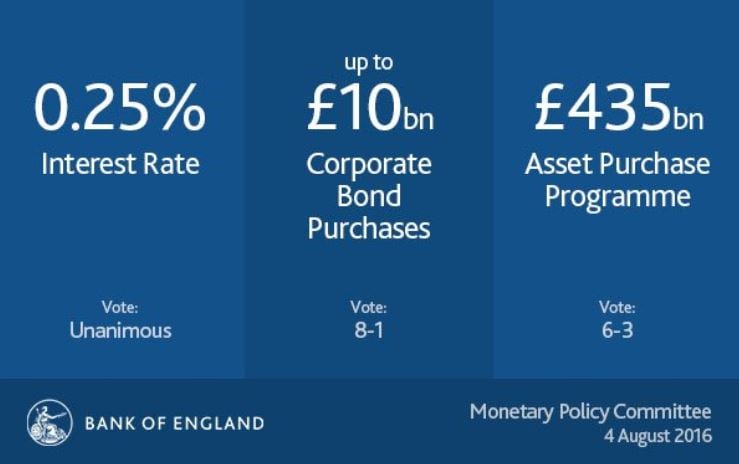

After slashing the bank rate from 0.5% to 0.25% and pumping an additional £70 billion into the economy, the pressure is growing for Chancellor Philip Hammond to announce tax cuts at the Autumn Statement in November 2016. Comments from within the BoE (Bank of England) and across the country suggest even lower interest rates are likely in the near future – possibly before the end of this year.

Britain’s banks started rolling out interest rate cuts following the halving of the base rate to a record low. HSBC, the UK’s largest high street bank, was one of several financial institutions to announce today that it was lowering rates on tracker mortgages.

Among economists and analysts, all bets are on for another interest rate cut – possibly to 0.1% – before the end of this year.

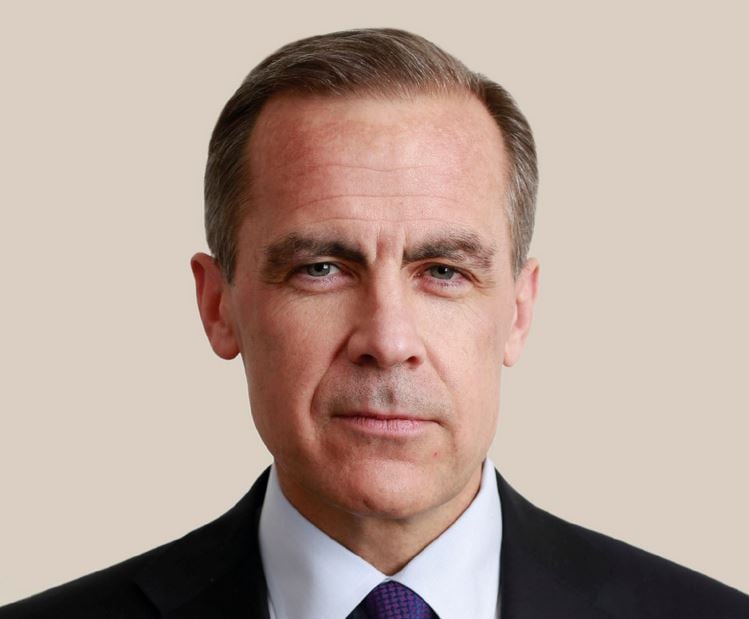

In a letter to Chancellor Philip Hammond, Bank of England Governor Mark Carney wrote: “Uk is a highly flexible, dynamic economy. These characteristics will help it to move to a new equilibrium as its future relationship with the EU become clear and new opportunities with the rest of the world open up.” (Image: Bank of England)

In a letter to Chancellor Philip Hammond, Bank of England Governor Mark Carney wrote: “Uk is a highly flexible, dynamic economy. These characteristics will help it to move to a new equilibrium as its future relationship with the EU become clear and new opportunities with the rest of the world open up.” (Image: Bank of England)

If passed on to individual people with bank accounts and loans, it will mean lower monthly mortgage repayments and an even more abysmal environment for savers.

New money should go to citizens

It all sounds great, doesn’t it? The UK’s central bank, worried about a Brexit-driven economic recession, reduces interest rates by 25 basis points, unveils a new Term Funding Scheme to reinforce the pass-through of the Bank Rate cut, will purchase up to £10 billion of UK corporate bonds, and will expand the purchase of UK government bonds of by £60 billion to £435 billion.

The last time the BoE took drastic measures to kick-start the economy – in response to the 2008 Global Financial Crisis – only 2% (approximately) of the extra money dispensed by the bank found its way into general circulation; the rest remained in the banks or shareholders’ pockets.

How can we be sure that the same thing will not happen again? Is this not similar to the monolingual Brit abroad who tries to solve his communication problem with the locals by shouting even louder in English instead of learning the country’s language. Woody Allen once complained about some New York restaurants that served dreadful meals, and tried to address their problem by serving larger portions – is what the Bank of England is doing more or less the same?

In a response letter to BoE Governor Mark Carney, UK Chancellor of the Exchequer Philip Hammond wrote: “You make clear in its August Inflation Report the MCP expect the vote to leave the EU will lead to a materially lower path for growth and a somewhat higher path for inflation than set out in May. The UK economy is fundamentally strong – employment is at a record high, there are almost a million new businesses since 2010, and the budget deficit has been reduced by almost two-thirds as a share of GDP.” (Image: twitter.com/PHammondMP)

In a response letter to BoE Governor Mark Carney, UK Chancellor of the Exchequer Philip Hammond wrote: “You make clear in its August Inflation Report the MCP expect the vote to leave the EU will lead to a materially lower path for growth and a somewhat higher path for inflation than set out in May. The UK economy is fundamentally strong – employment is at a record high, there are almost a million new businesses since 2010, and the budget deficit has been reduced by almost two-thirds as a share of GDP.” (Image: twitter.com/PHammondMP)

BoE Governor Mark Carney assured everybody this week that the new Term Funding Scheme will make sure that the measures will pass through into general circulation.

Purchasing corporate and government bonds is an example of QE (quantitative easing), which many say is really a euphemism for creating money out of nothing and giving it away – printing money.

According to theory, wealth is meant to ‘trickle down’ from those with loads of cash to people and entities that need it. However, there is no compelling evidence that this occurs in any significant way – in fact, all the evidence points the other way.

The British economy, like the rest of Western Europe, North America, Japan, S. Korea and Australasia, is driven by consumption. Sixty percent of GDP (gross domestic product) comes from consumer demand.

If people have no disposable income, or decide not to spend whatever spare cash they have, then the economy is in trouble.

BoE – why cut the Bank Rate plus the QE?

The Bank of England explains that following the decision in a referendum by the electorate on 23rd June this year to leave the European Union – the Brexit vote – the pound sterling has fallen and the outlook for GDP growth in the short-to-medium term has weakened considerably.

Before the referendum we were warned this would happen by Mr. Carney, the Prime Minister, the American President, the German Chancellor, the CBI, the British Chambers of Commerce, the World Bank, the IMF, and thousands of economists and businesses across the country. The Leave campaigners accused all of them of scaremongering and assured that nothing of the sort would happen.

How completely wrong the Leave campaigners were. To add insult to injury, they all jumped ship. As soon as the pound took a nosedive, Prime Minister David Cameron resigned, and national-European-global panic emerged, UKIP leader Nigel Farage ran for cover (resigned as party leader) and Boris Johnson pulled out of the race to become the new Tory leader.

According to the Bank of England, each MPC member has expertise in the fields of economics and monetary policy. They do not represent individual groups or areas, i.e. they are independent. Each member has a vote to set interest rates – the Committee’s decision is made on the basis of 1-person-1-vote, and not on a consensus of opinion. (Image: adapted from Bank of England MPC web page)

According to the Bank of England, each MPC member has expertise in the fields of economics and monetary policy. They do not represent individual groups or areas, i.e. they are independent. Each member has a vote to set interest rates – the Committee’s decision is made on the basis of 1-person-1-vote, and not on a consensus of opinion. (Image: adapted from Bank of England MPC web page)

According to UK’s central bank, the sterling decline will probably push up CPI inflation in the near term, accelerating our inflation rate to the 2% target. Most economists predict inflation will soon exceed that target.

The BoE added:

“In the real economy, although the weaker medium-term outlook for activity largely reflects a downward revision to the economy’s supply capacity, near-term weakness in demand is likely to open up a margin of spare capacity, including an eventual rise in unemployment.”

“Consistent with this, recent surveys of business activity, confidence and optimism suggest that the United Kingdom is likely to see little growth in GDP in the second half of this year.”

The BoE’s Monetary Policy Committee (MCP) – a 9-member committee that meets every month and decides on interest rates and other monetary policy measures – these latest measures will not only help eliminate the degree of spare capacity in our economy over time, it should also help make sure that inflation does not fall back below the 2% target in over the medium term.

— Bank of England (@bankofengland) August 4, 2016

“Thus, in tolerating a temporary period of above-target inflation, the Committee expects the eventual return of inflation to the target to be more sustainable,” the BoE wrote.

The MCP said that the Bank Rate cut will reduce borrowing costs for both businesses and households. However, as interest rates are nearly at the zero mark, it is going to be difficult for some banks and building societies to bring down deposit rates much further. This will limit their ability to reduce their lending rates.

Term Funding Scheme

The MPC says it is addressing this problem by launching a TFS (Term Funding Scheme), which will provide funding for banks at close to Bank Rate interest rates.

The BoE wrote:

“This monetary policy action should help reinforce the transmission of the reduction in Bank Rate to the real economy to ensure that households and firms benefit from the MPC’s actions. In addition, the TFS provides participants with a cost effective source of funding to support additional lending to the real economy, providing insurance against the risk that conditions tighten in bank funding markets.”

The MPC approved a three-pronged approach to prevent a recession. The vote to slash the Bank Rate was unanimous – this was not the case with the QE measures. (Image: twitter.com/bankofengland)

The MPC approved a three-pronged approach to prevent a recession. The vote to slash the Bank Rate was unanimous – this was not the case with the QE measures. (Image: twitter.com/bankofengland)

Buying more government bonds

The expansion of the central bank’s asset purchase programme for British government bonds will provide monetary stimulus by lowering yields on securities that are used to determine borrowing costs for businesses and households.

The majority of MPC members believe it should also trigger portfolio rebalancing into riskier assets by current government bond holders, which will further expand the supply of credit to the broader economy.

Purchases of corporate bonds

“Purchases of corporate bonds could provide somewhat more stimulus than the same amount of gilt purchases,” said the BoE.

As corporate bonds are higher-yielding than government bonds, investors selling corporate debt to the BoE will hopefully be more likely to invest the money they get into other corporate assets than those selling gilts.

Whether the MPC’s measure will work remains to be seen. British newspapers responded either with a cautious welcome or fiercely against. Future job prospects have changed from excellent to uncertain as a result of the Brexit vote. (Image: twitter.com/FT/status)

Whether the MPC’s measure will work remains to be seen. British newspapers responded either with a cautious welcome or fiercely against. Future job prospects have changed from excellent to uncertain as a result of the Brexit vote. (Image: twitter.com/FT/status)

By expanding demand in secondary markets, purchases by the BoE could reduce *liquidity premia; and ‘such purchases could stimulate issuance in sterling corporate bond markets.’

* Liquidity premium (plural: premia) is premium that investors demand when any given security cannot be easily converted into cash for its fair market value.

Conditional on the latest package of measures, the MPC says it expects that during the 3-year forecast horizon unemployment will have started falling back, while much of the nation’s spare capacity will have been re-absorbed. It also predicts that inflation will be marginally above the 2% target.

According to the MCP:

“In those projections the cumulative growth in output is still around 2½% less at the end of the forecast period than in the MPC’s May projections. Much of this reflects a downward revision to potential supply that monetary policy cannot offset.”

“However, monetary policy can provide support as the economy adjusts. Had it not taken the action announced today, the MPC judges it likely that output would be lower, unemployment higher and slack greater throughout the forecast period, jeopardising a sustainable return of inflation to the target.”

The following members of the Committee were present at the MPC meeting on 3rd August:

– Mark Carney, Governor

– Ben Broadbent, Deputy Governor responsible for monetary policy

– Jon Cunliffe, Deputy Governor responsible for financial stability

– Nemat Shafik, Deputy Governor responsible for markets and banking

– Ian McCafferty

– Kristin Forbes

– Martin Weale

– Andrew Haldane

– Gertjan Vlieghe

– Dave Ramsden was present as the Treasury representative.

(Above) Rain Newton-Smith, CBI Chief Economist. The CBI described the combination of a rate cut plus more QE as a ‘shot-in-the-arm’ for consumer and business confidence. (Image: news.cbi.org.uk)

(Above) Rain Newton-Smith, CBI Chief Economist. The CBI described the combination of a rate cut plus more QE as a ‘shot-in-the-arm’ for consumer and business confidence. (Image: news.cbi.org.uk)

Responding to the latest BoE measures, CBI Chief Economist, Rain Newton-Smith, said:

“The Bank has rightly prioritised growth in its response to greater economic uncertainty after the EU referendum. The innovation of the Term Funding Scheme will make it easier for banks to ensure that the interest rate cut will fully benefit businesses and households.”

“The Bank’s expectation that the UK’s growth potential could be negatively affected by Brexit in the medium-term makes it all the more important for the Government to take swift, decisive action to unlock key infrastructure investment and show that the UK is open for business.”

“With interest rates once again at record lows, expansionary fiscal policy can do more to shore up business and consumer confidence, and put the UK on a stronger growth path for the future.”

Video – Bank of England throws cash at Brexit

This CNNMoney report explains in simple terms what the BoE has done in response to the economic uncertainty and risk of recession triggered by the Brexit vote in June.