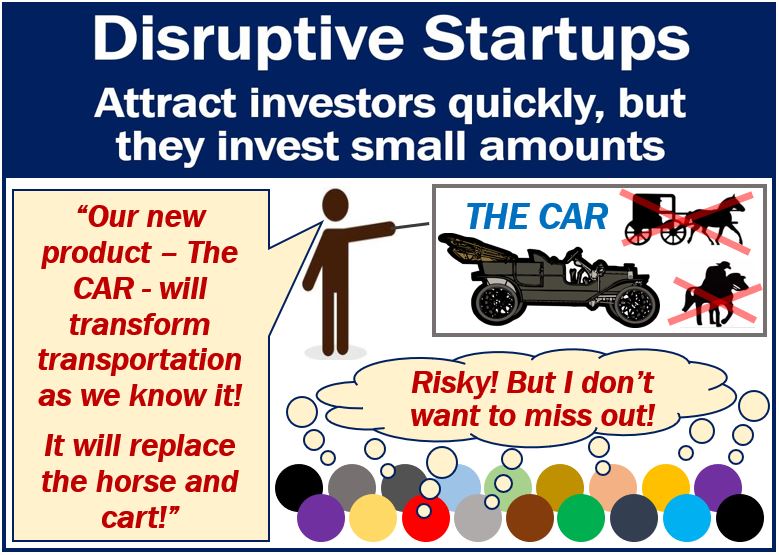

Disruptive startups are quick to attract investors, mainly because they do not want to miss out. However, the disruptive startup notion makes them cautious. In other words, unproven ideas that may end up being unprofitable make investors apprehensive. Therefore, they usually invest moderate amounts.

A disruptive startup is a startup that creates a new market and value market if it is successful. It eventually disrupts an existing market. In other words, it displaces established market leaders and top-selling products.

Researchers from the Rotterdam School of Management and the University of California, Riverside carried out a study on investors and disruptive startups. They found that fear of missing out motivates venture capitalists to invest money early. However, they are reluctant to invest large sums.

Venture capitalists are individuals or firms that invest in startups. In other words, they invest in new business ventures. We refer to the money they invest as venture capital.

Entrepreneurs and disruptive startups

Entrepreneurs make themselves stand out by using two main strategies.

- First, they emphasize their track records and achievements. They also emphasize the startups’ unique resources or initial success.

- Second, they tout what the business will become and what the entrepreneurs expect to accomplish. Disruptive visions belong in the second category.

The researchers wrote about their study and findings in the Journal of Management Studies (citation below).

What are disruptive innovations?

Disruptive innovations introduce a fundamental change, re-ordering, or disturbance in the ways organizations, business ecosystems, and markets operate.

Netflix, for example, completely transformed the video-rental industry. TiVo changed how people watch television.

There is a love affair in the world of startups with the concept of disruption. Elon Musk, for example, attracts investors by promoting disruptive visions in space travel, electric cars, and urban transportation.

Despite this trend, nobody looked into whether investors dismiss or applaud self-acclaimed investors. Ashish Sood, Timo van Balen, and Murat Tarakci decided to put that to the test.

Sood is an Associate Professor of Marketing at the UC Riverside School of Marketing. Balen is a PhD Candidate at the Rotterdam School of Management’s Department of Technology and Operations Management. Tarakci is an Associate Professor of Innovation Management at the Rotterdam School of Management’s Department of Technology and Operations Management.

Disruptive startups – success at attracting investors

To determine how good disruptive startups were at attracting investors, the researchers studied 918 Israeli startups. Specifically, they looked at their first round of funding.

Israel has the highest density of startups in the world. The country has produced several extremely lucrative ventures.

The researchers gathered and analyzed data from Startup Nation Central. Startup National Central is a non-profit organization that offers an exhaustive platform for Israel’s startup ecosystem.

The authors found that a small increase in the disruptiveness that the startup entrepreneurs communicated improved their chances of getting first-round funding by 22%.

Surprisingly, disruptive startups got much less money in the first round – 24% less.

According to a UC Riverside press release:

” A disruptive vision caused the typical Israeli venture to lose $87,000 in the first round and $361,000 in the second round.”

Regarding investors’ attitudes toward disruptive startups, Prof. Sood said:

“Why might investors be so positively biased toward disruptive visions, yet opt for investing for so little? Our research reveals that talking about disruption can be a double-edged sword.”

An experiment with 203 participants

The research team recruited 203 participants for an experiment. The participants had previous investment experience in government bonds, stocks, unit trusts, private equity funds, and angel investing. They also had experience in crowdfunding, exchange-traded commodities, and venture capital funds.

The participants had to answer questions about two vision statements (fictitious ones). They were identical except for their degree of disruptiveness.

Each participant received just one of the statements. They also received information about the company. They had to answer questions regarding the type of investment decisions they would make.

The results of the researchers’ experiment matched what they had found in the database in Israel. Investors are quicker to invest in disruptive startups, but they do so with smaller amounts.

Expectations of extraordinary returns entice investors

Prof. Tarakci explained:

“Expectations of making extraordinary returns is what entices investors to fund the self-claimed disruptors.”

Just a small increase in expected returns made investors four times more likely to invest in a venture.

Even though they invest sooner, they do not do so blindly. Investors are aware that disruptive startups stand a significant chance of failure.

Investing moderately early on is like purchasing an option to invest more later on when risks might be lower.

Prof. Sood said:

“For entrepreneurs seeking early-stage investments, we have the following simple but important advice: carefully craft your message.”

“If you are looking to acquire large sums of money, perhaps you should keep your disruptive plans quiet.”

Citation

“Do Disruptive Visions Pay Off? The Impact of Disruptive Entrepreneurial Visions on Venture Funding,” Timo van Balen, Murat Tarakci, and Ashish Sood. Journal of Management Studies (2018). DOI: 10.1111/joms.12390.

Video – What is a startup?

A startup company is a young or new business that venture capitalists and major companies are interested in. What makes them different from other new companies? This MBN (Market Business News) video explains.