Could a central bank digital currency, or CBDC, be the foundation of India’s future economy? India has been relatively keen to adopt new payment methods, such as mobile wallets, UPI (Unified Payments Interface), and QR code-based systems.

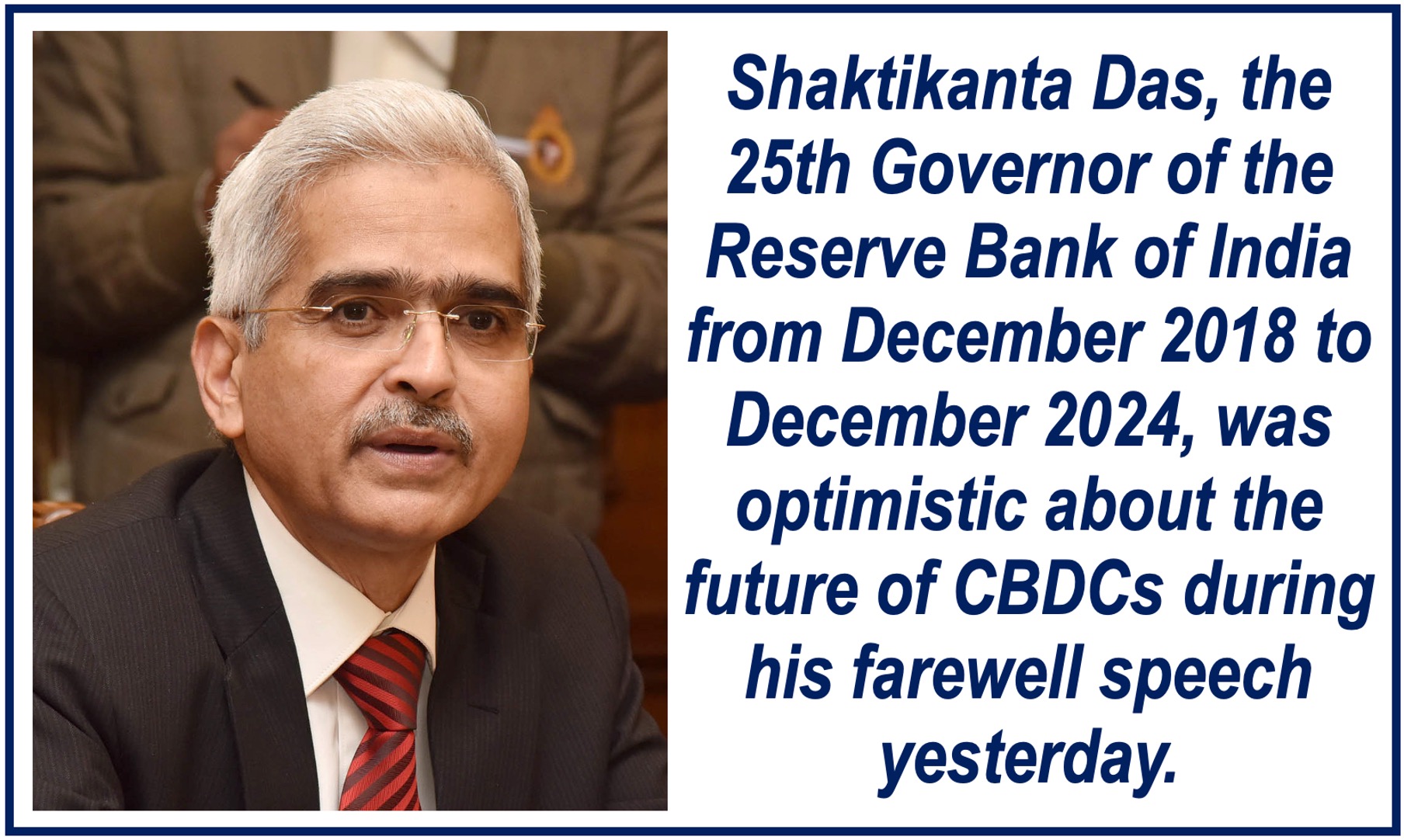

An official at the Reserve Bank of India (RBI), India’s central bank, believes a CBDC will be important for the country.

The governor of RBI, Shaktikanta Das, made the remarks during a farewell speech. He said that the digital rupee, India’s CBDC, “has a huge potential in the coming years, in the future. In fact, it is the future of currency.”

While many central banks globally are stuck in preliminary discussions and experimentation, “RBI, among the central banks, is a pioneer (it is one of the few central banks to launch a pilot CBDC),” Das added.

Binance Square made the following comment about Das’ farewell speech:

“Das spoke confidently about the power of the digital rupee to change the way people make payments. He noted that digital currency could eventually replace paper money, creating a more efficient system for transactions.”

Das’ Stance Has Changed

Das has not always been so keen on a system-wide CBDC rollout.

Last year, he said that nobody knew what the technology’s potential impact might be on users and the country’s monetary policy.

However, he now believes that we can gain a deeper understanding of these implications by gathering and analyzing data generated in pilot programs.

To minimize risks, Das suggests that a CBDC could be phased in gradually. He is now confident that a CBDC could eventually be the foundation of India’s future domestic and cross-border payment systems.

India – an Instant Payments Forerunner

Thanks to its popular UPI platform, India is today a forerunner of instant payments. The UPI platform is the country’s most dominant payment method.

Its success has enabled India to export its instant payment system to various parts of the world, including Africa and Latin America.

Some people, including experts, have wondered and speculated whether UPI instant payments and the digital rupee can coexist. According to Das, there shouldn’t be any competition between the two.

Consumers could make a CBDC or UPI payment from the same QR code. Therefore, there shouldn’t be a barrier to the adoption of either payment method.

Joel Hugentobler, Cryptocurrency Analyst at Javelin Strategy & Research, said the following to PaymentsJournal:

“Whether it’s a retail or wholesale CBDC will dictate some of those factors, but India has led the world in some areas of innovation.”

“If they are seeking real adoption of users for their CBDC, they will focus on privacy, security, and interoperability between existing systems. It will be interesting to see if their roll out is successful, and if so, which central bank will be next.”