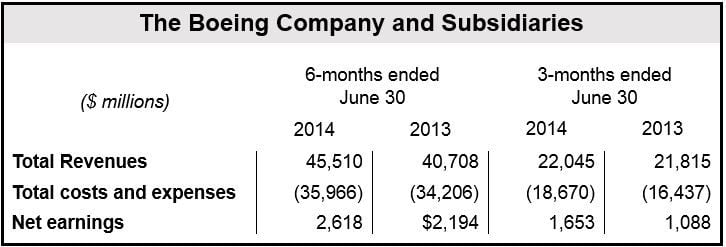

Strong commercial sales boosted Boeing Q2 2014 net profit by 52 percent to $1.653 billion compared to $1.088 in Q2 2013. Revenue rose 1% to $22.045 billion compared to $21,815 billion in Q2 2013.

The company delivered its first Dreamliner 787-9 jetliner in the last quarter. Its sales of commercial airplanes helped offset a decline in defense profits and problems with its tanker test aircraft. The company is still selling each Dreamliner at a loss.

Boeing’s defense, space and security earnings dropped by 25% to $582 million.

The Chicago-based aircraft maker reported Q2 2014 (non-GAAP) earnings per share (EPS) of $2.42. The results for the last quarter included a $272 million net-of-tax charge ($0.37 per share) on the KC-46Q Tanker program.

Core EPS guidance for 2014 rose to between $7.90 and $8.10, from $7.15 to $7.35. GAAP EPS guidance for 2014 rose to between $6.85 and $7.05.

Jim McNerney, Boeing’s Chairman and Chief Executive Officer, said:

“Strong operating performance across our production programs and services businesses drove revenue and earnings-per-share growth and healthy operating cash flow, which supported $1.5 billion in additional share repurchases in the quarter.”

During Q2 2014, Boeing:

- delivered its first 787-9,

- delivered its 8000th 737,

- completed a key missile defense intercept test successfully,

- delivered its 100th EA-18G Growler to the US Navy.

(Data source: The Boeing Company)

In an interview with USA Today, industrial analyst Christian Mayes, who works at Edward Jones Equity Research, said that on the surface performance looked good. However, it was less impressive when he learned that $524 million came from a one-off tax benefit. “The headline number looks really good, but peering into it a little bit deeper, it was helped a lot by lower taxes,” he said.

Boeing’s tanker test aircraft problems

Mr. McNerney admitted there are challenges resolving engineering and systems problems in its tanker test aircraft, which have resulted in higher spending. He adds, however, that the issues are well understood and the tankers are set to be tested in the first part of 2015.

Investors were surprised by the Tanker charge after a May guidance indicated that the program was on track.

The Wall Street Journal quotes RBC Capital analysts who described the charge as “worrying”, given the early stage in the program.

Boeing commercial aircraft

During the first half of this year, Boeing has received 783 orders for commercial aircraft. Commercial aircraft Q2 2014 revenue rose by 5% to $14.3 billion on greater deliveries. According to Boeing, rising fuel costs and better overall airline financial performance have helped boost sales.

Qatar Airways and Emirates Airline finalized orders for two-hundred 777X aircraft, while Monarch Airlines announced a commitment to buy thirty 737 MAX airplanes.

During the quarter, Commercial Airlines booked 264 net orders. There is a backlog of 5,200 aircraft valued at $377 billion.

Operating margin in the second quarter was 10.8%.

The first 787-9 Dreamliner was delivered to Air New Zealand in Q2 2014.

Dreamliner unit costs

Dreamliner costs still exceed the average sale price. Had Boeing accounted for the cost of each of the 30 Dreamliners delivered in Q2 2014, the commercial unit would have posted a $484 million loss.

The cost of producing each airplane is expected to equal the sale price by the end of 2014 as its unit costs steadily decline.

Boeing’s Dreamliner was haunted by a string of glitches last year. This year they have become much less prevalent. However, Mike Fleming, the company’s vice president for support and services, said in January that defects still affect about 2% of all Dreamliner flights.