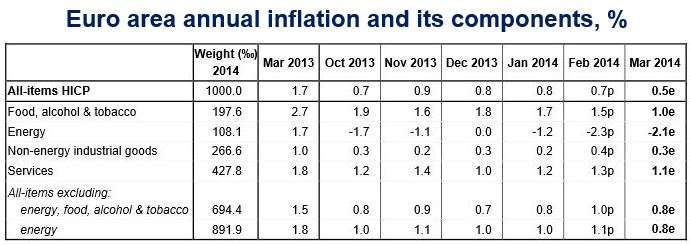

March Eurozone inflation declined to 0.5%, compared to 0.7% in February, according to Eurostat, the statistical office of the European Union. Analysts had predicted an inflation rate of 0.6%.

Each month the Eurozone has been moving further away from the 2% target set by the ECB (European Central Bank), increasing worries that the 18-nation currency area might be sliding into a damaging period of deflation.

The Eurozone’s inflation rate has been below 1% for six consecutive months.

March Eurozone inflation for services stood at 1.1% compared to 1.3% in February, while food, alcohol and tobacco prices rose by 1% (1.5% Feb), non-energy industrial goods by 0.3% (o.4% Feb), and energy dropped by -2.1% (-2.3% Feb).

Today’s figure is a “flash” estimate, i.e. it will be revised at a later date.

Growing risk of deflation in Eurozone

When January Eurozone inflation dropped to 0.7% from 0.8% in December, there was talk of a growing deflation risk. It is logical to assume that the fear has increased in March.

In an interview with the Financial Times, Philippe Gudin de Vallerin, chief European economist at Barclays, said “The risk of deflation is definitely mounting. The risk of de-anchoring inflation expectations is rising. The ECB can argue that it’s a base effect. But if you look at the trend since last summer, they’ve been revising inflation down and down.”

If deflation were to hit the Eurozone, its fragile economic recovery could be reversed. In a deflationary environment consumers and businesses postpone purchases in the expectation of falling prices, which slows the economy down. If people’s salaries and company incomes drop, often the case during deflation, their debt burdens increase.

Will ECB act on March Eurozone inflation figures?

European Central Bank (ECB) President, Mario Draghi, had previously said the ECB would take all necessary action to boost economic growth and make sure the Eurozone does not slip into a period of deflation. After the release of today’s figures, more analysts are predicting that the ECB will take action this week when it meets – but many still believe it will stay put.

(Source: Eurostat)

In its last meeting earlier in March, the ECB left interest rates unchanged at 0.25% and decided to wait-and-see before considering any new measures to stimulate the Eurozone’s economy.

The ECB is running out of tools it can use to boost the Eurozone’s fragile economy. It could reduce interests rates even further or implement a US Fed-style bond-buying stimulus program.

The BBC quoted Howard Archer, an economists at IHS Global Insight, who said that for the ECB, March Eurozone inflation figures were “uncomfortable and unwelcome news. If the ECB does eventually act, it will probably include measures aimed at adding liquidity.”

Easter arrives later-than-usual this year, which could delay the impact of greater spending on travel and hotels, which in turn push prices up. Some analysts believe the ECB may decide to wait until the holiday period is over before deciding on whether to act.

Why ECB may decide to stay put

With a later 2014 Easter and energy prices expected to firm up in the coming months, the ECB is likely to predict higher inflation rates from April onwards and decide to wait before acting on March’s figures.

The Eurozone economy has picked up over the last few months. Much of the downward pressure on inflation has come from energy and food prices, something the ECB cannot do anything about. The Euro has also been strong, which pushes down import prices.

The Euro is expected to weaken later on this year, which should push inflation up. With US unemployment falling the Fed will probably increase interest rates either later this year or early in 2015.