Ringing in a new year invites new goals and challenges for those who aim for personal and professional growth, especially when it comes to running a small business. As a new business quarter begins, many small business owners will feel challenged to create goals for business growth and change, but some may not know where to even begin.

Without clear vision and measurable benchmarks, business goals can be murky and serve as mere distractions from the bigger picture. Instead of fumbling in the dark, here are 5 business goals small business owners can set for their businesses in 2020.

Without clear vision and measurable benchmarks, business goals can be murky and serve as mere distractions from the bigger picture. Instead of fumbling in the dark, here are 5 business goals small business owners can set for their businesses in 2020.

1. Clear all debts, account receivables, and IOUs

When starting off a new year and business quarter, a great way to hit the reset button is by beginning with a clean slate. If you let receivables pile up, it will only add to clutter which will make organizing your accounts more confusing. Instead, small business owners should bring their focus to clearing account receivables and vendor IOUs.

This will help business owners have an accurate idea of their business accounting. Set a date for when each debt should be cleared by and make decisions on pending repayments and IOUs that are taking too long. If needed, look into business debt consolidation to make things simpler. Companies such as Opportunity Business Loans can connect you with lenders that offer this option. As you take into consideration how well your finances did in the last year, also note which vendors and clients were consistent in their payment and timing.

2. Boost your personal and business credit score

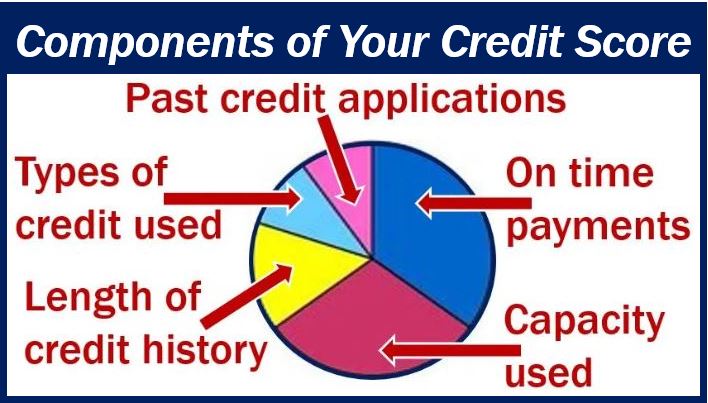

One overlooked but essential aspect of running a small business is upkeeping a good personal and business credit score. When business gets busy and chaotic, it can be difficult to keep track of your credit scores if you’re not occasionally checking in. Both business and personal credit scores can impact your chances of loan approval and business financing.

According to Alabrava, 33% of small business owners say that lack of cash flow is their biggest challenge. Without a good business credit score, businesses will face lower loan approval and higher interest rates. Order your personal and business credit score report multiple times a year to make sure your reports hold no mistakes, inaccuracies, or false information. If you do find an issue on your report, dispute the problem with the credit bureaus. If you’re short on time and need to outsource to work to someone else, companies such as Star Credit Repair can help you find the best credit repair company for your situation.

3. Auditing your ROI

It’s easy to become complacent in your business goals when times are going well and things are busy. However, it’s important to evaluate and measure the return on investment in each area where you are investing your resources. Without this occasional fine tuning, you may not know about a large financial sinkhole until it wreaks havoc later on.

Take the time to consider where your resources, money, and energy are going and whether or not the output is giving back an adequate return for your investment. Auditing the ROI for your business could help you cut out unnecessary costs and help you direct your cash flow into places that are giving you more for your time, energy, and resources.

4. Focus on improving customer relations

Another goal to set for your business is to focus on improving your CRM systems and customer relations. Customers are the lifeblood of your business and if your customer base is not progressively growing, it can be easy for your company to hit a plateau. However, if you commit to investing your time and resources into building a stronger CRM and customer relations strategy, your return could propel your business in growth.

Building better customer relations could look like taking the time to come up with new strategies in customer service. Whether it’s by receiving feedback or building rapport with your customers, the effort you invest into building a positive experience for your customer will not be wasted.

5. Increase employee training

What is the difference between a work team that is just surviving versus a work team that is thriving? Investing into talent retention can make all the difference for a growing business. One of the leading factors for high turnover rates in an office is employee dissatisfaction. This could be attributed to lack of growth and opportunities, low morale, toxic work environments, changes in life circumstances, and more. However, one way to lower turnover rate is by investing in your employees.

Taking the time to train your employees in new skills and responsibilities can demonstrate a stronger sense of loyalty and trust to your employees and vice versa. The best return on investment that you make is into the people of your organization and giving them opportunities to thrive and grow.

Final Thoughts

Every small business owner needs a clear vision and strategy of where to take their business and how to implement growth. During the start of a new year, small business owners can take charge by using the above goals to create growth for their company.

_____________________________________________________

Interesting related article: “What is Training?“