Major innovations help create stock market bubbles. The more radical the innovation, the bigger the bubble. Major innovations sometimes also help boost other industries. The advent of smartphones, for example, boosted the phenomenal growth of the app industry.

The major innovator should view the bubble it caused positively. During bubble periods, the innovator can usually raise equity capital easily, and on more favorable terms.

In business and finance, a bubble is a sudden and rapid growth in, for example, stock values. Everyone loves a company or sector during a bubble. However, often the bubble bursts.

In this context, the word ‘stocks‘ means the same as ‘shares.’ Hence the term ‘stocks and shares.’

A team of data scientists carried out an in-depth analysis of stock market bubbles and major innovations. Specifically, they looked at the period between 1825 and 2000.

Their findings show some very distinctive patterns in bubble occurrence during the 175-year period.

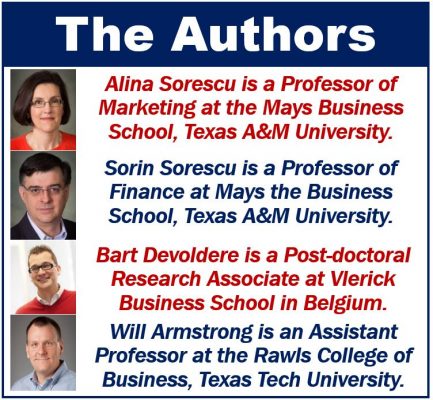

The researchers, from Texas and Belgium, wrote about their study and findings in the journal INFORMSPubsOnLine (citation below).

Major innovations and bubble occurrence

The researchers found bubbles in about seventy-three percent of the innovations they studied. This showed that there is a close relationship between stock market bubbles and innovation.

They also found that a bubble’s magnitude is often tied to the visibility or awareness levels of an innovation.

In other words, the more people knew about an innovation, the more likely a bubble would emerge. It was also more likely that the bubble would be a major one.

Major innovations not only factor

However, awareness and major innovations are on the only factors that drive stock market bubbles.

The more ‘radical’ an innovation was, the more likely it would boost the clout of that innovation in the marketplace. We call this the ‘indirect network effect.’

In this context, the term ‘marketplace‘ means the same as ‘market‘ in its abstract sense.

That is why, during bubble periods, companies can raise more equity capital than during other periods. New capital is also linked to stronger and faster increased awareness of the major innovation.

This continues being the case even after the bubble bursts.

Major innovations – stock performance

Ultimately, stocks of innovating companies outperform the overall market throughout the bubble’s lifespan.

This suggests that major innovations add value not only to the company but also to the large economy. They add value in spite of the presence of bubbles.

Co-author, Sorin Sorescu said:

“While some of our findings provide a retrospective look at stock market activity over 175 years, and prior to the continued innovations we’ve seen the past 18 years, one realization for us has been that traditional financial economics may not have viewed innovation with enough specificity.”

Alina Sorescu added:

“A good deal of literature in financial economics on stock market bubble activity tends to view innovation as something generated by an aggregate production function.”

“What it doesn’t do is approach innovation as a collection of products with distinct characteristics. Studies in this area rarely incorporate a formal statistical measurement of market bubbles.”

“Instead they rely on hindsight analysis of stock price fluctuations with little attempt to link those movements to specific innovations.”

Alina and Sorin Sorescu are from Mays Business School at Texas A&M University.

Using statistical tests to measure bubbles

The authors claim that their study is the first to look at bubble occurrence in association with a large set of specific innovations. These innovations appeared over a period of almost two centuries. It was also the first study to use statistical tests to measure bubbles.

Alina Sorescu added:

“We are also the first to show that firms can benefit from bubbles driven by innovation. This is in contrast to the conventional thinking that bubbles are detrimental, i.e., that the have few, if any, positive effects.”

Bart Devoldere from the Vlerick Business School in The Hague, The Netherlands, and Will Armstrong from the Rawls College of Business at Texas Tech University, were also co-authors.

Citation

‘Two Centuries of Innovations and Stock Market Bubbles,’ Alina Sorescu, Sorin M. Sorescu, Will J. Armstrong and Bart Devoldere. INFORMSPubsOnline. Published Online: 16 Jul 2018. DOI: https://doi.org/10.1287/mksc.2018.1095.