The retirement age should be increased to at least 70 years by 2050, says a new report issued by the World Economic Forum, when a life expectancy of more than 100 years will be the norm in the United States, United Kingdom, Japan, and the other advanced economies.

Life expectancy refers to people’s estimated lifespans.

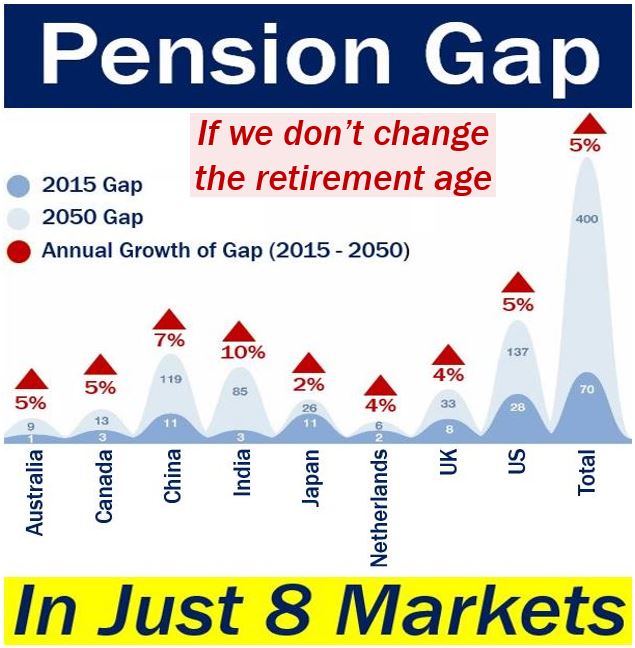

The World Economic Forum’s new study – ‘We’ll Live to 100 – How Can We Afford It?‘ – warns that the six largest pension saving systems in the world – those of Canada, the US, UK, Japan, Australia, and the Netherlands – are forecast to reach a $224 trillion gap by the middle of this century.

If we add India and China to the total, the combined savings gap will reach $400 trillion – that is five times the global economy today!

If we don’t change the retirement age and find ways of getting people to save more, by the middle of this century our economies will be sunk by a colossal and prolonged financial crisis – one that would make all other crises in our history seem insignificant. (Image: adapted from weforum.org)

If we don’t change the retirement age and find ways of getting people to save more, by the middle of this century our economies will be sunk by a colossal and prolonged financial crisis – one that would make all other crises in our history seem insignificant. (Image: adapted from weforum.org)

Raise retirement age in line with life expectancy

The gap is growing because we are living longer and saving less, say the authors, who recommend five measures to help prevent a prolonged pension crisis.

– Retirement Age: where future generations have a life expectancy of more than one century, the real retirement age should be at least seventy years by 2050.

– Make Saving Money Easier: the authors point to recent reforms in the United Kingdom, where 8% of earnings will automatically go to a pension savings account for each person – starting in 2019.

“[This initiative] is estimated to create $2.5 billion in additional pension savings each year.”

– Support Financial Literacy Efforts: this should start when children are at school. Governments should also target vulnerable groups.

Financial literacy is the ability to understand how money works globally, how it is earned or made, how it is managed, how we should turn it into more (invest it), and donate it to help other people.

– Explain National Pension Systems: the government needs to provide clear communication on the aims of each pillar of national pension systems and the benefits for citizens.

Individuals would then have an understanding of the level of income they may expect from their government, and whether they need to ‘top-up’ with their own savings plans.

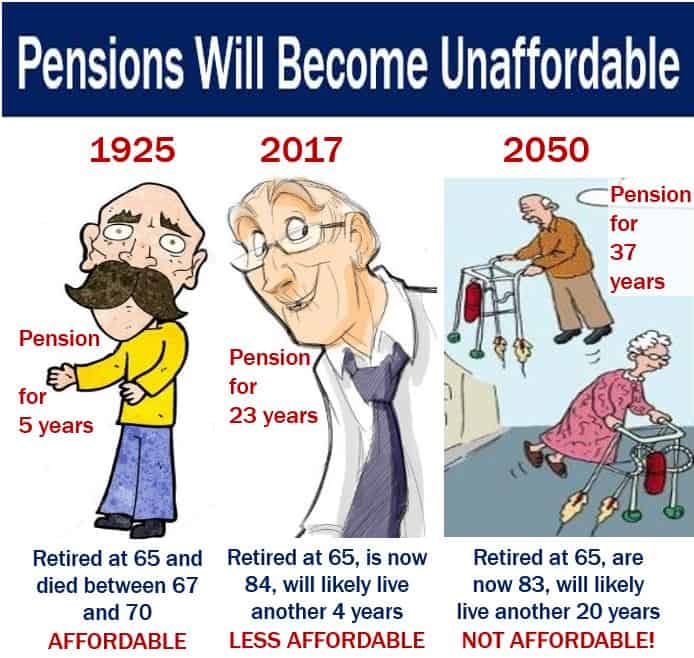

Ninety years ago, a pension in the UK, USA, or one of the other advanced economies was expected to provide a retired person with an income for an average of up to five years. Over the last nine decades, the retirement age has remained pretty much unchanged across the world, but we are living considerably longer. By 2050, the whole pension system, if we do not change it, will become completely unaffordable.

Ninety years ago, a pension in the UK, USA, or one of the other advanced economies was expected to provide a retired person with an income for an average of up to five years. Over the last nine decades, the retirement age has remained pretty much unchanged across the world, but we are living considerably longer. By 2050, the whole pension system, if we do not change it, will become completely unaffordable.

– Standardize and Aggregate Pension Data: so that citizens are given a full picture of how they stand financially. In Denmark there is an online dashboard that collates pension data to provide people with a holistic view of a number of different pension savings accounts.

Society needs to adapt to an aging population

Governments, lawmakers, and policymakers have a central and crucial role to play in reforming pension systems, the authors believe. We need to make sure that our society in future – with life expectancy exceeding 100 years – is able to adapt.

Robert Prince, Co-Chief Investment Officer at Bridgewater Associates, and part of the World Economic Forum’s Retirement Investment Systems Reform Project Steering Committee, explained:

“Because retirement outcomes unfold slowly over decades, emerging problems are very hard to see and are virtually unchangeable once they occur. Good outcomes require effective approaches and good decisions applied consistently over decades.”

“Ineffective actions taken over decades will put a weight on society and economies that will be virtually impossible to lift once it occurs. Given ageing populations and increasing lifespans, effective reforms are required now.”

Video – World’s aging population 2050

According to this ZoomIn video, the United Nations predicts that by the year 2050, the proportion of the world’s population aged 60+ will be the same as the child population (up to 14) for the first time in history. In countries like Germany and Japan, more than 35% of their populations will be aged sixty or over by the middle of this century.