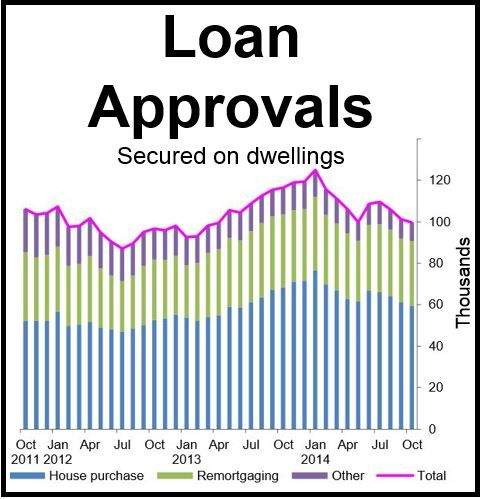

Mortgage approvals were at a 16-month low in October, lower than in any month since June 2013, while consumer lending soared, the Bank of England announced on Monday. Despite the housing market losing momentum, consumer morale remains high.

The number of mortgage approvals in October dropped to 59,426, compared to 61,234 in September.

Nationwide, a major UK mortgage lender, announced on Friday that mortgage approvals were well below historical trends and house prices rose in the 3-month period ending in November at the slowest rate since the middle of 2013.

Stricter mortgage lending regulations introduced earlier this year have dampened demand.

Consumer lending expanded by an annual rate of 6.4% in October, the highest rate since July 2006.

Source: Bank of England.

The BoE figures match data from the Office for National Statistics last week showing household spending rising rapidly in the third quarter, with consumers going more for larger purchases.

Credit card borrowing increased by 5% annually in October, the BoE informed. With consumers no longer wanting to de-lever, the economic recovery should gather pace, economists believe.

Many analysts suggest that people are borrowing more because their wages have not kept up with inflation, meaning their purchasing power is being squeezed.

Net mortgage lending in October increased by £1.496 billion, the smallest rise in 11 months. Net mortgage lending typically lags behind approvals.

Over the past 12 months, total mortgage lending has been 1.8% higher than the preceding 12 months. Most of the increase, however, occurred in the first months.