Elon Musk has thrown a multibillion-dollar curveball at Tesla’s investors: should the EV maker invest in his fast-growing artificial-intelligence venture, xAI?

In Tesla’s second-quarter earnings call CEO Elon Musk said any xAI cash injection “should be proposed by the shareholders,” while Chief Financial Officer Vaibhav Taneja was quick to jump in and say that the call may not be the best forum to discuss this.

Musk previously said a vote on whether to invest in xAI would be on the table for Tesla shareholders. While he didn’t say when, a Form 8-K filed on July 9 sets November 6 as the date of Tesla’s annual meeting, which (assuming that’s when shareholders will vote) means backers and critics have about three months to craft a formal resolution.

The heart of the proposal: Colossus 1 now, Colossus 2 very soon

xAI wants to compute at break-neck scale. Its first system, Colossus 1, is already training models with 230,000 GPUs, including 30,000 Blackwell-class GB200 GPUs.

The follow-on Colossus 2 will deploy hundreds of thousands more top of the line Blackwell GPUs.

“At Colossus 2, the first batch of 550k GB200s & GB300s, also for training, start going online in a few weeks,” Musk said on X on July 22.

Hardware at that scale costs real money. A lot of money. According to a recent report by the WSJ, xAI is turning to Antonio Gracias’s Valor Equity Partners to raise up to $12 billion in private-credit financing so it can buy and lease back a fresh haul of Nvidia chips for a second “Colossus 2” data-center cluster.

Elon’s rocket company, SpaceX, committed about $2 billion to xAI earlier this month.

All that compute requires power, which could potentially benefit Tesla’s energy division. According to reports, from January 2024 to February 2025 xAI ordered roughly $230 million in Tesla Megapack batteries.

Software loops back to the car

Tesla has already integrated the xAI Grok assistant inside its infotainment software for voice queries and trip planning. In fact, since July 12, 2025, all Tesla vehicles include Grok as standard.

On Tesla’s website it says: “You can now talk to Grok, your AI companion built by xAI, hands-free in your Tesla vehicle. You can choose Grok’s voice and personality, ranging from Storyteller to Unhinged, to enhance convenience while you’re on the go.”

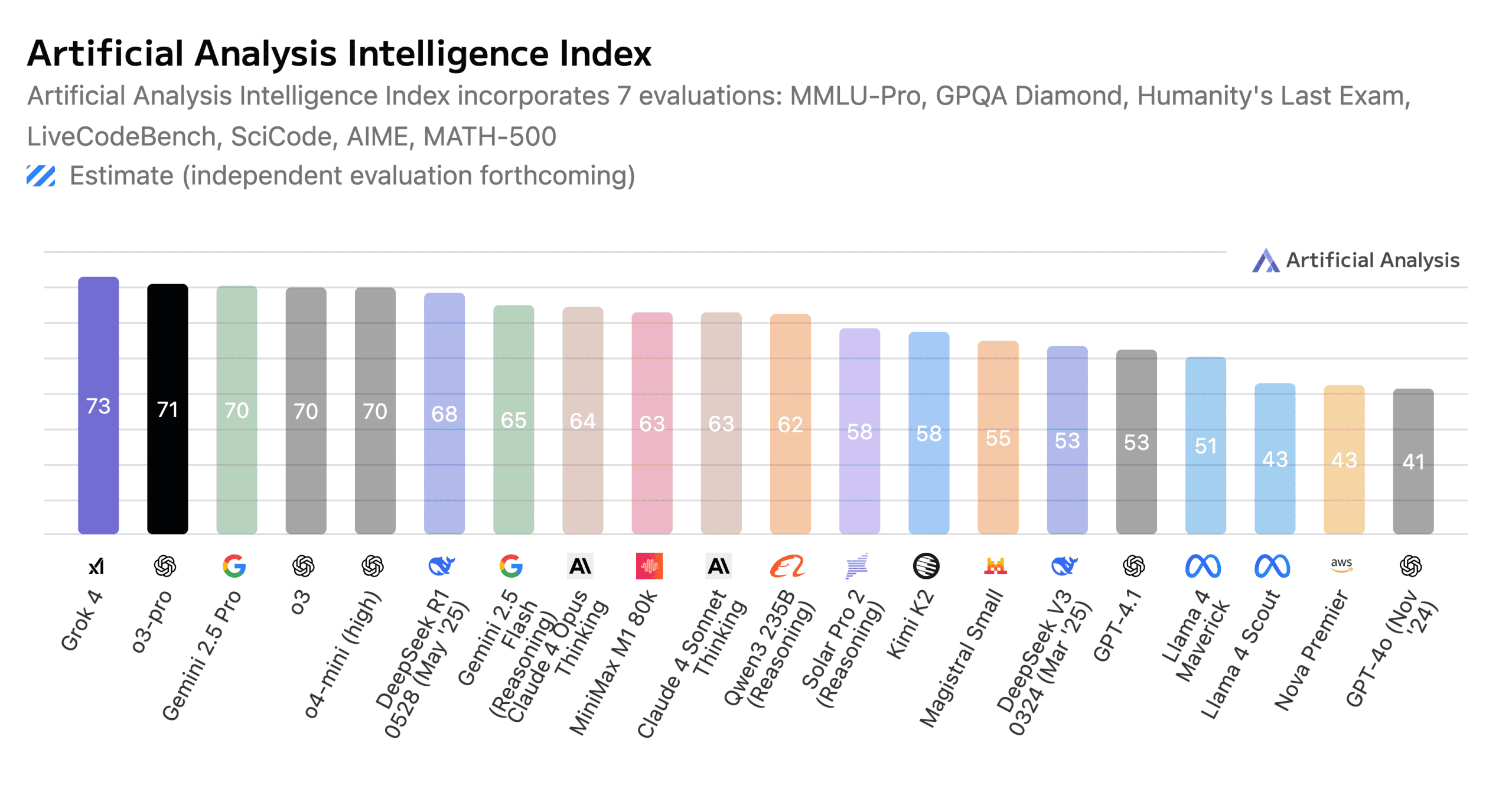

And the latest version of xAI’s Grok, Grok 4, has performed considerably well on benchmarks, especially in areas like advanced reasoning and generalization.

Governance ghosts: remembering SolarCity

The last time Musk asked Tesla holders to ratify a related-party deal was the 2016 acquisition of SolarCity, a solar installer he co-founded with his cousins. Proxy adviser ISS reluctantly backed that merger, calling governance “sub-optimal,” while Glass Lewis urged a “no” vote, branding the deal a “veiled bail-out.” Shareholders approved it anyway; a Delaware judge later ruled in Musk’s favor after a lengthy lawsuit.

Upsides investors may hear

- Direct participation in a private AI firm that could reach a valuation in the hundreds of billions.

- Reinforced strategic loop between Tesla’s autonomy push, vehicle software and xAI’s language-model research.

- Megapack pull-through and potential grid-services revenue around new data-center builds.

Potential risks

- Capital drain: Tesla’s own AI-chip program (“Dojo”) and robotaxi fleet already cost quite a lot.

- Governance complexity: cross-directorships and Musk’s dual loyalties could raise conflict-of-interest alarms.

But with Colossus 1 already up and running and Colossus 2 about to light up, xAI is scaling just as fast, if not faster, than other juggernauts like OpenAI, Google, Meta and Anthropic in the generative-AI race.

For Tesla shareholders, a vote would offer a chance to buy into that momentum.