Chinese August manufacturing activity was less than analysts had expected. The Country’s PMI (purchasing managers index) dropped from 51.7 in July to 51.1 in August, according to data published today by the National Bureau of Statistics. Economists had expected a reading of 51.2.

The August results points to an economy that is losing momentum. Economists predict authorities may have to take measures to stimulate growth.

The Chinese government is now more likely to enhance easing measures in order to achieve its goal of 7.5% GDP growth for 2014. The People’s Bank of China, the country’s central bank, may cut interest rates or lower the amount of reserves banks need to hold as deposits to bolster the economy.

Any PMI reading over 50, which gauge’s the sector’s overall health, points to expansion. The PMI is calculated according to responses from purchasing managers at 3,000 firms.

Most analysts have interpreted today’s data as a softening of economic conditions in China, and a probable slowdown during the coming months.

The BBC quoted Julian Evans-Pritchard, China Economist at Capital Economics who said “Broadly speaking, today’s PMI reading suggests that downwards pressure on the economy, as a result of slowing investment in sectors with overcapacity, particularly property, is no longer being fully offset by policy support measures.”

Smaller companies worse off

While the Index for large companies continued pointing to sustained expansion, for medium-sized firms it fell to 49.9, and 49.1 for small businesses.

The output subindex declined by 1 point to 53.2, while new-export orders fell by 1.1 points to 50.

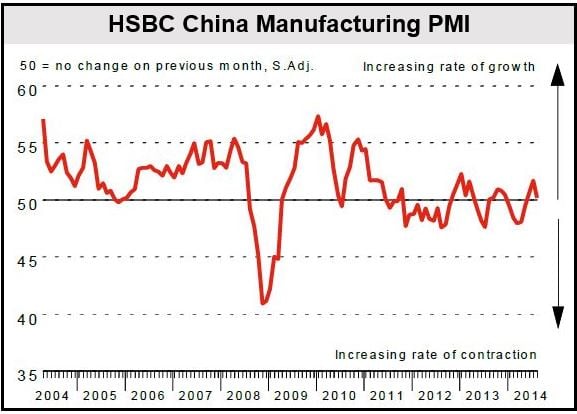

HSBC-Markit China Manufacturing PMI

In another closely-followed private survey, HSBC published data also showing a slowdown in manufacturing activity growth.

The HSBC China Manufacturing PMI for August went down from 51.7 in July to 50.2 in August.

According to HSBC, growth has eased to a fractional pace as both manufacturing and new order growth slowed down and job cutting in the sector persisted.

Factories have been shedding jobs every month for the past 24 months.

(Source: HSBC)

HSBC wrote:

“Although external demand showed improvement, domestic demand looked more subdued. Overall, the manufacturing sector still expanded in August, but at a slower pace compared to previous months.”

“We think the economy still faces considerable downside risks to growth in the second half of the year, which warrant further policy easing to ensure a steady growth recovery.”

The Chinese economy has had a bumpy year so far. In the first quarter, GDP growth fell to 7.4%, an 18-month low, and then edged up to 7.5% in Q2.

According to The Conference Board’s LEI for July, however, China’s outlook improved.