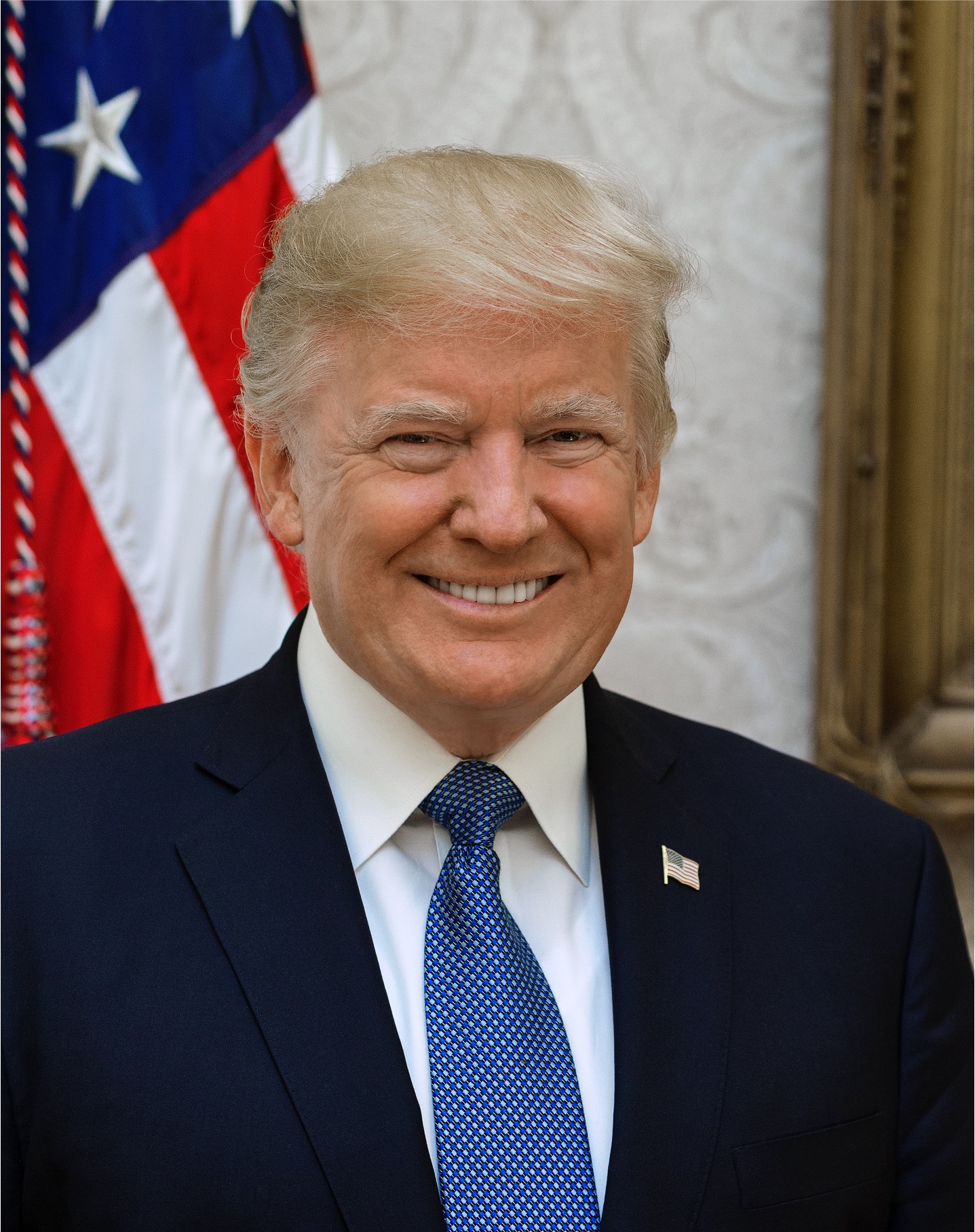

The world of business, investors, and traders has responded enthusiastically to Trump’s election victory.

Cryptocurrency investors, traders, and other stakeholders are expecting a more favorable administration when Trump returns to the White House. Bitcoin soared today.

Markets were also pleased that the Republican Party has regained control of the Senate. It is too early to tell who will take control of Congress. Traders are looking forward to a more favorable environment with lower taxes and fewer regulations.

Wall Street, S&P 500, and Crypto

Stock futures indicated strong gains ahead of Wall Street’s opening. S&P 500 futures increased by 1.23%, while the Nasdaq composite futures and Dow Jones Industrial Average gained 1.43% and 1.02%, respectively.

In Europe, the FTSE 100 in the UK initially shot up and then fell—it is now 0.12% down on the day. Germany’s DAX and France’s CAC also soared at first and then fell; they are now 1.18% and 0.59% lower compared to the day’s opening, respectively.

Bitcoin shot up to $75,345, a record high, before declining marginally, indicating strong activity in the crypto market.

Bond Yields

US bond yields have surged on the news of Trump’s victory. The 10-year Treasury, which was at 4.28% yesterday, is now at 4.4%.

Investors and analysts expect higher growth and inflation under the new President’s policies.

Trump has expressed a desire to have greater influence over the Federal Reserve’s (Fed’s) decisions, including interest rates. His Vice-President, J.D. Vance, feels the same. If the Fed loses its autonomy and politicians control monetary policy, it could potentially affect inflation and economic stability.

For example, if the economy stalls and inflation is high, a politician may lower interest rates to kickstart the economy. However, lowering interest rates while inflation is high will push it even higher.

Dollar Strengthens

The US dollar rose against multiple currencies, including the pound sterling, euro, Japanese yen, and Canadian dollar.

The Mexican peso plummeted to a two-year low. In early trading, it fell more than 3% below its previous close to 20.81 per dollar. It has since recovered some of its losses and currently stands at 20.62, which is down 2.59% below yesterday’s close.

The South China Morning Post reported the following regarding the Chinese yuan: “The offshore yuan on Wednesday had at one stage fallen by more than 900 basis points against the US dollar, dropping below the 7.19 mark, before regaining some ground.”

Tariffs

During his election campaign, Trump said he would place tariffs on imports from China, and possibly other parts of the world too, including Europe.

He also warned Mexico that if it did not significantly reduce the number of undocumented people crossing the border, he would impose a steep tax on their exports.

Markets globally will be watching Trump’s trade policies very closely. The Chinese economy has been lackluster for most of this year. If steep duties are slapped on its US exports, it would severely impact the country’s economy.

Conclusion

Markets, traders, and the business community worldwide are enthusiastic about Trump’s election victory. The only exception is, perhaps, China, which is concerned about tariffs.