It’s never too early to get started investing money, and it’s not as risky as many novice investors think. While no investment is completely without risk, there are some strategies for protecting a portfolio that are less risky than others. Read on to find out about a few safe investments for beginners, but don’t be afraid to start taking more risks for a better return once that portfolio begins to grow.

Investing in Gold

Gold is considered by some to be one of the safest investments around. Nearly all the gold that will enter the market has already been discovered, which makes it a scarce resource, and gold is strongly associated with luxury and wealth for a reason. It is always in demand. In fact, historically it was used to back fiat currency even in the United States.

What makes gold a great investment isn’t just its inherent and perceived value. It’s also viewed by financial experts as an excellent hedge against inflation.

Treasury Bonds

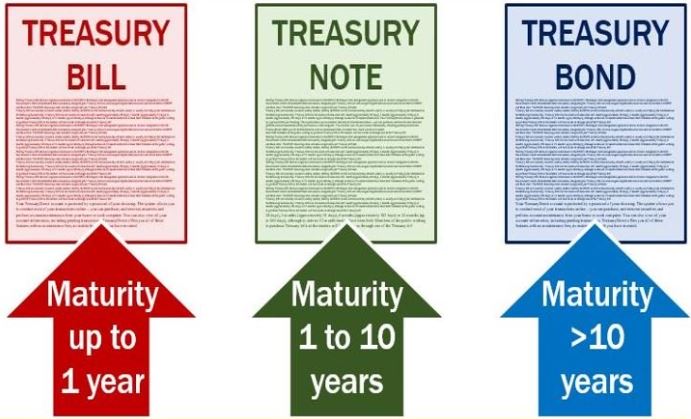

Treasury bonds allow Americans to essentially give a loan to their government. The government will pay interest on the loan at regular intervals, then when the term comes due, the government pays back the face value of the bond. Since they’re backed by the U.S. government, investors are guaranteed to get the interest rates they are promised for as long as they own the bond.

Bonds are long-term investments. They won’t come due for 20 or 30 years. Those looking for shorter payback periods may want to investigate treasury notes or bills instead, but they should note that the interest rates aren’t as good on these short-term investments.

Fixed-Interest Rate Corporate Bonds

Corporate bonds purchased from stable companies with good track records aren’t as low-risk as treasury bonds, but they can offer higher payoffs. UK corporate bonds constitute a reliable

source of income for a portfolio. Current returns range from around 3% to over 4%, and these bonds come with a promise from the company that it will pay back the principal amount.

What makes corporate bonds slightly riskier than treasury bonds is that if the company goes bankrupt, it can default on its debt. Choosing stable companies with a good track record can minimize this risk. Even if a company goes bankrupt, corporate bonds are less risky than preferred stocks or dividend-paying common stocks since bondholders will be the first to have their debts paid.

Mutual Funds

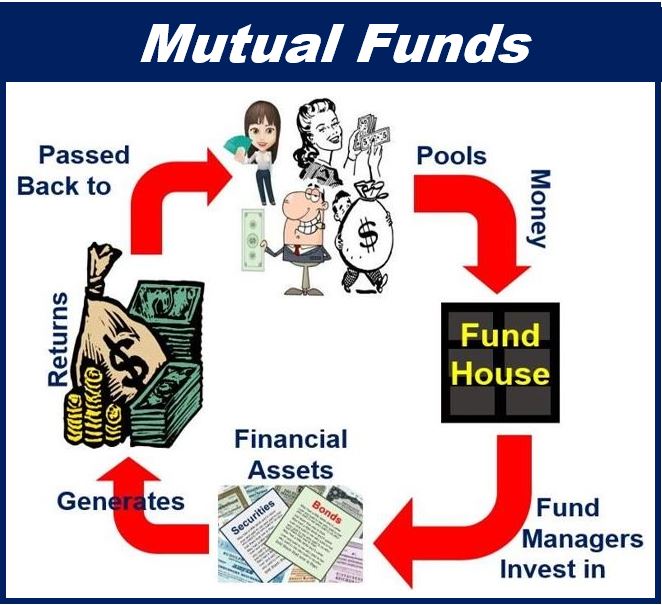

Mutual funds are single investments that offer exposure to multiple assets. They offer higher rates of return than any of the other options on this list but also come with a greater level of risk. That being said, they’re great for long-term investors who have the time to weather the market’s inevitable rises and falls.

There are two main types of mutual funds. Investors can either take out actively managed mutual funds, which come with higher fees, or they can opt for passively managed funds that have lower expense ratios. Try to maintain an acceptable balance of risks and returns and resist the urge to pull out each time the market takes a turn for the worse.

The Bottom Line

Investing money can be scary. There are plenty of ways for investors to minimize risk, though, even if they’re new to the game. Creating a diverse portfolio that balances risk-averse investments with high-return ones is the best way to go, but it’s fine to start out with low-risk investments like gold and bonds.

Interesting related articles:

- “What is Gold?“

- “What is a Bond?”