A single-payer plan could achieve universal health care without costing more, a new study found. Universal health care is a system that provides health care and financial protection to every resident. Single-payer health care is a system which is financed by taxes.

There is a citation of the study at the end of this article.

However, the single-payer plan would require a new tax system, according to a new analysis. The RAND Corporation and The New York State Health Foundation carried out the study.

The RAND Corporation, with headquarters in Santa Monica, California, is a nonprofit global policy think tank.

The New York State Health Foundation or NYSHealth funded the study. NYSHealth is a private, statewide foundation that focuses on improving the health of all residents.

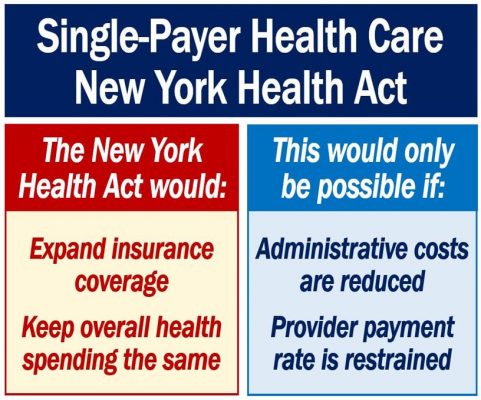

A plan that the New York Health Act outlined would likely raise the use of health services as more residents received coverage. However, overall health care costs would decline marginally over time. That is, they would decrease if administrative costs came down.

They would also decline if state officials slowed the growth of payments to providers of health care, the analysis showed.

Definition of health care

Health care includes everything health providers and medical professional do to restore people’s physical, emotional, and mental well-being. We can write the term as one or two words, i.e., health care or healthcare.

Single-payer health plan – taxes

The New York Health Act proposes to graduate taxes to pay for the plan progressively . However, it fails to specify tax structures or tax rates. In other words, it does not provide any figures.

RAND researchers estimate that the tax rates required to fund a single-payer plan would cut health care payments for most people. Households with the highest incomes, on the other hand, would pay significantly more than they do today.

Lead author, Jodi Liu, who is an Associate Policy Researcher at RAND, said:

“Our analysis finds that a single-payer plan in New York does not have to increase the amount of money spent overall on health care in the state, but it would substantially change who pays for health care.”

“While we estimate the impacts of the New York Health Act across a number of reasonable assumptions, the actual effects would be subject to many future decisions that ultimately influence cost and who pays.”

David Sandman, President and CEO of NYS Health, said:

“There was a great need for an independent, rigorous, and credible analysis of an issue that has arrived center stage for New York State and the nation.”

“With a fair and factual assessment in hand, the public and policymakers can make up their own minds about the merits of a single-payer approach.”

Single-payer – universal health care

A single-payer plan that would provide coverage for all state residents is something the New York State Legislature is considering. New York State lawmakers are currently discussing a bill that would do that.

Also, calls for some kind of single-payer health care plan have grown across the country.

If the proposal comes to fruition, New Yorkers will call it ‘New York Health.’

‘New York Health’ would offer comprehensive benefits. Initially, however, it would not cover long-term care benefits. Lawmakers may consider including long-term care benefits later.

Single payer health care – funding

A trust fund would pay for the single-payer plan. A trust fund is a fund whose assets are managed by a trustee or trustees. The trust aims to benefit a charity, organization, person, or people.

The fund would receive money from the federal government. This federal government’s money would be in lieu of federal financing for the states current health programs.

The term ‘in lieu of‘ refers to replacing something with something else. It is similar to, but not the same as, the term ‘instead of.’

The fund would also receive money from current local and state funding for health care and additional income from taxpayers.

New taxes

There would be two new state taxes.

– A payroll tax to which employers would contribute 80% and employees 20%.

– Non-payroll taxes such as a tax on capital gains, dividends, and interest.

A patient in such a system would have no copayments, deductibles, or other out-of-pocket expenses at the point of service.

Microsimulation

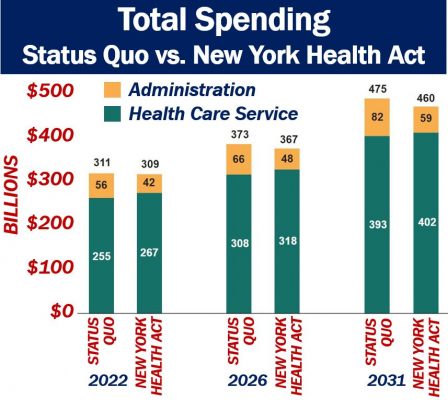

Researchers at RAND used a microsimulation model. The model estimated the plan’s effects on health care spending, use, and payments in New York. They then compared those estimates with estimates for the state’s spending under the current status quo. The researchers focussed on the years 2022, 2026, 2031.

During the first few years, health care spending under the New York Health Act would be similar to the status quo’s. However, by 2031 it would be three percent lower.

The microsimulation assumes that New York Health’s costs would rise slower than the current health system. The researchers point out that this has been the case with other health programs that operate with public funding.

New health care taxes

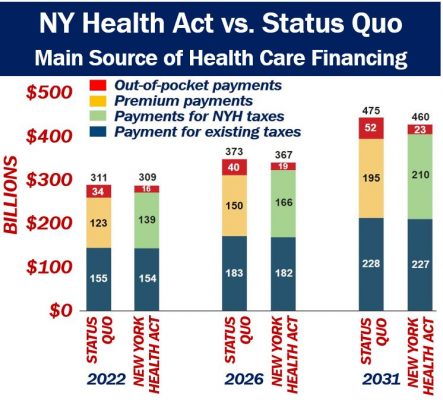

New health care taxes would need to be about $139bn and $210bn in 2022 and 2031 respectively. Those figures would be necessary to fund New York Health fully.

Under the status quo, on the other hand, tax income from all sources would be about $89bn in 2022. Therefore, under the new single-payer system, total state tax revenue would be 156% higher.

Regarding household expenses, a press release by RAND said the following:

“As payments for health care shift from premiums and out-of-pocket payments to progressive taxes, most households in New York could pay less and the highest-income households could pay substantially more.”

“The shift in who pays more or less would ultimately depend on the design of the tax schedule.”

New taxes – estimates

The Bill does not specify levels of new taxes. All it says is that they be graduated.

Researchers at RAND looked at one scenario. They subsequently came up with the following estimates for payroll taxes in 2022:

– 6% for those earning less than $27,500.

– 12% for those in the middle-income bracket.

– 18% for those earning more than $141,200.

N.B. These are ‘marginal tax rates.’ For example, for the payroll tax in 2022, a household with income of $150,000 would pay about 6% on the first $27,500, about 12% on the amount between $27,500-$141,200, and about 18% on the amount above $141,200.

Non-payroll taxes would also rise from 6% to 12%, and then to 19% for the three income brackets.

Under those tax schedules, in 2022, NY residents with household compensation below the 90th percentile would pay less. Specifically, they would pay $2,800 less per resident for health care.

For most people in this group, payments would decline. However, they would probably rise for employees whose employers had not previously offered health care coverage.

Rich people would pay much more

Average health care payments for those in the 90th to 95th percentile would rise by $1,700 per resident in 2022.

The richest residents, i.e., the top 5%, would pay $50,200 more per person on average. A person in the top 5% earns at least $1,255,700 per year.

What if there’s an exodus?

Researchers at RAND added that the introduction of new taxes could trigger an exodus of businesses and residents. In other words, some residents and companies might leave the state.

This could potentially alter the plan’s financing. Even if a tiny proportion of the state’s richest people left, planners would need to revise the tax structure.

Co-author Christine Eibner, who is the Paul O’Neill Alcoa Chair in Policy Analysis at RAND, said:

“The estimated effects of the New York Health Act are highly dependent on assumptions about provider payments, administrative costs, and drug prices.”

“The actual cost of a single-payer health plan in New York would be sensitive to the extent to which state officials would negotiate or set price levels and generate efficiencies that would curb health care spending.”

Citation:

‘An Assessment of the New York Health Act – A Single-Payer Option for New York State.’ Jodi L. Liu, Chapin White, Sarah A. Nowak, Asa Wilks, Jamie Ryan, and Christine Eibner. Published by the RAND Corporation, Santa Monica, Calif. 2018.