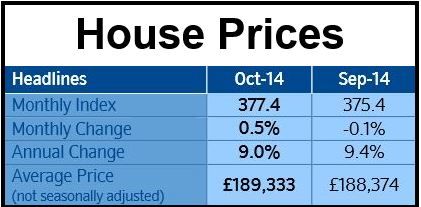

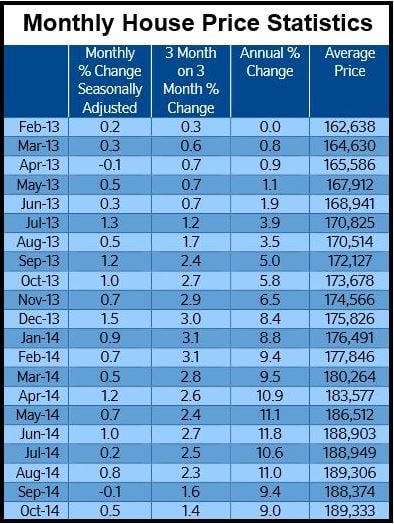

House price growth continued to lose momentum in October, falling to 9% from September’s 9.4%, the second successive month of annual growth decrease, Robert Gardner, Chief Economist at the Nationwide Building Society, said on Thursday.

A range of indicators point to a housing market that has lost momentum. In September, there were nearly 20% fewer mortgages approved for house purchase compared to January.

According to buyer inquiry data, activity may slow down even more in the months to come, particularly in London, Mr. Gardner added.

Broader economic indicators, however, remain positive. Total employment continues to rise, and the rate of unemployment has declined to 6% in the three-month period ending in August, while mortgage rates are at record lows.

Consumer confidence in the UK is still close to recent highs.

(Data source: Nationwide Building Society)

Growing popularity of fixed rate mortgages

Recently, a growing number of borrowers have been choosing fixed rate mortgages. According to the Council of Mortgage Lenders, approximately 90% of all new mortgages have been fixed-rate ones in recent months, compared to 67% in 2012.

First-time buyers, especially, prefer fixed rate mortgages, where they can be sure about the monthly payment amounts. Ninety-five percent of mortgage lending to for first-time buyers is of this type.

Home buyers with fixed-mortgage contracts have benefited from historically low interest rates. For those who bought a house with a 25% deposit, the average two-year interest rate is just 2.46%. While slightly higher than a few months ago, it is one percentage point less than in 2012.

For borrowers who put down a 10% deposit, fixed-mortgage interest rates are at record lows.

The negative impact of rising property prices has been partly offset by lower interest rates. Even though house prices are at record highs, as a percentage of take home pay the cost of servicing an average mortgage has remained virtually unchanged.

(Data source: Historical figures including index levels come from the Nationwide House Price Index.)

About 60% of stock of outstanding mortgages are on variable interest rates, compared to 38% before the 2008/9 financial crisis. Most recent fixes are for comparatively short periods – 30% for 5 years and 60% for 2 years.

Regarding a likely rise in interest rates, Mr. Gardner said:

“The housing market should be able to cope with higher interest rates, provided the increase is gradual and the economy and labor market remain in good shape.”

“Guidance from the Bank of England suggests that the increase in interest rates is likely to be gradual, and that they are expected to settle at a level somewhat below the average prevailing before the financial crisis, which should help ensure borrowing costs remain manageable.”

The Bank of England reported on Wednesday that the number of approved mortgages in the UK has declined to a one-year low. In September there were 61,267 approved mortgages for private dwellings, compared to 64,054 in August.