Rona Inc., the home improvements retailer, posted a third quarter net profit increase of 28.4% on Tuesday. After seeing its first rise in same-store sales in four years, the company announced plans to expand in 2015, including opening a couple of shuttered stores.

After closing down eleven loss-making stores in Western Canada and Ontario, cutting 1,000 front-line and management posts, and deriving $110 million savings in annual costs, Rona’s results have improved.

Rona’s President and CEO Robert Sawyer said:

“The third quarter results demonstrate the positive impact of having our teams focused on optimizing store operations. Despite a slow economy and strong competition, our same-store sales in the Retail segment have grown by 2.0%. We are satisfied with the progress of our Réno-Dépôt banner and the performance of our converted TOTEM stores.”

“Across the country, our various banners’ merchandising programs are bearing fruit and the improved management of store operations is yielding the expected results.”

(Source: Rona Inc. Third Quarter Results, 2014)

In the third quarter, same-store sales rose by 3%, which included an 8.3% and 2% gain in the distribution and retail segments respectively.

Mr. Sawyer assured investors that Rona’s expansion will be “disciplined” and will focus on protecting market share.

The company plans to open five stores next year, including two Réno-Dépôt box stores outside Quebec.

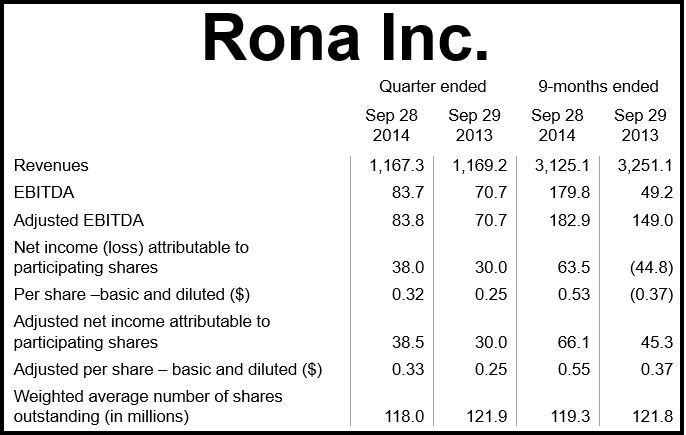

The Boucherville-based company said it earned $38 million ($0.32 per share) in the third quarter, versus $30 million ($0.25 per share) in Q3 2013. Adjusted profit (excl. one-off items) rose by 28% to $38.5 million ($0.33 per share).

Revenue, at $1.167 billion in Q3 2014, was marginally lower than $1.169 billion in Q3 2013.

Gross margins fell to 25.2% from 27.2% as a percentage of revenue, which was more than offset by the cost savings from store closings over the past 24 months.

EBITDA (earnings before interest, taxes, depreciation, and amortization) rose to $83.7 million (7.2% margin) in the third quarter, compared to $70.7 million (6.1% margin) in Q3 2013.

Rona also renewed its share buyback program, spending $77.1 million buying almost 6.1 million shares in its previous normal course issuers bid, at $12.69 per share. The company has the option of repurchasing 9.2 million common shares.