Shareholders should decide executive pay in a binding vote, the European Commission proposes as part of a package to increase shareholder power and democratize firms’ remuneration policies.

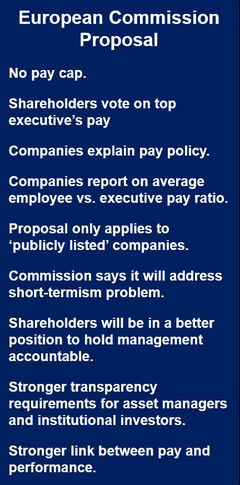

If the European Commission’s proposal gets approval there would be no European Union pay cap. What the Commission calls its “say on pay” policy would only apply to companies that are publicly traded in the stock markets of the 28 Member States – about 10,000 firms.

Many economists, lawmakers, investors and academics believe shareholders should decide executive pay. They argue that business executives are there to serve the company, which belongs to its shareholders.

EU pushing to control runaway executive pay

Since the global financial crisis that hit in 2007-2008, the European Union has managed to push forward limits on banker bonuses, which currently stand at twice their annual fixed pay levels. Other legislation regarding managers of hedge funds and other EU investment packages have also been introduced.

Michel Barnier, Internal Market and Services Commissioner said:

“The last years have shown time and time again how **short-termism damages European companies and the economy. Sound corporate governance can help to change that.”

“Today’s proposals will encourage shareholders to engage more with the companies they invest in, and to take a longer-term perspective of their investment. To do that, they need to have the rights to exercise proper control over management, including with a binding ‘say on pay’.”

“I also see it as a priority that company law offers European SMEs an efficient framework for their operations and growth. The European Single-Member Company will help entrepreneurs reduce costs and organize their activities abroad.”

** Short-Termism – focusing too much on current and short-term gains, rather than a company’s long-term financial and economic health.

According to the European Commission, its proposal to revise the Shareholder Rights Directive (Directive 2007/36/EC) would address corporate governance deficiencies linked to listed companies and their boards, institutional investors and asset managers (shareholders), and companies providing services to shareholders (e.g. voting advice).

Executives’ risk-taking needs closer monitoring

As the global financial crisis showed, too often shareholders backed managers’ excessive short-term risk-taking strategies and did not closely oversee the businesses they invested in.

The European Commission says its proposals would make it easier for stockholders to exercise their existing rights over companies “and enhance those rights where necessary.” Shareholders would then become more engaged and in a better position to hold the company’s management to account and act in the long-term interests of the business.

According to the European Commission, “A longer term perspective creates better operating conditions for listed companies and improves their competitiveness.”

Within the proposals are stronger transparency requirements for institutional investors and asset managers on their engagement policies and investment regarding the businesses in which they invest, “as well as a framework to make it easier to identify shareholders so they can more easily exercise their rights (e.g. voting rights), in particular in cross-border situations (44% of shareholders are from another EU Member State or foreign). Proxy advisors would also have to become more transparent on the methodologies they use to prepare their voting recommendations and on how they manage conflicts of interests.”

Stronger link between pay and performance needed

Legislation giving a “say on pay” for shareholders would be introduced. Barnier argues that the link between executive pay and performance is currently insufficient; this encourages harmful short-term tendencies.

If the proposals are approved, companies would have to disclose clear, comparable and comprehensive data on their pay policies and how they were implemented. Although there would be no binding limit on executive pay, each company would be required to put its executive pay policy to a binding shareholder vote. The policy would clearly include a maximum remuneration level for executives.

Companies would also be obliged to explain how their pay policy contributes to the company’s long-term interests and sustainability, as well as listing the ratio between average employees’ pay and executive pay.

Many say top executives have learned nothing

There is a growing feeling around the world that many companies, especially banks and other financial institutions that went cap-in-hand to their governments desperately asking for bailout money only a few years ago, have learned nothing and are sliding back into their old “fat cats”, “jobs for the boys” behaviors.

A fat cat is an executive who is overpaid, i.e., their bonuses do not reflect their performance.

According to a study by eFinancialCareers, banking bonuses globally have risen by 29% over the last 12 months. The Royal Bank of Scotland managed to put aside £576 million ($964 million) for bonuses after posting a shocking pre-tax loss of £8.243 billion ($13.30 billion) for 2013.

After laying off 8,000 working to save money, JP Morgan gave its CEO a 74% pay rise. Barclays is laying off 12,000 workers but raising bonuses for its top executives.

Shareholders should focus on the big picture

Not everybody agrees that shareholders should decide executive pay. The Confederation of British Industry (CBI) warns of the dangers of shareholders micromanaging executive activity.

CBI Director of Competitive Markets, Matthew Fell, said:

“We welcome the European Commission’s objective to encourage more long-term focused shareholder engagement. However, any changes to the rights and responsibilities of shareholders should not blur their roles with those of company boards and management, otherwise they will result in inefficient micro-management by shareholders.”

“It shouldn’t be shareholders’ responsibility to set specific pay levels or vote on pay ratios, for example. It’s right that shareholders focus on the big picture when it comes to pay, and in the UK they have a vote on company pay policy, but the remuneration committee should retain responsibility for specific pay levels.”

Pension fund managers cautiously keen

The UK’s National Association of Pension Funds (NAPF) says it supports the EU’s proposal to encourage long-term shareholder engagements, but warns against a “tick-box exercise.”

Will Pomroy, Policy Lead for Corporate Governance at the National Association of Pension Funds (NAPF), said that the Commission’s directive has positive objectives. However, he cautioned against unintentionally tying the hands of investors or creating a tick-box exercise that could undermine the right behaviors.

Mr. Pomroy said regarding shareholders having the right to vote on directors’ remuneration policy:

“With our members invested in companies across Europe, the extension of a shareholder binding vote on executive remuneration across the single market is very welcome.”

“We believe that executive pay should be proportionate and aligned with shareholder interests and long-term sustainable value creation. It is also important that remuneration committees should be able to justify credibly pay differentials within the company.”