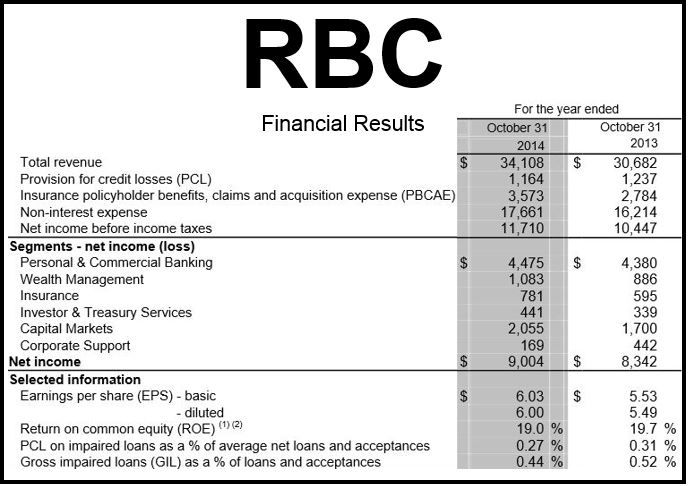

The country’s largest financial institution, Royal Bank of Canada, posted an all-time high net income of C$9 billion for the year ended Oct 31, 2014, which was 8% (C$662m) higher than last year.

The Toronto-based bank said the strong figures were driven by record earnings across all its business segments.

It reported positive operating leverage across most businesses, and solid credit quality with a PCL (provision for credit loss) of 0.27%. At the end of the fiscal year its Basel III Common Equity Tier 1 ratio stood at 9.9%.

President and CEO Dave McKay said:

“We delivered record earnings of $9bn in 2014, with record results in each of our business segments. Looking ahead, while we anticipate industry headwinds to persist, we believe RBC is well positioned given the strength of our franchise as well as our commitment to delivering superior advice and a differentiated experience to our clients.”

Personal and commercial banking profit increased by 8% to C$1.15 million, driven by loan and fee-based revenue growth.

Net income wealth management grew by 41% to C$285 million, with market gains and net sales raising assets under management.

However, it was hit by weakness at its capital markets unit, where income declined by 14% to C$402 million.

Net income in Q4 was C$2.3, which was 11% (C$232 million) higher than in the previous Q4.

Net income, also known as net earnings or net profit, describes a company’s income after accounting for taxes, the cost of good sold, depreciation and expenses.