A survey of 700 companies by the Bank of England revealed that UK business investment is expected to rise in 2017 on higher export orders and resilient consumer spending.

The BoE survey included 341 firms with a combined employment of around 530,000 staff. The information was gathered from contacts between late November 2016 and mid-January 2017.

The survey found that export growth had risen due to the fall in sterling and stronger world growth.

Hiring plans had edged up, with expectations overall of “a slight increase in the growth of total labour costs per employee in 2017” due to difficulties hiring and the forthcoming apprenticeship levy of 0.5% on company payrolls.

Price pressures

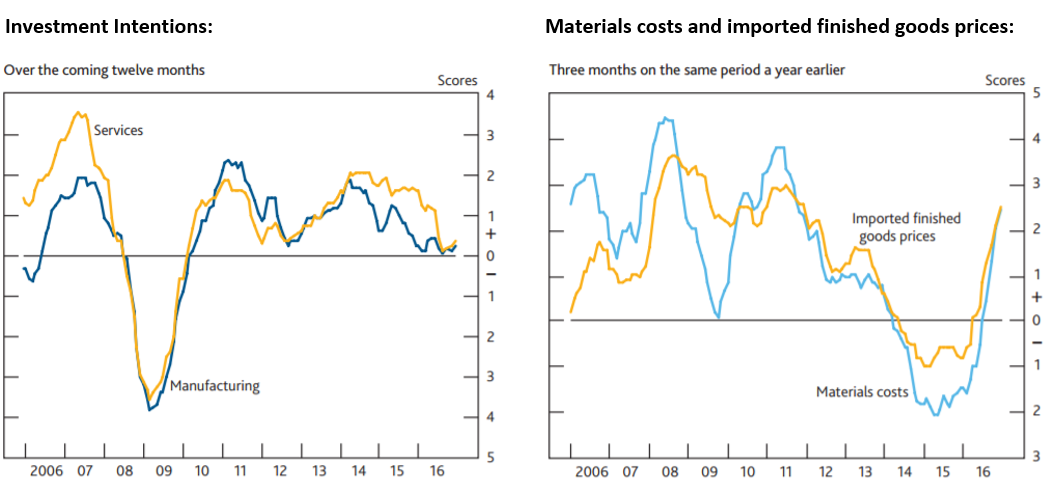

Input cost inflation had risen more “as sterling’s fall fed through” and the cost of manufactured goods is expected to increase.

Some firms reported increased sourcing from domestic suppliers because of sterling’s decline.

In December, the annual rate of Consumer Prices Index (CPI) inflation increase to 1.6% from 1.2% in November, according to the Office for National Statistics.

So far, the main effect of a weaker sterling on consumer prices had been higher food and fuel prices, but the report added that “a wider range of goods prices were expected to be affected over the coming year, causing inflation to rise further.”

Robert Wood, chief UK economist at Bank of America Merrill Lynch, was quoted by the FT as saying that the survey is “pointing to stagnant investment and employment”, adding that “the BoE agents find no evidence that pay is going to rise with inflation.”