Progressive Tax is an income tax that takes a greater percentage of high-earners’ incomes and a smaller proportion from lower-income earners. A progressive tax structure is one in which a person’s or household’s tax liability rises as a fraction of income as earnings increase.

Progressive and Regressive Tax

It is called progressive because the tax rate progresses from a low to a high rate. It is the opposite of regressive tax, which takes a higher percentage of income from low earners compared to that of their richer counterparts.

The term may apply to just income tax or the tax system as a whole. For example, if ultra-luxury cars have a proportionally higher sales tax placed on them, the tax will hit higher earners and rich people more than the rest of the population. Progressive tax applies to both individuals and businesses.

According to financial-dictionary.thefreedictionary.com, progressive taxation is:

“A system of taxation in which persons or corporations are assessed at a greater percentage of their income according to the theoretical ability to pay. That is, taxpayers pay more in taxes if they earn more in income.”

“For example, taxpayers may pay 25% of their income in taxes up to a certain amount, and 35% of everything earned over that amount.”

Progressive tax common worldwide

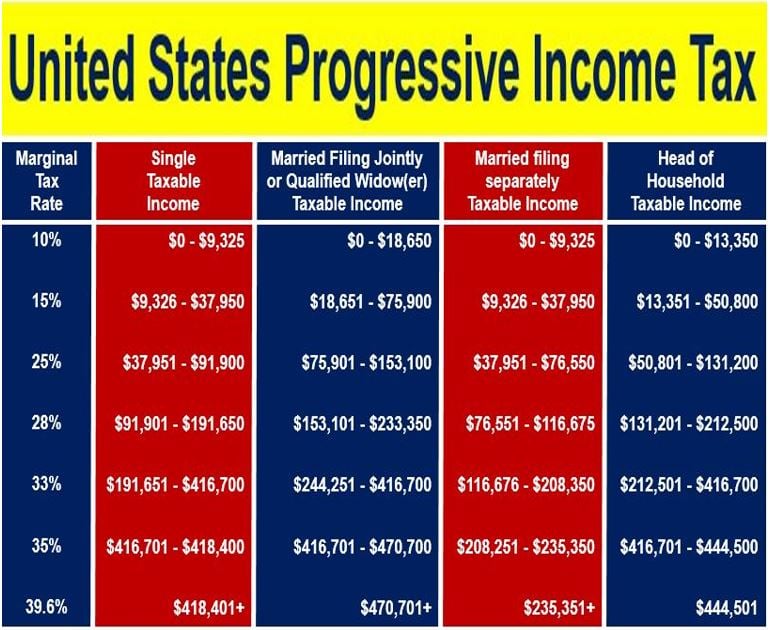

All the advanced economies (rich countries) have progressive taxation systems, including the United States. In 2016, Americans earning less than $9,275 of taxable income were liable to pay 10% of that in income tax, while those earning in excess of $415,050 – the benchmark cutoff – faced rates of up to 39.6%.

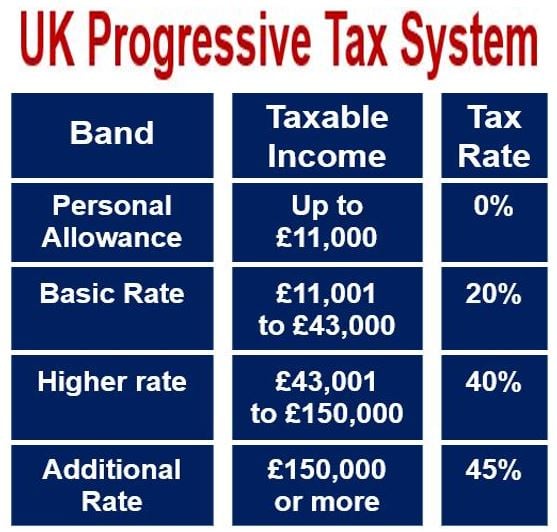

In the United Kingdom, which also has a progressive tax system, earners get a tax-free personal allowance of £11,000. From £11,001 to £43,000 the basic rate of 20% applies, then 40% from £43,001 to £150,000, and 45% for any income over £150,000.

Canadians pay 15% on the first $45,916 of income, then 20.5% on the next $45,915, twenty-six percent on the next $50,522, twenty-nine percent on the next $60,447, and 33% on income over $202,800. According to the Canada Revenue Agency, all figures apply to taxable income.

Progressive tax – pros & cons

-

Advantages

The system reduces the tax burden on individuals at the lower end of the socioeconomic ladder. Low-wage earners end up having more take home pay – cash in their pockets.

People on lower incomes tend to spend most of what they earn. If they have more to spend, this stimulates demand in the economy, which is good for GDP (gross domestic product) growth and employment.

As far as the government is concerned, progressive taxation means more tax revenue – the system allows the government to collect more taxes than regressive or flat taxes, because tax rates are indexed to increase as earnings go up.

Some people say that progressive taxation is fairer – those with the greatest resources can afford to pay more, and ‘so they should’.

-

Disadvantages

People who are against this type of tax system say it is discriminatory against high-income individuals and rich people. It is simply a form of income redistribution.

They also point out that when the government gets hold of people’s money, it does not spend it wisely – a very small proportion of government spending goes to helping poor people, they claim.

Very steep progressive tax systems – where the top rate is extremely high – discourage hard work and ambition. “Why should I bother to work hard, create lots of jobs and earn loads of money, if the government then takes most of it from me,” critics say.

In the late 1960s, Britain’s tax system hit rich people extremely hard – Prime Minister Harold Wilson raised the top rate of income tax to 83%. The result was that thousands of wealthy individuals emigrated.

The following rich people left the UK – they became tax exiles – in the late 1960s and 1970s: Shirley Bassey (singer), Michael Caine (actor), John Barry (composer of 11 James Bond movies), Marc Bolan (musician), Jethro Tull (musician), Tom Jones (singer), members of the group Pink Floyd, and Rod Steward (singer). Most of them returned when income tax rates for the well-off went down.

Progressive income tax – a brief history

Governments have been taxing their citizens progressively for thousands of years. In the early days of the Roman Republic, people were liable for taxes according to how much wealth and property they owned. Rates were considerably lower than they are today. Under normal circumstances – when there were no great wars to finance – the tax rate was 1% of property value. Even in times of war, this rate rarely went higher than 3%.

These taxes on Romans were levied against homes, other real estate and land, animals, personal items, monetary wealth, and slaves.

By 167 B.C., the Roman Empire was so powerful and wealthy that its citizens in the Italian peninsula paid no taxes at all.

By the 1st century, after considerable Roman expansion, Augustus Caesar introduced a flat poll tax on each adult citizen and a **wealth tax of approximately 1%.

** Wealth tax is levied on things people own, as opposed to income tax, which people pay on what they earn.

-

William Pitt the Younger

Economic historians say that the first modern income tax was introduced by British Prime Minister William Pitt the Younger in December 1798. The British government needed funds to pay for equipment and weapons for the French Revolutionary War.

Pitt’s new progressive income tax started at a levy of 2 pennies in the pound – 1/120 – on annual incomes greater than £60, or £5,696 as of 2015., and went up to a maximum of 10% (two shillings) for those earning more than £200.

Pitts’ target was to raise £10 million – by the end of 1799 the total reached slightly more than £6 million. The tax continued being levied until 1802, when Henry Addington (1757-1844), who was Prime Minister from 1801 to 1804, abolished it during the Peace of Amiens.

Addington reintroduced income tax in 1803, when hostilities with France recommenced. In 1816, one year after the Battle of Waterloo, it was again abolished.

-

Sir Robert Peel

Sir Robert Peel (1788-1850), who was Prime Minister from 1834 to 1835 and 1841 to 1846, reintroduced income tax in the Income Tax Act 1842. In his election campaign in 1841, Peel, a Conservative, had argued strongly against any type of income tax. However, a growing budget deficit was getting out of control and a new source of funds was desperately needed.

Peel’s new income tax, which was based on Addington’s model, was imposed on citizens earning more than £150 per year (£12,735 as of 2015). This ‘temporary’ measure stuck, and soon became a permanent feature of the country’s taxation system.

-

William Gladstone

William Gladstone (1809-1898), who was Prime Minister on four separate occasions and Chancellor of the Exchequer (Finance Minister) four times, kept the progressive income tax from 1852, despite vociferous objections from the Conservative opposition. Gladstone started off as a Conservative and then became a Liberal. By the 1860s, both Conservative and Liberal lawmakers grudgingly accepted that income tax had become a permanent fixture of Britain’s fiscal system.

The first progressive income tax in the United States appeared when the Revenue Act of 1862 was established. The Act, which repealed the flat tax, was signed by President Abraham Lincoln.

Following the Revenue Act, the progressive tax system evolved with the economy and society, reflecting changes in the nation’s values and the role of government over time.

The Sixteenth Amendment of the US Constitution, adopted in 1913, allowed Congress to levy all income taxes with no apportionment requirement. By the middle of 20th century, virtually every country across the globe had implemented some kind of progressive tax.

Compound words with “tax”

“Progressive Tax” is a compound noun – a noun consisting of two or more words. Below, you can see several compound nouns containing the word “tax,” their meanings, and how we can use them in a sentence:

A regressive tax is one where the tax rate decreases as the amount subject to taxation increases, often placing a heavier burden on lower-income individuals.

Example: “Sales taxes are often considered a form of regressive tax because they take a larger percentage of income from low-income earners.”

Income tax is a tax that governments impose on income generated by businesses and individuals within their jurisdiction.

Example: “Every April, U.S. citizens file their income tax returns to report their earnings from the previous year.”

An occupation tax is levied on businesses or individuals practicing certain trades or professions.

Example: “The local government imposed an occupation tax on all accountants operating within the city limits.”

Corporate tax is a tax imposed on the net income of the company. In the UK/Ireland, people say corporation tax.

Example: “The recent legislation proposed a reduction in corporate tax to encourage business investment.”

A wealth tax is a tax based on the market value of assets owned by individuals or corporations.

Example: “Some European countries have instituted a wealth tax on individuals’ net worth as a means to reduce inequality.”

Tax evasion is the illegal non-payment or underpayment of taxes, typically by deliberately misrepresenting or concealing information.

Example: “The celebrity faced severe penalties after being convicted of tax evasion for not reporting international income.”

Tax avoidance involves arranging one’s financial affairs to minimize tax liability within the law.

Example: “By investing in government bonds, he engaged in tax avoidance, legally lowering his taxable income.”

Value Added Tax, or VAT, is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale.

Example: “The price tag includes value added tax, which in many countries is a significant portion of the final cost to the consumer.”

Two Videos

These two YouTube videos come from our sister channel, Marketing Business Network or MBN. They explain what the terms “Progressive Tax” and “Wealth Tax” mean using easy-to-understand language and examples:

-

What is Progressive Tax?

-

What is Wealth Tax?