Consumer sentiment in the United States saw a marked improvement in September 2024, reaching its highest level in five months.

According to multiple reports, optimism surrounding the economy has continued to rise, driven by the Federal Reserve’s decision to cut interest rates and a steady decline in inflation.

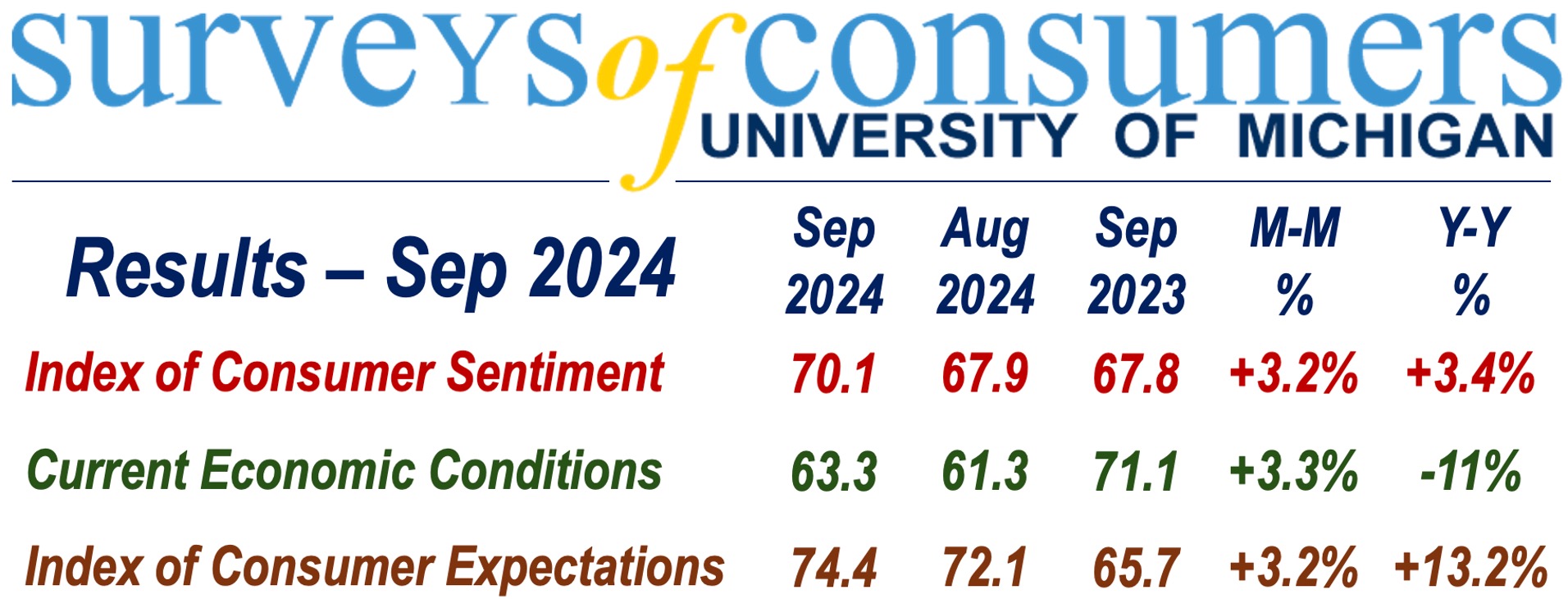

The University of Michigan’s Consumer Sentiment Index, which tracks consumer confidence, showed a notable increase from August, reflecting more positive economic expectations among U.S. households.

Consumer Sentiment on the Rise

In September 2024, the Consumer Sentiment Index reached 70.1, up from 67.9 in August.

This rise marks a significant improvement in consumer confidence, with a 3.2% increase from the previous month and a 3.4% gain compared to the same period last year.

This boost in sentiment was seen across various education groups and political affiliations, suggesting broad-based optimism.

The improvement in consumer sentiment can be attributed in part to the Federal Reserve’s recent decision to reduce interest rates by half a percentage point.

Lower borrowing costs have positively influenced consumers’ outlooks on the economy, making large purchases such as homes and vehicles more appealing.

This trend is reflected in the fact that 55% of consumers now expect borrowing costs to continue declining, a record-high percentage.

Optimism Around Inflation and the Labor Market

A major factor contributing to the boost in consumer sentiment has been the easing of inflation.

For the first time since December 2020, consumers expect inflation to rise at an annual rate of just 2.7% over the next year, down from 2.8% the previous month.

Long-term inflation expectations over the next five to ten years also remain stable at 3.1%.

Consumers have become less concerned about high prices for durable goods, homes, and vehicles, as they observe a slowdown in inflation that has continued for nearly two years.

Despite earlier concerns over the job market, views on unemployment improved in late September.

Consumers remain optimistic that the Federal Reserve will take action if necessary to prevent unemployment from significantly rising.

While there have been slight indications of a labor market slowdown, overall consumer expectations around job security have remained positive.

Economic Outlook Grows More Positive

Consumers’ expectations for the economy over the next year have been steadily improving, with the September outlook being the most optimistic in four months. As inflation continues to slow, more households believe the economy is on track for better times ahead.

The proportion of consumers who anticipate difficult times for the economy has dropped significantly from 50% last year to just 28% in September 2024.

This upbeat sentiment is reflected in the University of Michigan’s expectations index, which rose to 74.4 in September, a 3.2% improvement from August and a significant 13.2% rise year-over-year.

This indicates that consumers are becoming more confident in the long-term prospects for economic stability, fueled by hopes of continued falling interest rates.

Consumer Sentiment – Final Thoughts

U.S. consumer sentiment continues to gain momentum as optimism around the economy grows and inflation moderates.

The September 2024 data highlights improved confidence across various consumer groups, with many anticipating more favorable economic conditions ahead.

As the Federal Reserve’s interest rate cuts take effect and inflation cools, the outlook for both personal finances and the broader economy has brightened considerably.