Procter & Gamble says it is shedding half its consumer brands, and focusing on just 70 or 80 of them, including Pampers diapers and Tide detergent – brands that represent more than 90% of its income and an even higher proportion of the company’s profits.

The aim, says Chairman of the Board, President, and Chief Executive Officer, A. G. Lafley, who returned to the company from retirement in May last year, is to streamline the world’s largest consumer-brands product business and accelerate growth.

From expansion to contraction

The announcement is a massive strategy change for a company that has pushed expansion aggressively since the turn of the century. In today’s increasingly competitive market, investors and P&G’s top management say the multinational giant has become too cumbersome to navigate effectively.

Mr. Lafley says P&G will get rid of about 100 brands that have not been performing well. So far, nobody outside the company knows which ones will go. People familiar with the business are talking about half its products, which represent about 10% ($8 billion) of its $83 billion annual sales.

In other words, it is shedding about 50% of its products that bring in 10% of its income and keeping the other half that represent 90%.

Cumulatively, however, these poor-performing brands add up to the equivalent of a Fortune 500 business.

According to Reuters, Mr. Lafley said P&G’s baby care, feminine and family businesses would lose fewer brands than its other businesses.

While acknowledging that the divestment will mean a reduction of P&G’s workforce, Mr. Lafley emphasized that many workers will be transferred to whoever buys the brands it wants to get rid of. When its pet food business was sold to Mars Inc., 1,100 jobs shifted to the buyer.

P&G’s top selling brands are Tide, Pampers, Crest and Gillette.

Emerging markets may be interested

P&G owns dozens of non-household names, including Metamucil (laxatives), Glide (dental floss), Clearblue (pregnancy tests) and Cheer laundry (detergent). Experts believe certain private-equity firms that focus on emerging market businesses looking to internationalize may be interested.

In an Audio Webcast on Friday, Mr. Lafley said he is not interest in size, but rather whether his company is the preferred choice of shoppers. He said even its larger brands will be sold off if it is decided that they cannot thrive in those segments. He reminded listeners that its pet-food brands, including Iams and Eukanuba, which posted sales in excess of $1 billion per year, were sold off.

According to Mr. Lafley:

- 23 brands have sales exceeding $1 billion,

- 14 brands have sales of $500 million to $1 billion,

- 30-40 brands’ sales are between $100 million and $500 million.

Giants trimming down

Multinational investors have come under intense pressure from shareholders to become nimbler. Drugmaker giants Eli Lilly, GSK (GlaxoSmithKline) and Novartis have agreed on deals to divest some of their businesses and focus on their core operations. Kraft, the grocery manufacturing and processing conglomerate, has split itself in half, as did pharmaceutical company Abbot.

P&G’s new strategy is a total U-turn for Mr. Lafley, who had spent nine years (2000-2009) expanding the company.

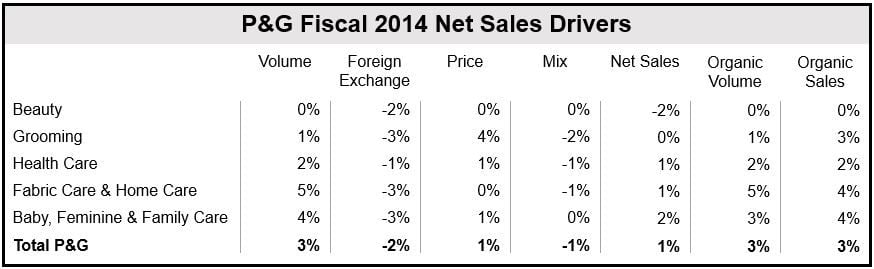

Mr. Lafley returned in May 2013 after Bob McDonald left following several disappointing results. Its Q4 results, which were published on Friday, showed 12-month sales ending in June up by just 3%, not that different to his predecessor’s last twelve months.

(Data source: P&G)

In nine of the last thirteen quarters, P&G sales have been lower than Wall Street estimates.

While admitting the company should have done better over the last 12 months, Mr. Lafley stressed P&G had delivered on its business and financial commitments.