If parents want to prepare their kids financially, they should give them practice with money, say researchers. Children’s best sources for learning about finances are in their families. Specifically, from their mothers, fathers, and grandparents. We call the process of preparing kids financially, i.e., imparting financial knowledge, ‘financial socialization.’

Current literature on financial socialization focuses mainly on two things:

- The examples that mothers and fathers set for their children.

- What parents directly teach their children about money.

However, there is a third important piece that prepares kids financially: giving them hands-on experience with money, i.e., first-hand experience managing money. This is what a team of researchers from the University of Arizona, Northern Illinois University, New Mexico State University, and Brigham Young University say.

The researchers wrote about their study, findings, and conclusions in the Journal of Family Issues (citation below).

Preparing kids financially with real-world experience

The paper explores the parents’ importance regarding giving children real-world experience with money. This experience prepares kids financially for adulthood.

The authors suggest that future research should consider this type of experiential learning as a third key method of financial socialization.

Parents can prepare kids financially by giving them practice in various ways. They can, for example, give them a regular allowance, i.e., weekly pocket money. They could pay them for tasks that are not part of their normal chores, or reward them for academic achievement with cash. Also, encouraging them to save for charitable donations or special purposes is another option.

The specifics are not what really matter; neither is the amount of money. How much money to give usually depends on the family’s financial situation, says Ashley LeBaron. LeBaron is a Doctoral Student at the Norton School of Family and Consumer Sciences at the University of Arizona’s College of Agriculture and Life Sciences.

Prepare kids financially early in life

What matters is giving children hands-on experience with money early on, while the stakes are still relatively low.

LeBaron said:

“If the first time kids use a credit card or have to work or have to save up for something or have a bank account is when they’re on their own, that’s not a good time to be practicing.”

“It’s important for parents to give kids age-appropriate financial experiences when they’re monitoring them Let them make mistakes so you can help them learn from them, and help them develop habits before they’re on their own, when the consequences are a lot bigger and, they’re dealing with larger amounts of money.”

In their study, LeBaron and colleagues interviewed 115 participants. Ninety of them were college students aged between 18 and 30 years. The sample population also included some of those students’ parents and grandparents.

The researchers asked the students how their parents taught them about money. They also asked the parents and grandparents about money, but in this case, the questions were the other way around. In other words, how they prepared their kids financially.

Participants valued hands-on experience

Most of the participants reported that their parents or grandparents had given them some kind of experience with money in their youth. They also said that the experience was extremely valuable in preparing them to manage money.

The participants who never had those kinds of experiences said they wished they’d had them.

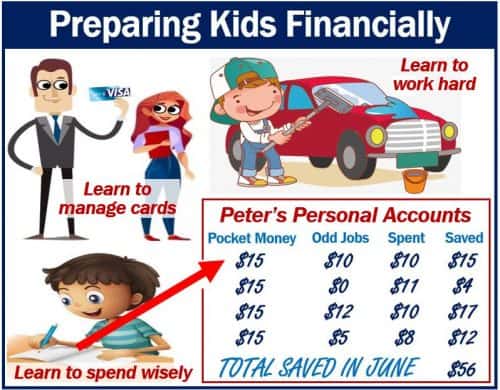

Based on the interviews, the researchers identified three main themes around what the participants had learned. Specifically, what they had learned from the financial experiences their parents had given them as children. The three main themes were:

- How to work hard,

- how to manage one’s money,

- and how to spend one’s money wisely.

The research team also identified three main reasons why parents said they gave their children hands-on experience with money:

– First, to prepare them financially, i.e., help them learn financial skills.

– Second, to help them acquire financial values, i.e., appreciate the value of money.

– Third, to help them become independent.

Millennials

LeBaron is a millennial. Millennials or the Millennial Generation are people born in the early 1980s to about 1995. We also refer to them as the Me Me Generation, the Echo Boomers, and Generation Y.

LeBaron wants to study financial socialization partly because of the persistent stereotype that her generation is bad with money. She wondered whether her generation hadn’t received the same degree of hands-on experience with money that previous generations had.

LeBaron does not yet have data to support those generational differences regarding preparing kids financially. However, she suspects that many mothers and fathers today may be reluctant to trust their children with money. Could this be stoking up problems for them in the future?

LeBaron said:

“I think it’s hard for parents, sometimes, to let their kids make mistakes. It’s tempting to just shield kids from everything related to money, but it’s really important for parents to get money into kids’ hands early on so they can practice working for it, managing it and learning how to spend it wisely.”

Ideally, parents will prepare their kids financially through modeling, explanation, and hands-on experience, LeBaron said.

LeBaron concluded:

“The best approach is a combination, where parents are setting a good example, they’re having open, ongoing conversations about money, and kids have the opportunity to practice.”

“If parents are doing all three of those things, there’s a really good chance their kids are going to learn important lessons about money.”

Citation

LeBaron, A. B., Runyan, S. D., Jorgensen, B. L., Marks, L. D., Li, X., & Jeffrey Hill, E. (2018). “Practice Makes Perfect: Experiential Learning as a Method for Financial Socialization.” Journal of Family Issues. DOI: https://doi.org/10.1177/0192513X18812917.