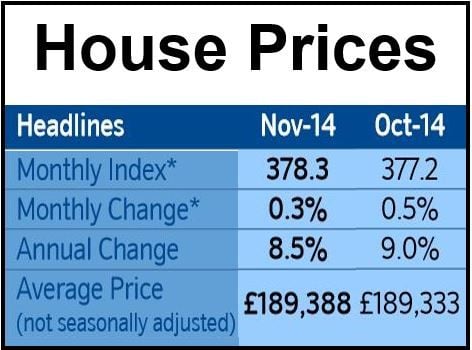

Annual UK house price growth fell to 8.5% in November compared to 9% in October, marking the third successive month of declining rises, says a new report by Nationwide on Friday, despite a month-on-month increase of 0.3% in November.

Activity levels in the UK housing market have remained comparatively weak in recent months, with September mortgage approvals 20% lower than they were at the beginning of the year and 27% below the long-term average, Nationwide added.

The number of current mortgage transactions equals approximately 4% of the housing stock, versus the long-run average of 6%.

Nationwide’s Chief Economist, Robert Gardner, said:

“There is something of a disconnect between the slowdown in the housing market in recent months and the broader economic indicators, which have remained relatively upbeat. While cooling in the London market is part of the story, this is unlikely to be the main explanation for the slowdown.”

“Indeed, in Q3, 10 of the 13 UK regions saw the pace of annual price growth slow and two regions saw quarterly price declines.”

Source: Nationwide.

Mr. Gardner adds that affordability does not seem overly stretched. First time buyers still make up an unusually high proportion of mortgage activity. Record-low interest rates have helped minimize the impact of house prices increasing at a faster rate than wages.

Mr. Gardner said:

“Forward looking indicators, such as new buyer inquiries point to further softness in the near-term. However, if the economy and labor market remain in good shape and mortgage rates do not rise sharply, activity is likely to pick up in the quarters ahead.”

On Tuesday, the British Bankers’ Association said mortgage approvals were at their lowest levels since May 2013.