Now is the time to strengthen growth and create a more favorable investment environment, four German institutes said on Thursday. Germany needs a more investment-friendly tax regime and higher expenditure in areas that encourage growth like human and physical capital.

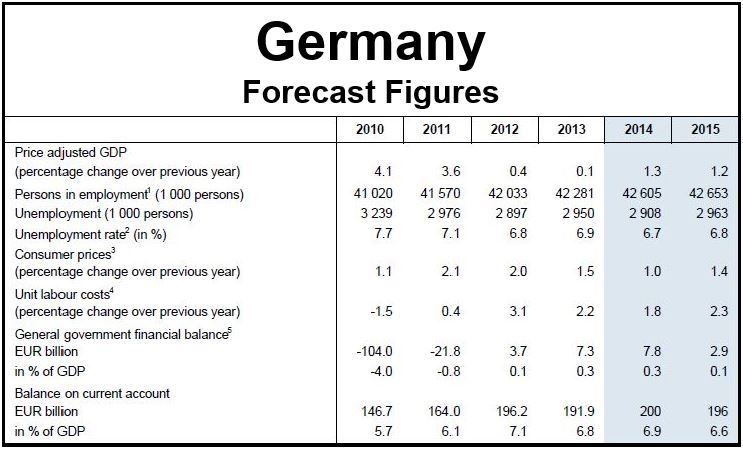

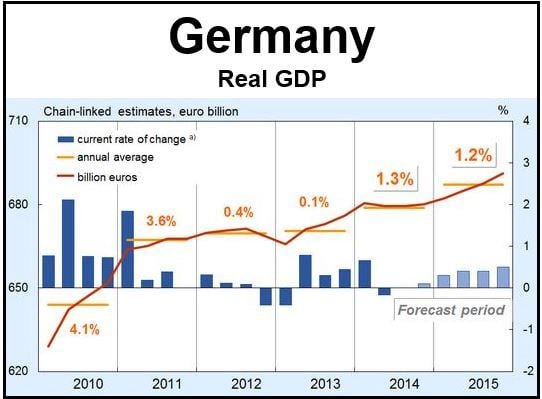

German GDP (gross domestic product) will expand by 1.3% in 2014 and 1.2% in 2015, according to the research institutes that contributed to the Joint Economic Forecast in their autumn report.

The members of the Joint Economic Forecast Project Group are: Deutsches Institut für Wirtschaftsforschung, Ifo Institute, Swiss Institute of Business Cycle Research (KOF), Halle Institute for Economic Research, and Deutsches Institut für Wirtschaftsforschung.

The report authors say German economic growth has slowed down significantly. With GDP shrinking in Q2 and stagnating in Q3, it is evident that revving up the engine is proving hard.

Both foreign and domestic demand are weak, the consumer climate has recently deteriorated considerably, and businesses remain cautious about investment. The global GDP growth slowdown, as well as an extremely weak Eurozone performance are having a negative impact on Germany’s economic outlook.

(Data source: Ifo Institute)

While global production continues expanding at a moderate pace in autumn 2014, and the US and UK economies grow strongly, no recovery has taken hold in the Eurozone. Economic activity in the emerging markets is diverse, with China growing now at a more moderate pace. During the first half of this year, world trade posted very moderate growth.

Advanced economies diverging

In 2014, the advanced economies started differing in their economic policy orientation. While the main refinancing rates in the US and UK are still at record-low-levels, they are expected to be raised in the first quarter of 2015 if economic growth continues.

The European Central Bank (ECB), on the other hand, reduced its main refinancing rate to 0.05% in September and its deposit rate went into a negative figure (-0.2%). “The implementation of targeted, longer-term refinancing operations and the purchasing programmes for covered bonds and asset-backed securities will provide little stimulus for the euro area’s economy,” the Ifo Institute wrote.

The German institutes believe fiscal policy will remain restrictive in the majority of the advanced economies, although the degree of restriction will continue easing.

The Ifo Institute wrote:

“Hardly any consolidation is still taking place in the USA. The institutes assume that consolidation efforts in many euro area countries will continue to lag behind what has been negotiated in the respective stability programs, although interest rates on government bonds are low, which reduces the interest burden.”

(Data source: Ifo Institute)

The institutes forecast that the pace of global economic growth will remain moderate, while the upturn in the United States will continue.

The report authors say the economic impetus on the Eurozone will remain weak. They see no sign of the long-awaited rebound, and have downgraded their forecasts accordingly.

With the global economy only gradually gaining pace, major impulses from exports are unlikely to occur.

Germany outlook subdued

The authors say the economic outlook for Germany remains subdued. They expect third quarter figures to show stagnating output, with another decline in industrial production. All *leading indicators point to weak German GDP growth until the end of 2014.

* Leading indicators are groups of statistics that point to what will happen in the near future – they are the economists’ crystal balls.

In July and August incoming orders were lower than in Q2.

The Ifo Institute wrote:

“All in all, GDP in 2014 is expected to rise by 1.3 percent. The 68 percent projection interval ranges from 1.1 percent to 1.5 percent. Stagnation in the second half of the year means that the capacity utilization of the German economy will fall, and the output gap remains negative.”

Signs of a weakening German economy are starting to appear in the labor market. Employment growth has slowed, while the number of people registering as unemployed increased marginally.

Germany’s inflation rate is falling. Consumer prices in September were only 0.8% up on September 2013. This was partly due to a fall in energy prices. The authors predict 2014 inflation will be 1%.

Policy harming Germany’s outlook

The authors believe that economic policy is also harming Germany’s economic outlook. Even though fiscal policy is providing a measure of expansive stimuli, the introduction of a national minimum wage plus the pension package are undermining growth.

All these factors, when taken together, have the effect of discouraging investment. While welcoming the German government’s fiscal discipline, the economists believe there is elbow room to reduce the tax burden, in view of an expected fiscal surplus of 0.3% in 2014 and 0.1% in 2015 in relation to GDP.

The Ifo Institute wrote:

“Monetary policy still aims to have a stimulating effect on the euro area economy. Interest rates in Germany are very low as a result. However, the measures recently agreed upon are not expected to provide hardly any additional stimuli for the real economy.”

“Despite slightly expansive fiscal policy and the fact that interest rates will remain low, the output gap will continue to be negative in the years ahead. The increase in production in 2015 will be lower than previously forecast. The institutes expected GDP to increase by 1.2 percent in 2015, which corresponds to a mere 1.0 percent increase when adjusted for calendar effects. The 68 percent projection interval ranges from -0.3 to 2.7 percent.”

“In this environment, the main task of economic policy is to strengthen growth and create favourable conditions for investment activity. There is a certain scope for a proactive fiscal policy that will achieve these aims. On the income side this scope should be used to design investment and growth-friendly tax systems, especially via reducing the tax burden. On the expenditure side, public spending should be increased in areas that potentially boost growth – in other words on physical and human capital. However, funds should not be distributed evenly across Länder, as intended by standard Länder entitlements, but tailored to their specific needs and dictated by considerations of efficiency.”