While the stimulus program taper starts in January, very low interest rates are here to stay for a very long while, the US Federal Reserve announced.

The $85 billion per month bond-buying program will go down to $75 billion in January.

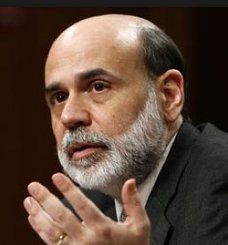

Ben Bernanke, who has been chairman of the US Federal Reserve (Fed) since 2006, has the experience to know that when you dish out tough news, try and present it with a silver lining. The Fed is America’s central bank.

Investors have been nervous for months wondering when the Fed might start scaling back on its stimulus program that pumps money into the financial system.

Their greatest fear has been that a stimulus program taper may trigger a hike in interest rates, which is bad news for stocks.

When Bernanke flirted with the idea in June this year stocks fell.

Stimulus program taper with no interest rate hike

At a news conference yesterday, Bernanke announced:

- Monthly bond purchases will be cut by $10 bn to $75 bn.

- Short term interest rates will remain low until unemployment reaches 6.5%, and not the current 7%, and well beyond that.

This means that while the much-feared taper will start, it will not be accompanied by interest rate hikes. The New Yorker has a headline today which expresses his move succinctly “Bernanke takes away the M&Ms but leavers the snickers bars.”

The Fed added that it expects its benchmark short-term interest rate to be near zero for quite a while, even well after the moment unemployment falls below 6.5%.

Investors and businesses say they need low interest rates, which allow for low-cost loans to boost the economy.

The Dow Jones industrial average rose nearly 300 points to a new record high yesterday, and then fell moderately today after the Labor Department announced a rise in people looking for jobs.

Pros and cons of very low interest rates

- They boost spending.

- They stimulate housing.

- They encourage hiring.

- People invest more.

- They punish savers. Risk-averse seniors earn less money.

- They can promote inflation.

- They can inflate dangerous bubbles in housing, stocks and other assets.

- After a while they leave the central bank and government with fewer options to simulate a slow-growing or stagnant economy, as is the case in the Eurozone.

Bernanke said the Fed chose the route of low interest rates combined with tapering for three main reasons:

- Unemployment rates are sometimes deceptive.

- Inflation is dangerously low.

- The central bank does not want to set unrealistic expectations.

Bernanke said:

“Today’s policy actions reflect the Committee’s assessment that the economy is continuing to make progress and that it also has much farther to travel before conditions can be judged normal.”

“Notably, despite significant headwinds the economy has been expanding at a moderate pace and we expect that growth will pickup somewhat in the coming quarters, helped by a highly accommodative monetary policy and waning fiscal drag.”

Bernanke reminded people that the Fed’s benchmark short-term rate is the main tool for stimulating the economy, while the bond-buying program is a ‘supplementary tool’.

Stimulus program taper – economists’ reaction

The Wall Street Journal quoted Ian Winer, director of trading at Wedbush Securities, who said that several large investors had been selling shares recently to register strong annual gains. “We got the telegraph from the Fed that it will keep rates incredibly low for an incredibly long time, and the taper will be tiny and in small increments. That’s a green light.” Winer sees quiet activity for the rest of 2013.

The Economist warns that January’s tapering may prove premature. The Fed did a u-turn on two previous rounds of quantitative easing, only to restart them when the threat of deflation loomed and the economy faltered. “The FOMC’s forecasts have repeatedly proved too optimistic. Two years ago it thought GDP would grow 3.2% in 2013; a year ago, that had dropped to 2.6%, and it now looks to come in around 2.2%.”

In a Comment in The Telegraph, Richard Franulovich, a senior currency strategist at Westpac, wrote “The forward guidance from the Fed has offset the tapering announcement. The Fed has come along and said we won’t be hiking until we’re well past 6.5pc in the unemployment rate. That pretty much did it for the dollar.”

In an interview with Bloomberg Businessweek, Ward McCarthy, chief financial economist at Jefferies LLC in New York, and a former Richmond Fed economist, said “The Fed is trying to get policy back in the direction of normal without causing setbacks in the economy and too much distress in financial markets. Based on the initial reaction, they found a magic elixir.”