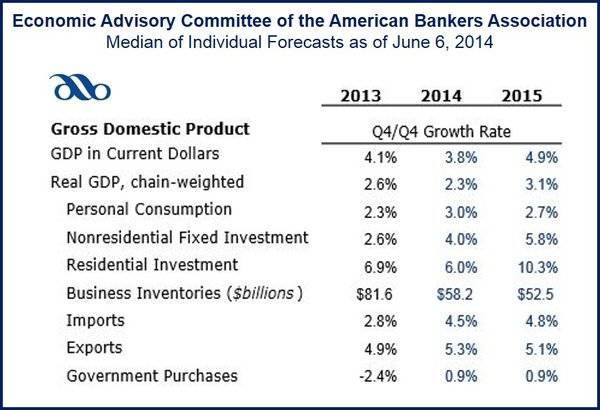

There is solid growth ahead, the American Bankers Association (ABA) predicts. The American economy started growing again in Q2 2014 after a particularly sluggish start to the year. However, investment in homes and businesses – combined with reduced fiscal drag – will boost GDP growth over the next two years, says the Economic Advisory Committee of the ABA.

The Committee is made up of 14 chief economists of the biggest banks in North America. They forecast inflation-adjusted GDP (gross domestic product) will grow by approximately 3% this year and by the same amount in 2015.

Christopher Low, chairman of the group and chief economist of First Horizon National Corp’s FTN Financial, said:

“The unusually cold winter, along with temporary drags from an inventory correction and weaker trade, slowed economic activity in the first quarter. As these temporary factors fade, the underlying health of the economy will show through, with business spending and hiring leading the charge.”

President of the Federal Reserve of Atlanta, Dennis Lockhart, forecasts 3% GDP growth for Q2 2014 after a dramatic Q1 slowdown. He also predicts that the housing market is likely to pick up again after its recent lull.

Moderate consumer spending growth

The economists say consumer spending will grow moderately until wages increase more rapidly.

Low said “Households are benefiting from a material rise in home and equity prices, but remain constrained by weak wage growth. A more meaningful pickup in consumption will be elusive without stronger wage growth.”

Home prices are set to rise solidly nationwide while residential investment will grow by 10% for the remainder of the year, the Committee predicts. Greater labor market activity will lead to stronger household formation, which will support the housing recovery, they add.

Low commented “We foresee enough growth in jobs and income to keep housing strong even as mortgage rates rise. As home prices rise, we may begin to see an increasing **wealth effect contribution to consumer spending.”

** The wealth effect is a theory that we spend more when we feel richer because our property, stocks or bonds have gone up in value.

Unemployment falling, inflation rising

Unemployment should decline to 6.1% by the end of 2014 and to 5.6% by the end of 2015, the group forecasts.

Low sees new jobs growing by an average of 200,000 per month for the remainder of 2014. The 217,000 jobs created in May reaffirm their outlook for the jobs market, he added.

The Committee predicts inflation will pick up, nearing the Federal Reserve’s (Fed’s) target of 2% by the end of next year. Its members believe the Fed will not alter policy rates until the middle of next year.

The tapering of the bond-buying stimulus program should be completed this year, after which the normalization of interest rates will occur during the second half of 2015.

Business lending to grow faster than lending to consumers

There is likely to be a moderate increase in lending to consumers this year – consumers continue being cautious about taking on more debt while banks face growing regulatory restraints.

Lending to businesses, on the other hand, will be stronger.

The Committee predicts that lending to consumers will grow by approximately 4.5%, while loans to businesses will expand by about 9%.

Low said:

“We’re optimistic that business lending will grow at a near double-digit rate over the next couple of years. Banks stand ready to meet demand as businesses take the next step forward.”

(Source: American Bankers Association)

The economists express concern about the current federal debt levels, despite its recent declines. They forecast the federal deficit will fall to $490 billion in 2014 (fiscal year) and $470 billion in fiscal year 2015.

Low said “Despite near-term improvements in deficit levels, we remain concerned about the prospects of larger looming deficits in the long run.”

A growing number of economists believe the US needs to implement economic reforms in order to secure sustainable, long-term economic growth. In June 2014, the OECD put forward a number of suggestions.