $3.5 billion of shares during the second half of 2014.

(Data source: The Home Depot)

E-commerce and physical stores

Home Depot is investing heavily in e-commerce, something some investors find surprising, given that it sells bricks and mortar. However, the company is convinced its future is in the internet.

Unlike other retailers that have seen a drop in people entering their high street premises, Home Depot continues to attract more customers to its physical stores.

In Q2, there were 409.7 million customer transactions, a 4.2% increase compared to Q2 2013. Higher-priced items, such as windows, home installation services and laminate flooring posted strong sales.

Shoppers bought 8.4% more items costing at least $900; these products usually make up about one fifth of total sales.

A sign of an improving housing market?

Are Home Depot’s second quarter results a sign of an improving housing market or simply an example of a business that is operating well? Opinions among analysts appear to be split.

Forbes quotes Kate McShane, a Citi analyst who said “This strong performance gives us further confidence that Home Depot can handle a slower paced housing market recovery on strong execution. Based on these results, the bar has now been raised for Lowe’s second quarter release tomorrow.”

Home Depot shares increased by 3.8% in pre-market trading following the publication of its earnings results. So far this year, its stocks had only risen by 1.9%.