Volkswagen’s recent crisis highlights how disruption in the supply chain can exacerbate financial risks.

Researchers at the Complexity Science Hub (CSH) in Vienna, Austria, and the Central Bank of Hungary, created a new model that demonstrates how supply chain risks transfer from the real economy to the financial system.

The CSH is a leading, non-profit research institution specializing in complex systems, using interdisciplinary approaches to address societal challenges like economic stability, health crises, and environmental sustainability.

From Automotive Industry to Financial System

When the largest vehicle manufacturer in Europe faces major challenges, the negative effects do not just remain within the automotive industry. They spread further, posing a threat to the wider financial system.

Volkswagen’s recent announcement that it is reducing its workforce, along with similar warnings from auto parts suppliers Bosch in Germany and Adient and Brawe in the Czech Republic, points to increasing risks.

As Volkswagen’s crisis gets worse, it could worsen Germany’s current economic problems. After the automaker announced plans to close three factories in Germany, Moody’s lowered its creditworthiness outlook.

In its recent Financial Stability Review, published on November 11, 2024, the Bundesbank (Germany’s Central Bank) forecasts corporate defaults for the country in 2025.

Zlata Tabachová, a PhD candidate at CSH, said:

“This situation underscores how supply chain disruptions can magnify financial risks.”

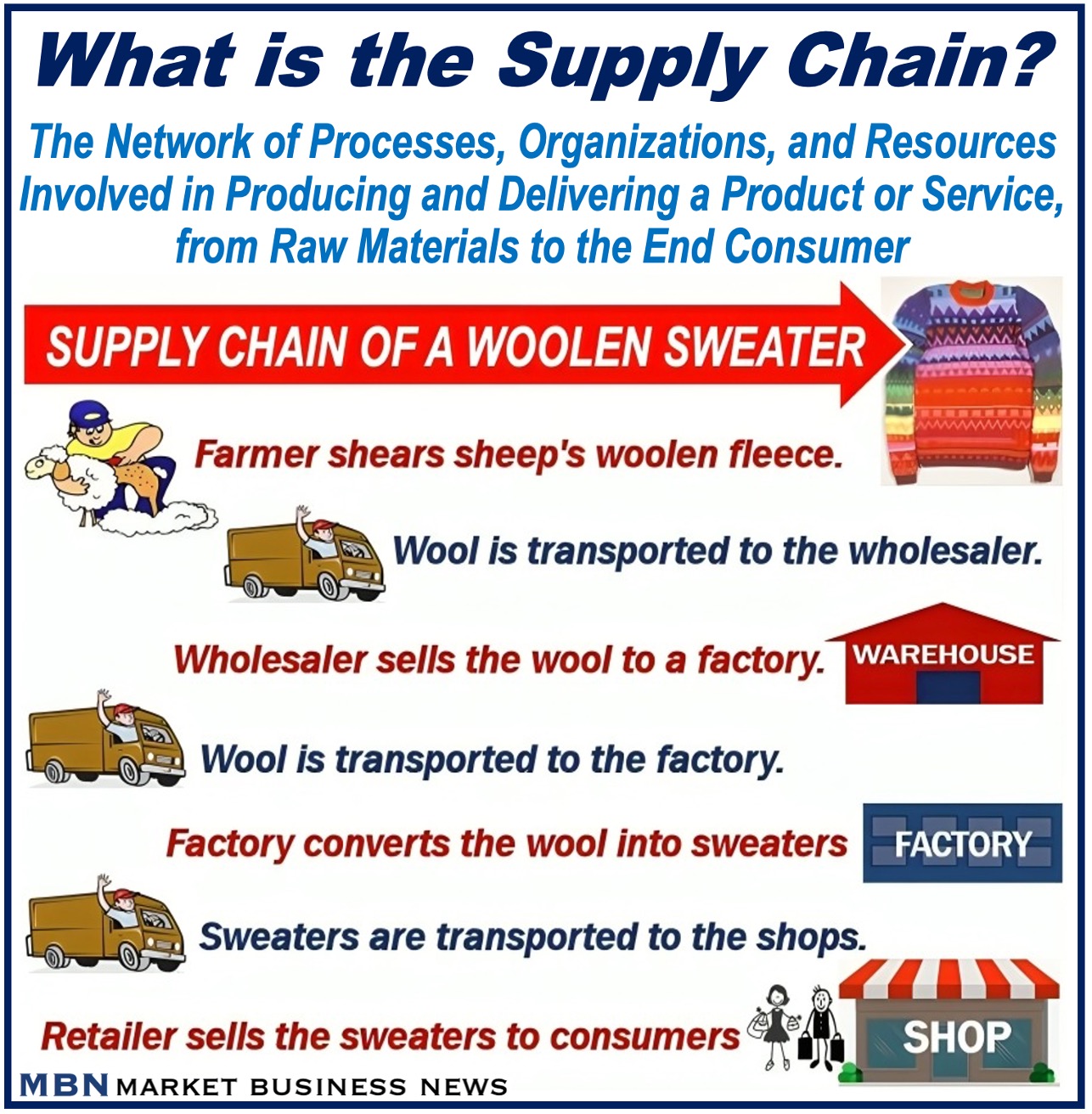

Quantifying Supply Chain Risks

Tabachová, along with Christian Diem, András Borsos, Csaba Burger, and Stefan Thurner, developed a new model that predicts how much supply chain disruptions can exacerbate financial risks.

They wrote about their new model in the Journal of Financial Stability (citation below).

According to their model, supply chain disruptions can amplify financial losses well beyond traditional credit risk assessments.

The authors explained that supply chain shocks can increase banks’ financial losses up to five times more than the losses forecast by traditional credit risk models that do not factor in supply chain contagion.

Tabachová explained:

“Our findings highlight that traditional credit risk models typically relying on financial performance of corporate clients may underestimate the real financial exposure of banks to supply chain disruptions.”

For the new model, Tabachová and colleagues used an extensive, nationwide dataset of more than 240,000 Hungarian companies, 27 banks, over 25,000 corporate loans from banks, and more than 1.1 million supply chain links.

Tabachová said:

“This multi-layer network model represents a step forward in the assessment of true credit risk. Traditionally, banks evaluate risk based mainly on client information and their first-order suppliers and buyers.”

“But in reality, these firms are deeply interconnected through higher-order supply chains, and disruptions to one link can cascade throughout the entire system.”

Very Few Firms

The authors wrote that individual firms pose a much greater risk than previously thought.

A small percentage of companies, particularly those highly connected in the supply chain or providing critical production inputs, can cause defaults resulting in up to 22% of total equity loss in the banking system.

Notably, these losses are mostly indirect—stemming from defaults triggered by supply chain disruptions rather than the initial failures themselves.

Tabachová explained:

“We found that many of the systemically important firms are essential to the production in the country.”

Monitoring Systemic Risks

The study suggests that financial regulators should reconsider how they assess or track systemic risks.

The authors believe that regulators should monitor companies that have the potential to trigger widespread defaults—due to their critical role in the supply chain—much more closely.

At the moment, companies that get the most attention are those with large loan portfolios because they are generally considered the most crucial for financial stability.

The authors warned:

“These types of firms would be clearly missed when not taking supply chain contagion into account. Regulators could benefit from building up capabilities to monitor supply chain generated and amplified systemic risks.”

Real-World Supply Chain Risk Simulation

To further test how effective and relevant their model was, the researchers simulated a real-world economic crisis triggered by the Covid-19 pandemic.

Bank equity losses could reach up to 6% if there were no intervention, their simulations revealed.

A modest liquidity injection, equivalent to only 0.5% of total bank equity, could reduce losses by over 80%.

This targeted support would primarily benefit struggling firms that are illiquid (lack liquidity) but still solvent, according to the study.

The researchers said:

“Our findings, obtained from the Covid-19-inspired contagion example endorse, the widespread practice of providing liquidity support to firms during crises.”

“Yet, by gaining in-depth knowledge about the supply chain network contagion-caused losses of individual firms, financing support can be tailored in the most effective manner, while curbing the detrimental effects of the crisis and keeping inflation under control.”

Tabachová added:

“Volkswagen is undeniably a systemically important firm with a significant influence that extends well beyond Germany’s borders.”

“A comprehensive understanding of its upstream and downstream supply chains is crucial for policymakers and regulators to facilitate a smooth and cost-effective transition aligned with climate policy objectives without a threat to financial stability.”

Citation

Tabachová, Z., Diem, C., Borsos, A., Burger, C., & Thurner, S. (2024). Estimating the impact of supply chain network contagion on financial stability. Journal of Financial Stability, 75, 101336. https://doi.org/10.1016/j.jfs.2024.101336