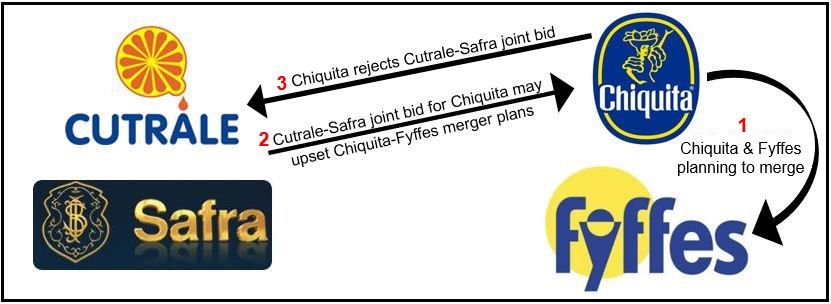

With the Brazilian Chiquita offer rejected, does it mean the merger with Fyffes is going ahead? Fruit juice giant Cutrale and investment conglomerate Safra, both Brazilian companies, had offered $611 million for the American banana company.

In a press release, Chiquita Brands International Inc. said its Board of Director unanimously rejected the hostile bid made on August 11 to acquire outstanding stock of Chiquita for $13.00 per share in cash.

Chiquita added that the sum offered was “inadequate and not in the best interests of Chiquita shareholders.”

Board recommends Fyffes merger

The Chiquita Board also voted unanimously to recommend to its shareholders that the definitive merger agreement with Fyffes go ahead.

Chiquita wrote:

“Chiquita remains committed to completing its transaction with Fyffes, which it believes will create a combined company that is better positioned to succeed in a highly competitive marketplace, while driving strong performance and value for shareholders.”

After the Brazilian bid became public on Monday, Chiquita’s shares rose 31% while Fyffes’ dropped by 15%.

If Charlotte-based Chiquita and Dublin-based Fyffes do merge, the new entity will be the largest supplier of bananas in the world, with annual revenues exceeding $4.6 billion.

The new company would be based in Dublin, where corporate tax is just 12.5%, much lower than the 35% US companies have to pay.

Cutrale and Safra say that their offer is better for Chiquita shareholders than a merger with Fyffes. The two Brazilian companies wrote in a letter to Chiquita:

“We are confident that this transaction offers compelling and more certain value for Chiquita shareholders as compared with the proposed transaction with Fyffes.”

Will the Fyffes merger go ahead? Will the Brazilians up their offer? Might Del Monte or Dole Food throw their hat in?

About the four companies

The Cutrale Group is one of the biggest orange juice suppliers worldwide. It has well-known juice brands in both Brazil and Florida and supplies orange-juice concentrate to Coca-Cola’s Minute Maid and Simply Orange. CEO Luis Cutrale is a member of the board of directors of the world’s biggest franchise bottler of Coke, Coca-Cola Femsa SAB in Mexico.

The Safra Group is a Brazilian multinational that has more than $200 billion under management. It is controlled by Joseph Safra, the second richest person in Brazil. The company consists of a global network of industrial operations, real estate firms, agribusinesses, banks and financial institutions.

Cutrale has partnered with banks that Mr. Safra controls to challenge the Fyffes-Chiquita merger plan.

Chiquita is a major international marketer and distributor of bananas, packaged salads and healthy snacks. It operates in more than 70 countries and has a major presence in the United States.

Fyffes is one of the world’s largest marketers and distributors of tropical produce, sold under several recognized brand names, including Fyffes and Sol. The company operates in Europe, North and South America, and Asia.

A raised bid from Cutrale-Safra?

Most analysts in the US and Europe are betting on a higher bid from Safra and Cutrale.

In a joint statement, the two Brazilian firms said they are considering all alternatives to provide Chiquita shareholders with a compelling reason to persuade the Board to enter discussions regarding the Safra-Cutrale proposal.

In an interview with Bloomberg, Brett M. Hundley, an analyst at BB&T Capital Markets, pointed out that the Fyffes combination is worth between $14 and $17 per share; any rival bid must be within that range.

Mr. Hundley, who recommends buying Chiquita shares, said “I think $15 gets the board’s attention and potentially opens up a dialog between the two companies.”

The worldwide market for bananas is currently dominated by four companies:

- Chiquita,

- Dole Food Company,

- Fresh Del Monte,

- Fyffes.