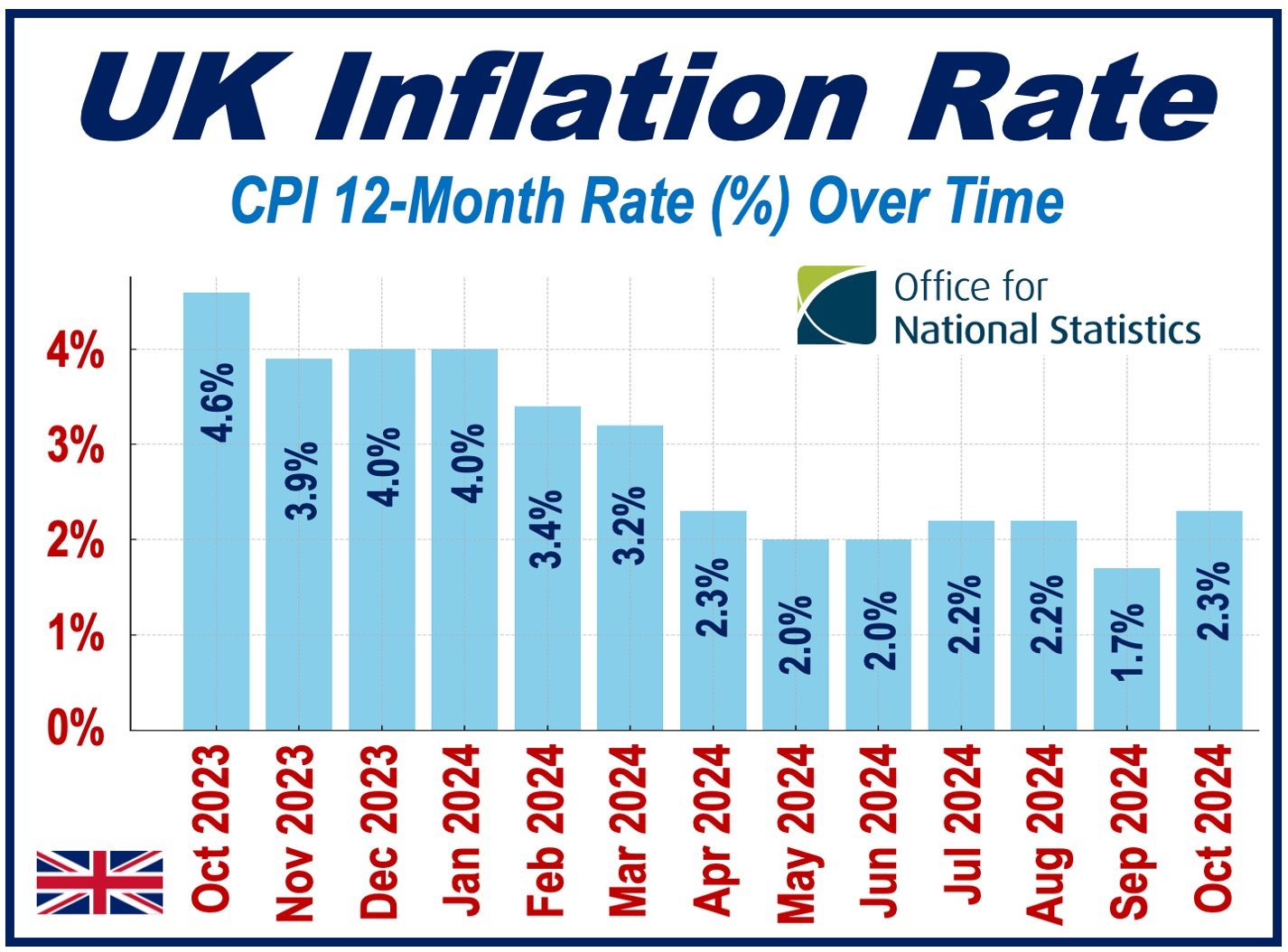

UK annual inflation rose to a 6-month high of 2.3% in October, compared to 1.7% in September, which had marked a three-year low. The Bank of England (BoE), like most other central banks, aims for an inflation rate of 2%, so, October’s figure exceeded its target.

City experts believe there will be no additional cuts in borrowing costs this year. October’s inflation rate was higher than most forecasts.

Earlier this month, the BoE lowered its main interest rate by 0.25 of a percentage point to 4.75% after inflation had dropped to its lowest level since April 2021.

Energy Prices

The surge in the UK inflation rate was mainly due to an increase in regulated domestic energy tariffs after Ofgem’s energy price cap adjustment.

On October 1, Ofgem’s new price cap increased by 10%, raising the average annual household energy bill from £1,568 to £1,717.

Ofgem, which stands for the Office of Gas and Electricity Markets, is a government regulator for the electricity and downstream natural gas markets in the UK.

Labour’s Budget Stoking UK Inflation

BoE Governor Andrew Bailey said last week that interest rates would be falling, if at all, much more slowly over the next few months, partly because of the new Labour government’s Budget measures. He explained that Labour’s inflationary Budget is likely to put upward pressure on prices.

In a Monetary Policy Report published on November 7th, 2024, the Bank of England wrote:

“The Budget is provisionally expected to boost CPI inflation by just under ½ of a percentage point at the peak, reflecting both the indirect effects of the smaller margin of excess supply and direct impacts from the Budget measures.”

The BoE’s Monetary Policy Committee, which consists of nine members and sets interest rates, has its next meeting on December 19th. What they decide regarding rates will depend partly on November’s inflation figures.

Post-Pandemic Borrowing Costs

After the COVID-19 pandemic, prices started rising significantly. Banks worldwide responded by increasing borrowing costs—that is, raising interest rates.

Initially, the rise in the UK inflation rate was mainly due to supply chain problems, and later by Russia’s invasion of Ukraine, which raised energy costs.

To bring inflation down, central banks worldwide raised interest rates significantly.

According to the World Health Organization (WHO), the pandemic lasted from March 11, 2020, to May 5, 2023.

In March 2020, the bank rate stood at a historic low of 0.1% in the UK. The BoE raised it incrementally until it reached 5.25% in August 2023. The BoE maintained this rate until November 2024, when it was reduced to 4.75% in response to a sharp decline in UK inflation.