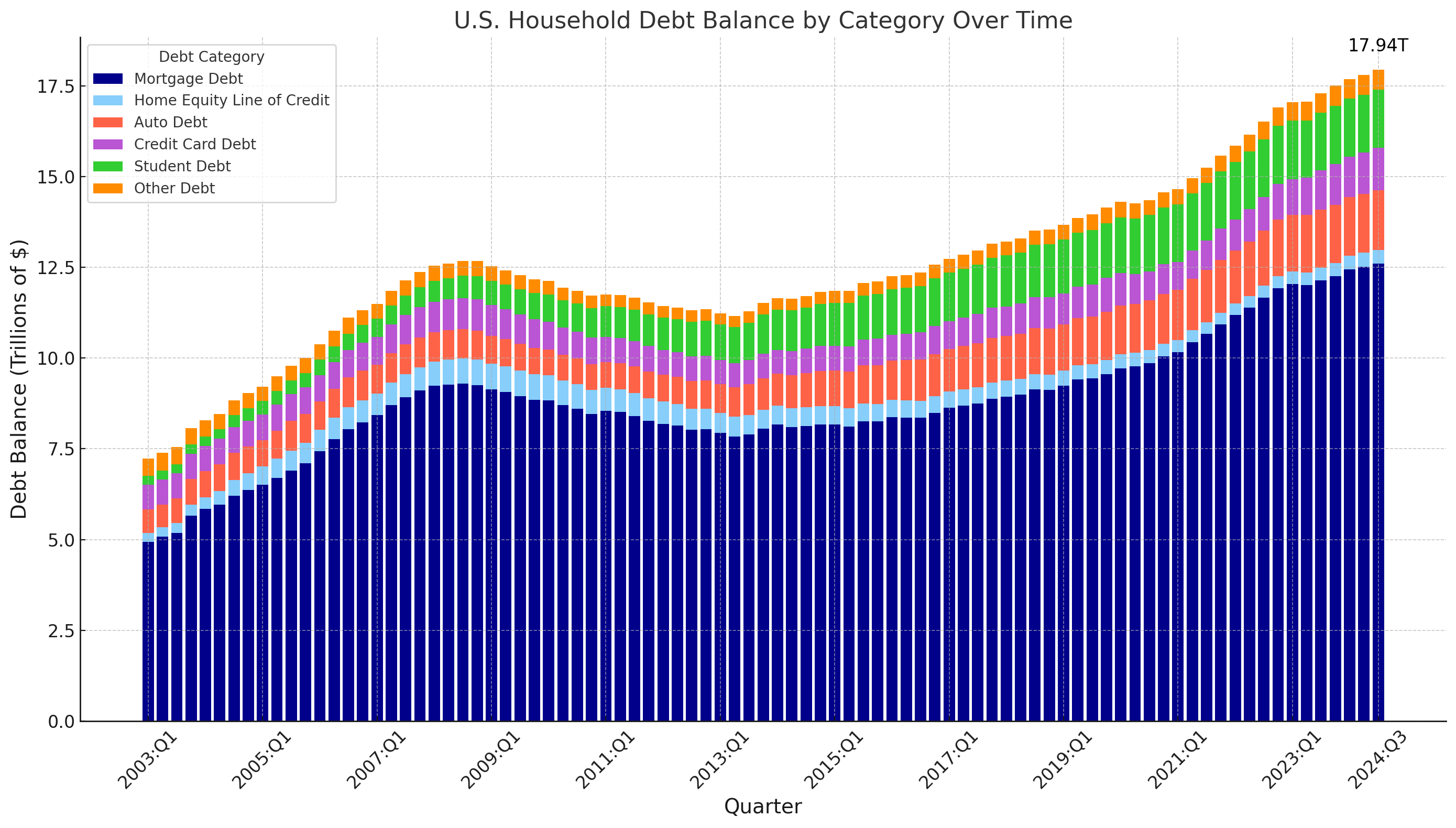

U.S. household debt is climbing again, pushing close to an eye-watering $18 trillion. And that’s not just some abstract Wall Street figure—it’s real money that millions of Americans are struggling to juggle, whether it’s buying a home, keeping a car, or putting kids through school. The Federal Reserve Bank of New York’s latest report points out that while incomes are up, debt is up too. So here’s the big question: is the country actually in shape to handle this?

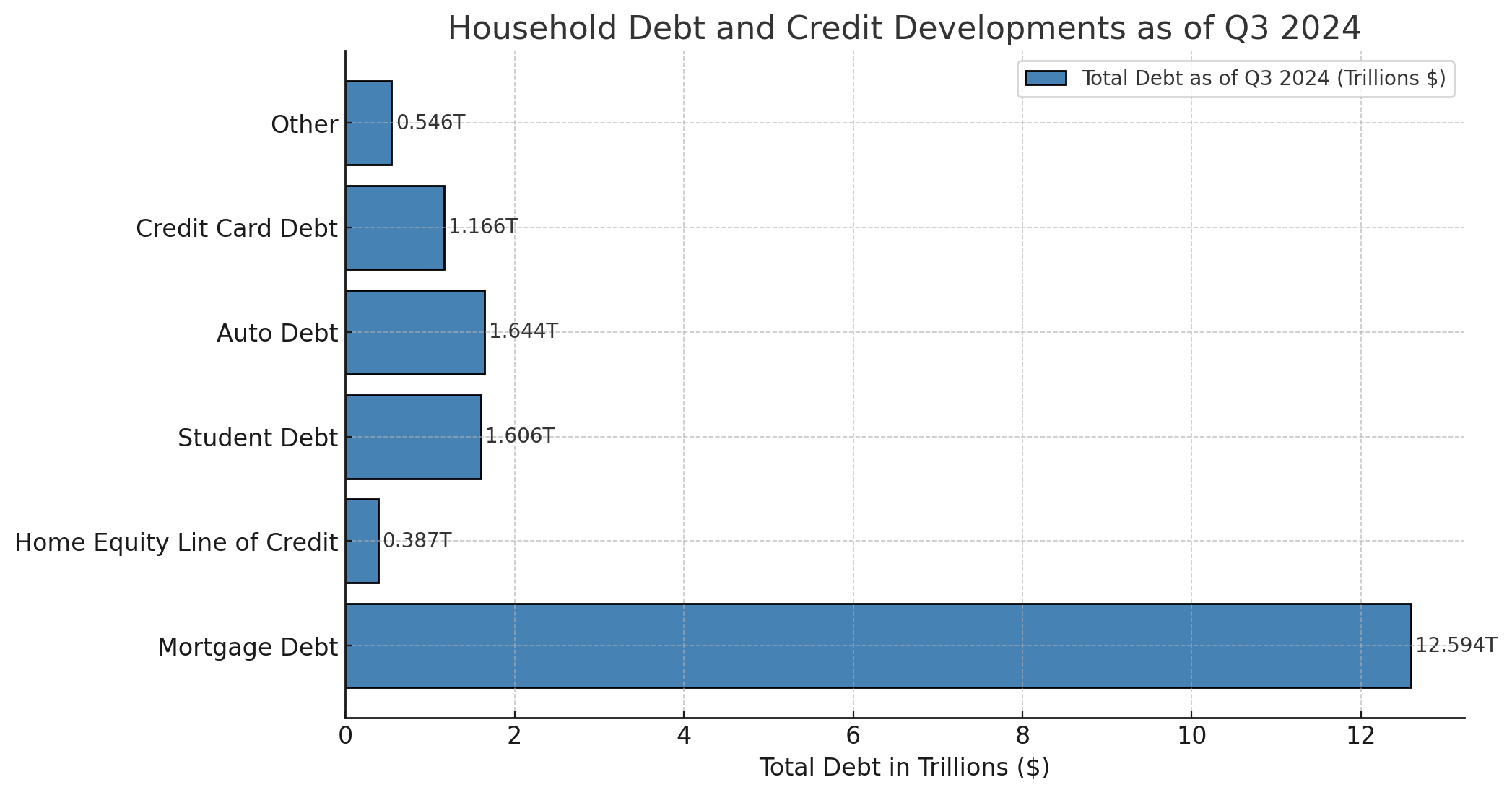

In just the last quarter, Americans borrowed even more, bumping the total debt load up by 0.8%. Mortgages alone are a huge chunk, sitting at $12.594 trillion. Then there’s credit card debt, hitting $1.166 trillion, auto loans at $1.644 trillion, and student loans weighing in at $1.606 trillion. At first glance, it might seem like people are handling it alright. After all, disposable income has grown, and the debt-to-income ratio sits at 82%, which is lower than it was before the pandemic. If we look only at the averages, it’s easy to think it’s no big deal.

But here’s the thing with averages—they often hide as much as they reveal. For many Americans, especially those with lower incomes, the reality is anything but rosy. Debt keeps piling up, and wages aren’t always keeping up at the same pace. So while some households might be managing just fine, others are feeling a lot more pressure.

Debt Puts Lower-Income Families in a Tight Spot

Not every paycheck stretches as far as it used to. For lower-income families, the weight of rising debt feels even heavier. Credit cards, car loans—these can be lifelines, sure, but they come with high interest rates and short repayment periods. Last quarter, credit card debt jumped by $24 billion, and now there are over 600 million credit card accounts open. When money’s tight, every swipe might help cover today’s expenses but could mean months (or even years) of paying it off.

Then there’s car debt. Auto loans are now at their highest levels, and we’re seeing more people fall behind. Some 3% of auto loans are at least 90 days overdue. For a family that relies on a car to get to work, those missed payments can lead to a whole new set of problems. Missing payments isn’t usually an option, but for some, it’s getting harder to avoid.

And let’s not forget student loans. That’s a separate weight entirely, especially for younger adults who are trying to build financial stability. With student debt at $1.61 trillion and federal payments back on for many, the strain on budgets is only getting tighter. For these folks, it’s not just about numbers—it’s about what that debt means for their future.

Mortgage Debt Grows, But Not Everyone’s Feeling Secure

Mortgages are the largest chunk of household debt, and borrowing against home equity has been rising too. Many homeowners are tapping into their home’s value to cover other expenses, pushing home equity lines of credit up to $387 billion. For some, that’s a welcome bit of flexibility. But it also adds to monthly financial commitments, which not everyone can manage with ease.

Mortgage delinquencies also inched up last quarter. It’s not a huge jump yet, but even a slight increase can hint at pressures starting to build. For homeowners, it’s a balancing act—keeping up with the mortgage, while also covering everything else. And if incomes can’t keep up, that balance gets harder to hold.

Rate Cuts Bring Some Relief—But Not Much

The Federal Reserve recently cut interest rates, and there’s some hope this might make debt a little easier to handle, especially for people facing steep credit card rates. But a small rate cut is just that—a small break. It doesn’t erase the mountain of payments many people already face.

For now, overall delinquency rates are still fairly low, but the tide is turning. A small increase from 3.2% to 3.5% might not sound like much, but if that number keeps creeping up, it could start to spell trouble.

Debt Stress Isn’t the Same for Everyone

Economists are seeing that not all households are in the same boat. For lower-income families and younger people, credit card debt, auto loans, and even student loans come with high interest rates and short repayment periods that strain monthly budgets. A minor setback—like a medical bill or a car repair—could be enough to start a chain of missed payments.

Debt isn’t just a line on a budget. For many, it’s an everyday pressure, and sometimes a missed payment here and there can snowball, creating a cycle that’s hard to escape. So while the system might look steady from the outside, for a lot of Americans, it doesn’t feel steady at all.

What’s Next?

Debt levels might be manageable on paper, but there are signs of stress showing. The next few months could tell us more about whether Americans can keep up—or if more households will start falling behind. Rate cuts may help slightly, but they won’t erase the deeper financial pressures many are dealing with.

For now, people are doing what they can to juggle it all. Debt isn’t just numbers on a report; it’s the constant stress people feel as they try to cover their bills and hold onto stability. As debt keeps climbing, these stats aren’t just indicators—they’re glimpses into the day-to-day reality for millions, some managing, and others close to their breaking point.

Discover more from Market Business News

Subscribe to get the latest posts sent to your email.