We appear to have reached a fork in the road, as far as the global economy is concerned. If we follow one route the normalization that has occurred since the 2007/8 financial crisis is set to continue, which is great. However, if we go down the other road, things could deteriorate rapidly, which is definitely not so great!

Some experts are predicting normalization, i.e. more balanced and sustainable growth, while others warn of a mega meltdown. Perhaps more worrying is that most of them agree there is not much we can do regarding policy to influence what happens.

Economists, analysts and investors definitely became much more jittery in the summer after China devalued the yuan, suggesting that the country’s prospects are far from promising. Two other BRIC nations, Brazil and Russia, have slid into severe recessions.

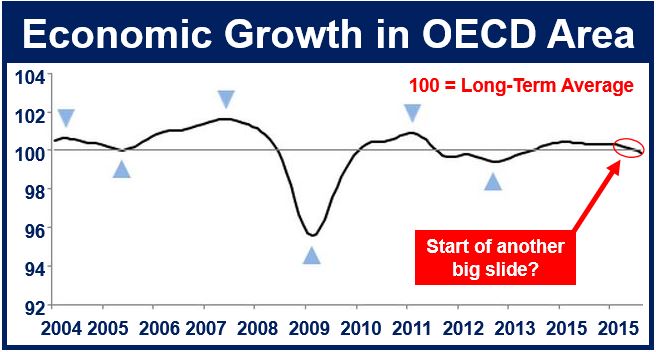

The OECD area shows signs of easing. (Data Source: OECD)

The OECD area shows signs of easing. (Data Source: OECD)

As far as global equity markets are concerned, the last quarter was the worst in four years (since 2011).

If you stack up some of the components that determine how well the global economy will do, it is not encouraging:

– Financial markets are very weak.

– Capital is moving away from the emerging economies to the advanced ones, as investors move their wealth towards havens.

– China, which represents about one third of global economic growth, has rapidly turned from being the planet’s engine into its greatest vulnerability.

– The debt bubble in the emerging markets is likely to pop soon.

OECD Composite Leading Indicators

The Composite Leading Indicators (CLI) for the OECD (October 2015) as a whole suggest world growth will ease. Growth momentum is forecast to slow down in the United States and United Kingdom, with more moderate easing predicted in Japan and Canada. Leading indicators are economic crystal balls – groups of statistics that point to what will be happening to the economy in the short-term.

In the Eurozone as a whole, stable growth is expected, with Italy and France perhaps pulling ahead more strongly.

The OECD added:

“Among the major emerging economies, CLIs continue to point to a loss of growth momentum in China, and weak growth momentum in Brazil and Russia. Firming growth is expected in India.”

Video – IMF warns of increased financial crash risk

The IMF warned this week that the risk of a global financial crash has increased, because the slowdown in both China and world trade are undermining the highly-indebted emerging economies.