The UK FTSE 100 ended 2016 at an all-time high.

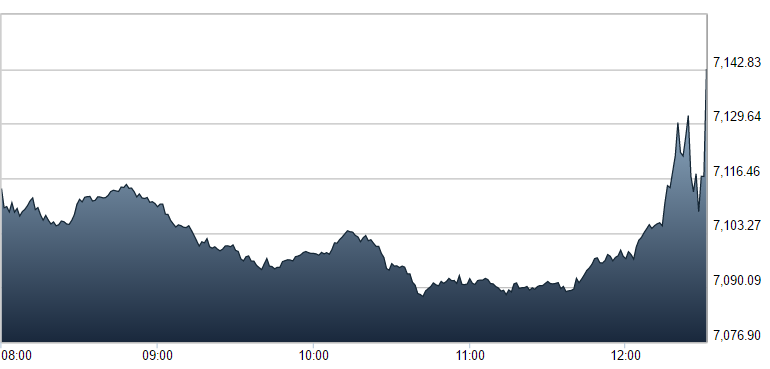

The FTSE 100 index rose by 14.4 percent in 2016, ending the year at a record high of 7142.83 – adding £232 billion to the value of the UK’s top 100 companies.

It was the best performing major European stock index of the year.

The index benefited from the pound’s plunge in value following the Brexit vote in June.

Many multinational companies listed on the FTSE 100 index have benefited from Britain’s decision to leave the EU as they have their earnings in foreign currencies, such as the US dollar, which have increased in value relative to the pound sterling.

The pound ended the year 18% lower against the US dollar than it was at the time of the referendum and ended the year 11% lower against the euro.

Miners and commodity-related stocks have also helped boost the FTSE 100 index to record highs, given the increases in commodity prices such as oil, gold, silver and copper.

The FTSE 250, a more powerful indicator of the national economy consisting largely of UK based manufacturers and retailers, finished the year up 47.77 points to 18,077.27.