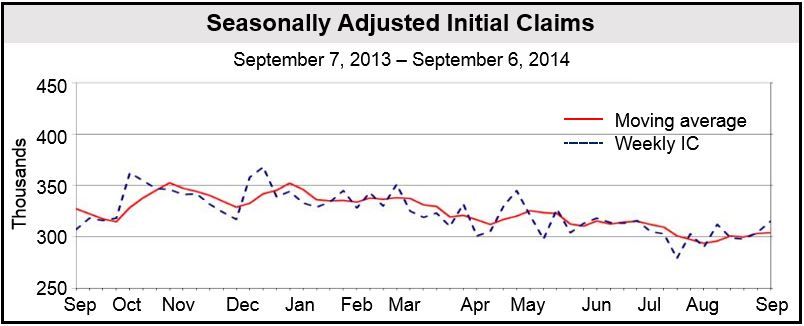

Jobless claims in the United States, i.e. the number of people filing for unemployment benefits, hit a two-month high on the week ending September 6, after falling to the lowest level since the financial crisis.

Jobless claims totaled 315,000, an increase of 11,000 on the previous week. The week included the Labor Day holiday, when figures are notoriously difficult to adjust.

The previous week’s level was revised upward to 304,000 from 302,000.

The Labor Department, which published the figures, said there were no special factors influencing the data.

As the US labor market gathers strength, initial claims have been close to pre-recession levels. However, before employers start raising wages, faster hiring growth rates will be required to reduce the slack in the labor market, which in turn would bolster consumer spending.

Bloomberg Businessweek quotes Omair Sharif, a US economist at RBS Securities, who said “Claims have been running around 300,000 for a couple of months now, so I would not regard this as a deterioration in labor demand. It was during Labor Day holiday, so odds are that there are some seasonal adjustment problems. Underlying labor demand remains very firm, and certainly that is going to help consumer spending going forward.”

The four-week average of claims increased marginally (by 750) to 304,000, close to pre-recession levels, suggesting labor market conditions are strengthening. The four-week average is a better measure of labor market activity because it smooths out any weekly volatility.

The report also showed that the number continuing to receive unemployment benefits increased by 9,000 to 2.49 million for the week ending on August 30.

The closing down of Atlantic City casinos will likely push up claims numbers in the weeks to come.

(Data source: Bureau of Labor Statistics)

August job gains slowed down

Job gains in August were much weaker than economists had expected. The Bureau of Labor Statistics published data last week showing that non-farm payroll employment increased by 142,000, reducing the unemployment rate to 6.1% (a reduction of 0.1%).

Retail sector payroll numbers declined in August for the first time since February. Manufacturing registered no job growth.

August’s employment increase was the weakest in eight months. Analysts say these data are likely to make the Federal Reserve wait longer than planned before considering raising the benchmark interest rate.