Shareholders are more likely to sue overconfident CEOs than other CEOs, says a new study. CEOs with big public personae have an abundance of confidence. People widely celebrate them as forward-thinking, innovative, and value-creating. We also admire them because they are risk-takers who make unconventional decisions.

Steve Jobs and Richard Branson, for example, are CEOs who possess these characteristics. That is partly why people admire them.

However, what about overconfident CEOs?

Suman Banerjee and colleagues carried out a study on overconfident CEOs and their risk of facing securities class actions. The researchers wrote about their study and findings in the Journal of Financial and Quantitative Analysis (citation below).

Banerjee, who led the study, is a professor at Stevens School of Business. His colleagues were Mark Humphery-Jenner (UNSW Business School), Vikram K. Nanda (University of Texas at Dallas), and T. Mandy Tham (Singapore Management University).

The term ‘securities‘ refers to any financial instrument or contract that is given a value when traded. In this article, ‘securities’ refers just to shares. ‘Securities class actions‘ are lawsuits that shareholders initiate. A lawsuit is a dispute or claim that one party or parties bring to a court for adjudication.

CEO stands for Chief Executive Officer. The CEO is the most senior corporate officer, i.e., the top executive in a company.

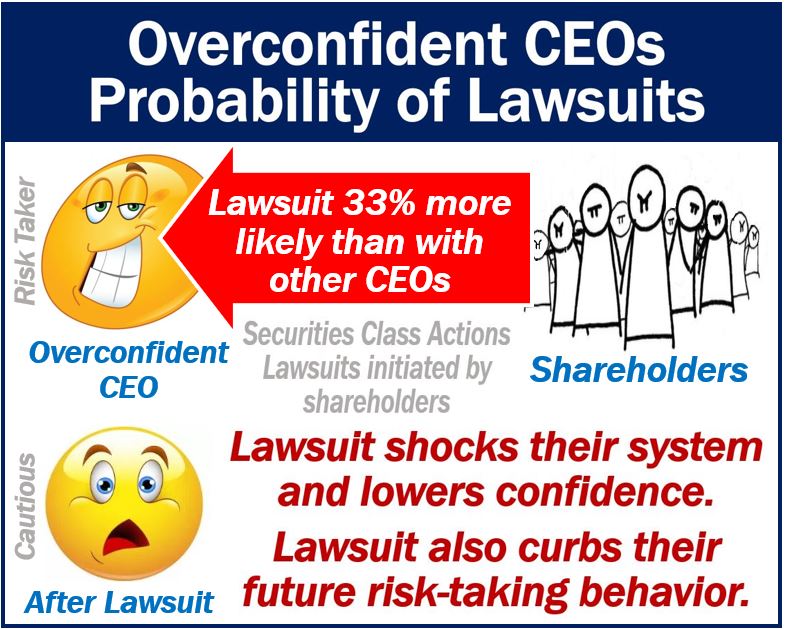

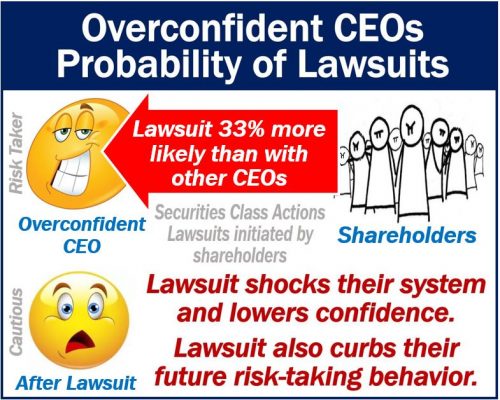

Overconfident CEOs – flip side

The research team found that overconfidence has a flip side. Shareholders were 33% more likely to sue overconfident CEOs than other CEOs. Specifically, compared to other CEOs with ‘normal confidence.’

The lawsuit was enough to lower CEOs’ confidence and shock their system, the researchers found. It also curbed their future risk-taking behavior. In other words, it made them more risk averse.

Prof. said:

“Shareholders are not powerless. Their legal actions do make a difference in company operations and help the company better adhere to business regulations and laws.”

The researchers gathered and analyzed data from the leadership rosters of 1,500 leading multinational companies.

They also analyzed a Stanford dataset which tracked almost 1,400 class action suits. Specifically, class action suits that shareholders had initiated against companies from 1996 to 2012.

Overconfident CEOs – rating them

The researchers assigned a confidence score to each executive. They largely depended on what portion of their own companies’ stock options the CEOs had retained or divested after vesting.

By these measures, overconfident CEOs represented approximately half of the team’s total sample.

Smart CEOs, Banerjee explains, in theory, diversify investments. Theoretically, they would divest their own company’s shares as soon as possible. They would subsequently invest in something else as a hedge against the unknown.

Sometimes, however, Chief Executive Officers don’t do that.

Banerjee explains:

“They hold onto their own shares, even when they are underperforming in the market, because they believe their own leadership is so superior and innovative that they will soon overcome market forces and gain a higher return anyway.”

When overconfident CEOs make statements

The researchers found that overconfident CEOs were more likely to make overly positive statements about their companies. Specifically, statements that had not yet been supported by facts.

They might, for example, over-invest in the short term. They might also postpone the reporting or accounting of losses and other unfavorable information.

Regarding the likelihood that these actions might trigger shareholder lawsuits, Banerjee says:

“It’s indisputable that these sorts of actions lead to shareholder lawsuits, whether intentional or unintentional.”

The authors also looked at how many lawsuits occurred after an initial shareholder-initiated lawsuit against overconfident CEOs.

Lawsuits reduced the likelihood that overconfident CEOs faced subsequent lawsuits. However, they also sometimes reduced the CEO’s confidence. In many cases, CEOs eventually started taking more prudent actions with their own companies’ stock options.

Sarbanes-Oxley Act

The Sarbanes-Oxley Act, a landmark 2002 US securities law, required more diverse and independent board members. The law also applied to nomination committees and company auditors. Furthermore, the Act required, for the first time, that CEOs sign off on company results.

The researchers looked at companies’ legal compliance up to six years after and before the implementation of the Sarbanes-Oxley Act.

Overconfident CEOs strived to comply with the legislation if they had not already been compliant.

The authors also found that CEOs taking over from overconfident CEOs learned from their predecessors’ mistakes.

In other words, the new CEO was less likely to be overconfident, as measured by stock option behaviors.

Citation

“Executive Overconfidence and Securities Class Actions,” Suman Banerjee, Mark Humphery-Jenner, Vikram K. Nanda, and T. Mandy Tham. Journal of Financial and Quantitative Analysis. 29 August 2018.

* The citation link is to SSRN, where many researchers post their articles before the academic journal’s publication date.