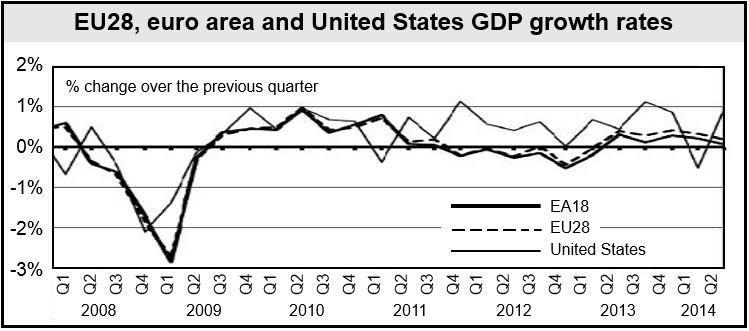

While Eurozone GDP flatlines in the second quarter, the economies of the other European Union (EU) nations surge ahead. Put simply, the EU is turning into two economic regions, one with high unemployment and no economic growth (the Eurozone) and the other one that is thriving.

While the EA18 (Eurozone nations) posted 0.0% growth in Q2, the EU28 (all 28 European Union members) registered 0.2% expansion, according to data published by Eurostat, the statistical office of the EU.

In Q1 2014, the economy expanded by 0.2 in the Eurozone and 0.3% in the EU28.

Seasonally adjusted GDP on a year-on-year basis grew by 0.7% in the Eurozone and 1.2% in the EU28 in the second quarter, compared to year-on-year growth of 0.9% and .4% respectively in the first quarter.

Eurozone’s outlook worsening

Economists from around the world are now forecasting economic decline in the Eurozone for the rest of this year and 2015. German GDP shrank in the second quarter, France has seen no growth since the beginning of the year, and Italy has fallen back into recession.

In contrast, the United States’ and the UK’s GDPs increased by 1% and 0.8% respectively.

(Data source: Eurostat)

In a separate report, Eurostat posted annualized inflation of 0.4% in July, down from 0.5% in June. With zero growth, falling inflation rates, and the economic toll for tightening sanctions against Russia, the euro area is looking more like it is sliding into a deflationary spiral.

All eyes on the ECB

The latest GDP and inflation figures will add pressure on the European Central Bank (ECB) to take further measures to bolster growth and push up inflation. The ECB’s 1% GDP growth forecast for the Eurozone now seems rather hopeful.

Interest rates were cut by the ECB in June, and a new program of cheap loans to banks was introduced.

A growing number of economists are now urging the central bank to embark on a large-sale purchase of public and private debt to bring down borrowing costs and boost the money supply.

What is the Eurozone?

In 1999, a number of EU countries adopted monetary union, they created a new currency – the euro – and abandoned their own currencies.

Today, the euro is a single currency shared by 18 EU member states, which together make up the Eurozone (or euro area).

The following countries are in the Eurozone, which is also known as EA18: Belgium, Germany, Estonia, Ireland, Greece, Spain, France, Italy, Cyprus, Latvia, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia, Slovakia and Finland.

The following EU member states are not in the Eurozone, they still have their own currencies: Bulgaria, Croatia, Czech Republic, Denmark, Hungary, Lithuania, Poland, Romania, Sweden, and the United Kingdom.

Some countries, including the UK, Denmark and Sweden, chose not to adopt the euro, while others are not members yet because their economies are not ready – they have not met certain criteria. As soon as they do, they will join the Eurozone. Lithuania is set to join in 2015.

Video – Eurozone, two points of view

In this video, by Saxo Bank and Tradingfloor.com, we see two points of view regarding the Eurozone.

Steen Jakobsen says 2014 is a lost year for the region. He had previously warned that Germany would not be able to maintain its growth momentum.

Peter Garnry, however, says that what has happened in the Eurozone is the opposite to what occurred in the US. Europe had a mild winter while the US had a severe one. First quarter results in the US were poor, and improved in Q2, while for the Eurozone it was the other way round.