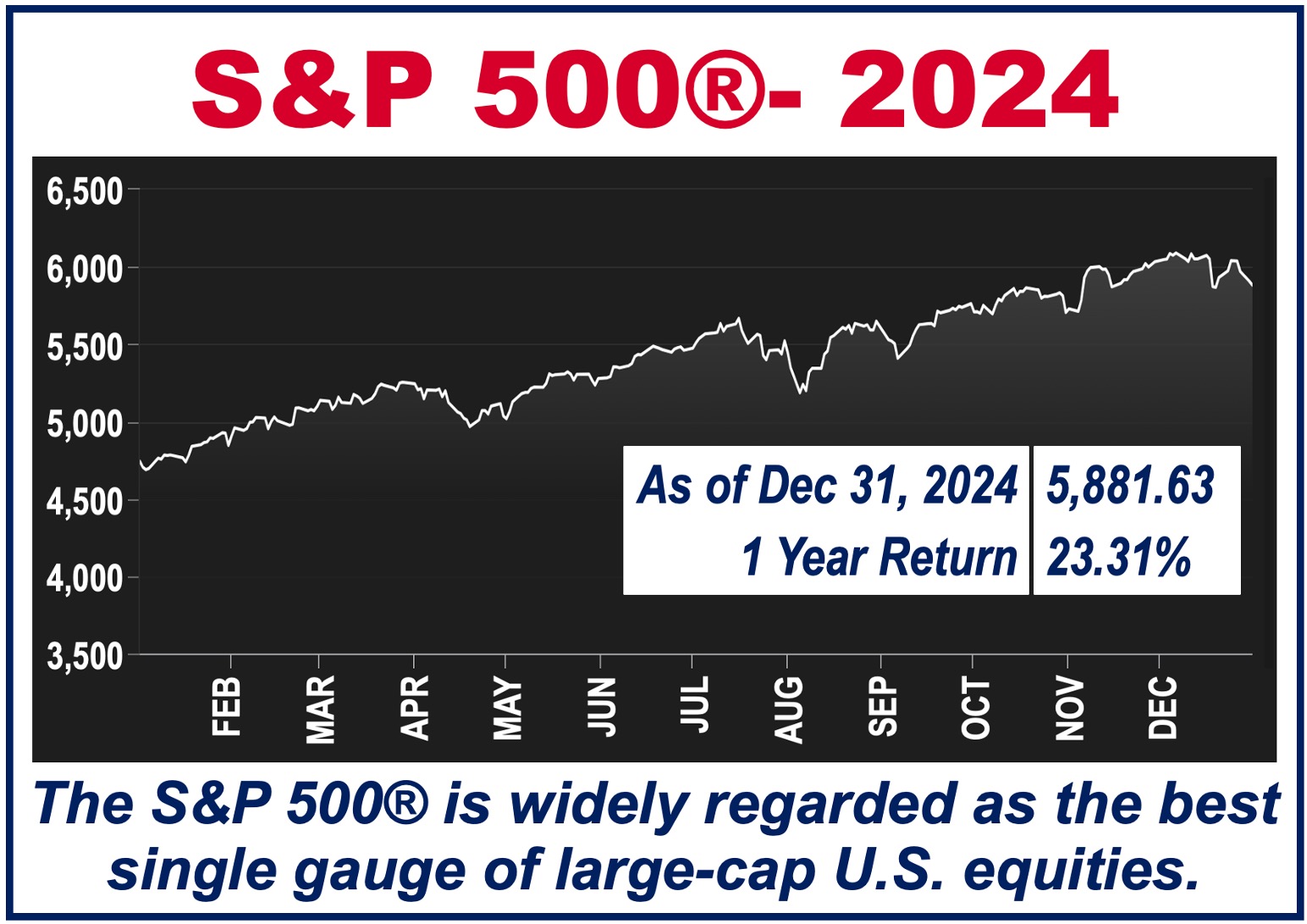

US stock market gains over the past couple of years have been impressive. The S&P 500 achieved two consecutive years of annual returns of more than 20% for the first time since the late 1990s.

Experts, analysts, and seasoned investors say that history, stock prices, and economic indicators suggest a complex mix of potential growth and challenges as they look ahead to 2025.

If you are an investor or plan to become one, the text below may help you understand what to expect and how you can prepare for the year ahead.

Historical Momentum Suggests Potential Gains

The S&P’s performance over the past two years has filled the investor world with optimism. Historically, whenever the index has delivered two consecutive years of returns over 20%, the following year has seen an average gain of 26%.

This trend supports the idea that after two consecutive years, the market gains considerable momentum. As a result, investors believe that 2025 will be another strong year in US markets.

We must remember, however, that in the world of stock markets, past performance does not always guarantee future results. Market conditions today are quite different from those of previous high-growth periods.

For example, while the artificial intelligence (AI) boom has fueled growth, high valuations and geopolitical uncertainties may have the opposite effect.

Valuation Concerns Highlight Potential Risks

A key metric for evaluating market valuation is the cyclically adjusted price-to-earnings (CAPE) ratio. The CAPE ratio measures stock prices relative to average inflation-adjusted earnings over the past 10 years.

Currently, the S&P 500 has a CAPE ratio of 38. This level last occurred during the dot-com bubble and the pandemic boom.

Historically, such high valuations are typically followed by much lower market returns or even declines. For instance, after previous peaks in the CAPE ratio, the S&P 500’s returns averaged -1% (minus one percent) over the subsequent year.

As an investor, you should be very cautious about stocks with excessively high valuations.

Keeping extra cash on hand and being ready for market drops can help you take advantage of opportunities when prices fall.

Economic Resilience Could Support Growth

Despite concerns about high valuations, the U.S. economy is expected to remain resilient in 2025.

The US economy is expected to grow by about 2.5% in 2025, driven by strong corporate earnings and robust consumer spending.

This healthy economic environment could support continued market gains, particularly for materials, financials, *consumer discretionary, and other sectors tied closely to GDP growth.

* ‘Consumer Discretionary’ refers to products or services that consumers buy when they have disposable income – non-essential goods and services.

Additionally, if the Federal Reserve (Fed) reduces interest rates, the market would receive another boost. While the Fed has signaled a cautious approach, even modest rate reductions could lower borrowing costs and support growth in rate-sensitive sectors. The Fed is America’s central bank.

US Market Outlook – Sector-Specific Opportunities

-

Technology and AI

AI investments are expected to continue driving growth, particularly in leading tech companies like Nvidia, Microsoft, Amazon, Meta, and Alphabet.

However, you should approach this sector carefully, as valuations remain elevated. Many AI-focused businesses have not yet made a profit.

-

Healthcare

Healthcare, which lagged in 2024, is poised for a rebound. Many pharmaceutical companies could see significant gains, driven by innovation and stable demand.

-

Energy and Industrials

Energy companies such as ExxonMobil and renewable energy leaders like NextEra Energy are well-positioned to benefit from ongoing infrastructure investments and reshoring efforts.

US Market Outlook – Risks

Before committing yourself to any investments, especially long-term ones, it is important that you know about some risks that have the potential to create volatility:

-

Geopolitical Uncertainty

President-elect Donald Trump said that he would impose tariffs on Chinese, Canadian, Mexican, and European imports. He also mentioned a 10% tax on all imports, regardless of the country of origin.

Such tariffs could disrupt global supply chains and increase inflation.

-

Sticky Inflation

If inflation is higher than expected, the Fed might not be able to cut interest rates, which could affect rate-sensitive sectors such as real estate, utilities, and technology.

-

Overheated Valuations

Elevated stock prices could lead to a correction, particularly in sectors with stretched valuations. If you hold such stocks, your investment could suddenly go down in value.

In an article published by Yahoo Finance, Josh Schafer wrote:

“With strong earnings expected from a widespread array of companies in 2025 and US economic growth anticipated to remain resilient, the fundamental story for further market increases remains intact for 2025.”

“But strategists have warned about a more volatile year for stocks as uncertainty surrounding Federal Reserve rate cuts and a new Donald Trump administration loom ahead.”

Preparing for 2025: A Balanced Approach

As an investor, you should adopt a diversified strategy to navigate potential challenges, while identifying and seizing growth opportunities

Key steps include:

-

Diversifying Across Sectors

Balance exposure to high-growth sectors like technology and renewable energy with defensive sectors such as healthcare and consumer staples.

-

Building Resilience

Maintain a mix of stocks and bonds to help steady your portfolio when markets are volatile.

-

Staying Liquid

You should always keep a cash reserve. You will then be in a better position to take advantage of potential market corrections.

Conclusion: Optimism with Caution

Most investors are optimistic about 2025; they believe that US stock markets have built up strong momentum and the economy remains resilient.

However, remember to adopt a cautious approach given current geopolitical uncertainties and high valuations.

If you build up a diversified portfolio and are prepared for potential volatility, you will be in the best position for success. Good luck!