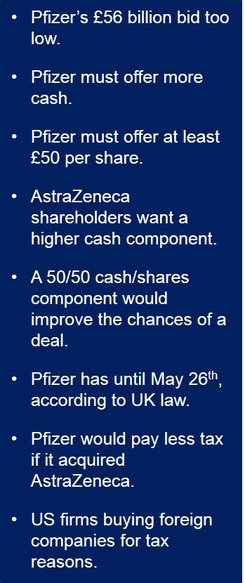

Pfizer must increase its AstraZeneca bid now that it has shown its hand, probably to about $110 billion, investors are saying. The world’s largest pharmaceutical money should also raise the proportion of cash in its acquisition offer in order win over AstraZeneca’s (AZ’s) Board and shareholders.

Yesterday Pfizer admitted that it had approached AZ twice this year regarding a potential takeover bid, the first in January and then again last weekend – on both occasions AZ turned the offers down. The UK’s Sunday Times broke the news regarding last weekend’s approach.

According to British takeover legislation, Ian Read, Pfizer’s CEO, has until May 26th to “put up or shut up.”

Read is in a strong position to succeed in an attempt to buy the UK’s second largest pharmaceutical company. Apparently, most Pfizer shareholders back him, as can be seen by Pfizer’s recent climbing share price. So far, nobody else appears remotely interested in placing a counterbid. However, things can change rapidly, so he needs to move fast.

Pfizer must increase its AstraZeneca bid of £58.8 billion

In January 2014, Pfizer offered to buy AZ for £58.8 billion ($98.8 billion), i.e. £46.61 for each share – a deal involving 30% cash up front and 70% in shares.

AZ turned the offer down flat, saying it was far too low, and the small cash component would not be in the best interests of investors.

Although AZ has not agreed to talk to Pfizer formally about any merger or takeover, Reuters quoted somebody “close to the company” who said a greater cash component in a new offer would be key in getting the AZ board to view the approach favorably.

It is not only the AZ Board members who see the cash component as key, AZ shareholders do too.

Rather than the last 70/30 shares/cash split, a 50/50 split with shares at £50 or more would be required for any chance of a deal, most analysts are saying.

Tax savings in Pfizer AstraZeneca deal

If Pfizer succeeds in acquiring AZ, it could move its official headquarters abroad, saving the company billions of dollars in just a few years. Some estimates place the tax savings at more than $1 billion each year.

Over the last year a number of American companies have moved their head offices from the US to the Netherlands or Ireland, using foreign deals to set up new legal homes in countries with lower corporation taxes. In order to be able to decamp the US company has to move 20% or more of its shares to foreign ownership.

Pfizer has billions of dollars accumulated abroad. Using that money to buy a foreign company would save it a large tax bill if the money were brought back home. It would also be able to relocate (in name only), while its operational activities could continue in New York.

The Wall Street Journal quoted Frank D’Amelio, Pfizer’s Chief Financial Officer, who said “That would still allow me to access the offshore funds and do it in a tax-efficient way.” He added that over 70% of Pfizer’s $49 billion in cash is held overseas.

AztraZeneca paid 21.3% in tax in the UK, compared to Pfizer’s 27.4% in the US. Each percentage point decline in tax would mean an extra $200 million in net income for Pfizer.

In a conference call with investors, D’Amelio explained what other advantages the UK offers, including tax credits for R&D (research and development). The UK government is considering a 10% tax rate on income generated from patents.

Many CEOs of US companies have complained about the American tax system, which does not appear to help firms compete in the global marketplace.